- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Phillips 66 (NYSE:PSX) Reports Q1 Revenue Drop to US$31.73 Billion and Net Income Decline

Reviewed by Simply Wall St

Phillips 66 (NYSE:PSX) recently reported its earnings for Q1 2025, showing a decrease in sales and net income from the previous year. Despite these declines, the company's stock price rose 4.91% over the past week, aligning with the overall market's upward trend of 4.7%. This movement may have been supported by the company's decision to increase its quarterly dividend by USD 0.05. Additionally, heightened investor activity surrounding Phillips 66, including communications from Elliott Management and the company's strategic updates, added to investor focus, aligning with a broadly bullish market sentiment.

The recent 4.91% rise in Phillips 66's stock price, coinciding with both a dividend increase and higher market trends, may bolster investor confidence. However, the company's Q1 2025 earnings report reflected decreased sales and net income, juxtaposing the positive price movement by highlighting areas of ongoing operational challenges. These results might incite concern regarding Phillips 66's future earnings and revenue forecasts, particularly with strategic asset optimizations and potential regulatory uncertainties in renewable fuels.

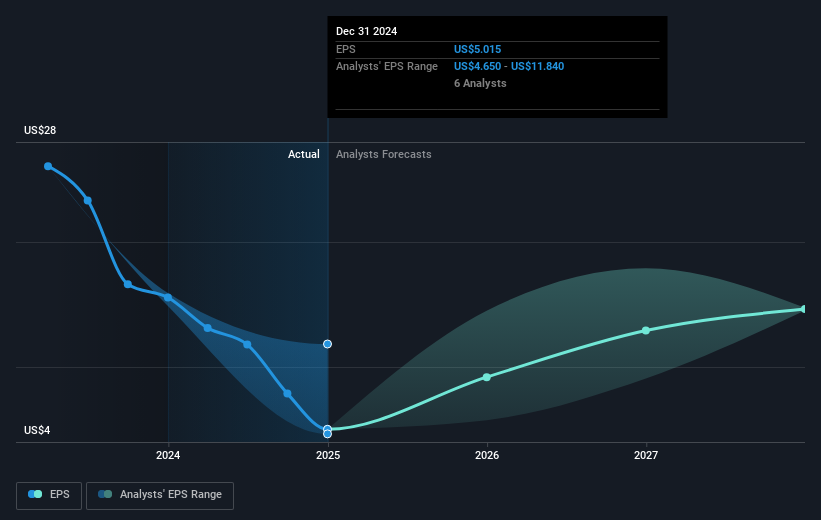

Over the past five years, the company's total shareholder return, including dividends, was 93.24%. In contrast, it underperformed the broader US market over the past year, which returned 7.7%. Analysts forecast Phillips 66's earnings to grow at 21.5% annually over the next three years, outpacing the US market's projected growth rate of 14.1% per year. Yet, the declining revenue expectations remain a focal point for stakeholders monitoring the firm's midstream and chemical segments' expansion effects.

The current share price of US$100.90, when set against the analysts' consensus price target of US$131.97, suggests potential upside, with a 23.5% increase needed to meet the target. This calculation is based on forecasts that assume significant EPS growth through to 2028 requiring a PE ratio of 12.1x. Despite Phillips 66 trading below its estimated fair value, risks such as high debt levels, planned refinery closures, and unpredictable renewable fuel margins could alter these favorable forecasts and require careful consideration by investors.

Explore historical data to track Phillips 66's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives