- United States

- /

- Retail Distributors

- /

- NasdaqCM:AENT

Exploring Undervalued Small Caps With Insider Action In September 2025

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite reach new highs, buoyed by favorable producer-price data and robust earnings from key players, the spotlight turns to small-cap stocks in the United States. Amidst a backdrop of potential interest rate cuts and fluctuating Treasury yields, investors are keenly observing small caps for opportunities that align with broader market trends. In this environment, a good stock often exhibits strong fundamentals coupled with insider activity, which can serve as an indicator of confidence in its future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Angel Oak Mortgage REIT | 6.2x | 4.0x | 32.50% | ★★★★★★ |

| PCB Bancorp | 9.9x | 3.0x | 32.80% | ★★★★★☆ |

| Peoples Bancorp | 10.3x | 1.9x | 42.63% | ★★★★★☆ |

| Citizens & Northern | 11.5x | 2.8x | 40.41% | ★★★★☆☆ |

| Limbach Holdings | 34.0x | 2.2x | 42.52% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 30.40% | ★★★★☆☆ |

| Tilray Brands | NA | 1.5x | 9.14% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 16.17% | ★★★★☆☆ |

| Shore Bancshares | 10.5x | 2.7x | -90.71% | ★★★☆☆☆ |

| Auburn National Bancorporation | 12.9x | 2.7x | 27.11% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

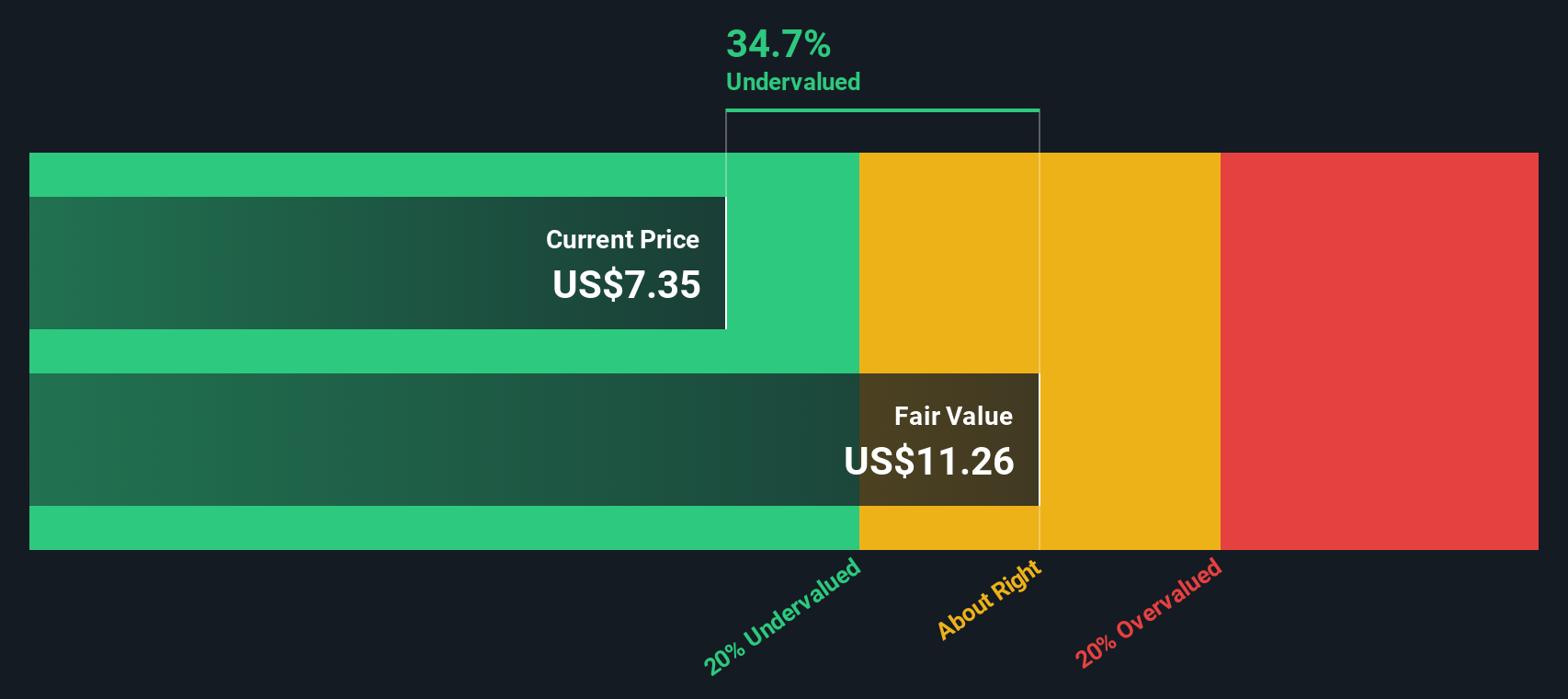

Alliance Entertainment Holding (AENT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alliance Entertainment Holding operates as a wholesale distributor of various entertainment products with a focus on miscellaneous categories, and it has a market capitalization of approximately $1.2 billion.

Operations: Alliance Entertainment Holding generates revenue primarily from its wholesale miscellaneous segment, with recent figures reaching approximately $1.07 billion. The company's financials reveal a gross profit margin that has shown fluctuations, recently recorded at 11.54%. Operating expenses are significant, with sales and marketing being notable components. The net income margin has seen variations, reflecting both positive and negative results over the periods analyzed.

PE: 30.0x

Alliance Entertainment, a company with a market cap below US$1 billion, is experiencing insider confidence through recent share purchases. Their latest earnings report for the year ending June 2025 showed a net income increase to US$15.08 million from US$4.58 million the previous year, despite sales dipping slightly to US$1.06 billion from US$1.10 billion. The company's strategic moves include expanding its Handmade by Robots brand and securing exclusive distribution partnerships, positioning it for potential growth in the collectibles sector despite reliance on external borrowing and volatile share prices recently observed over three months.

- Click here and access our complete valuation analysis report to understand the dynamics of Alliance Entertainment Holding.

Understand Alliance Entertainment Holding's track record by examining our Past report.

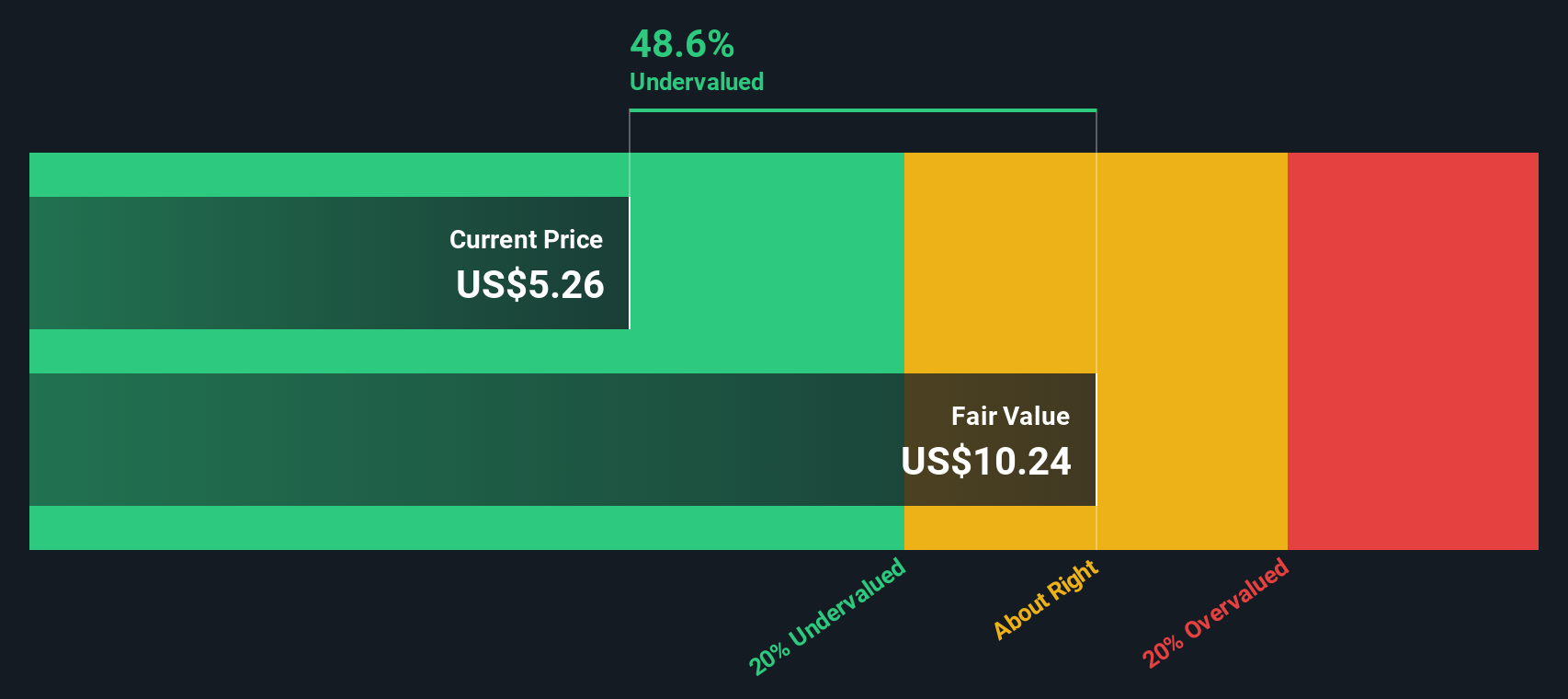

Granite Ridge Resources (GRNT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Granite Ridge Resources is involved in the development, exploration, and production of oil and natural gas with a focus on these energy resources.

Operations: Granite Ridge Resources generates revenue primarily from oil and natural gas development, exploration, and production. The company's cost of goods sold (COGS) has increased over time, impacting its gross profit margin which was 82.98% as of the latest period ending September 2025. Operating expenses include significant depreciation and amortization costs along with general and administrative expenses. Net income margins have shown a downward trend recently, reaching 7.83% in the most recent quarter ending September 2025.

PE: 22.1x

Granite Ridge Resources has shown significant earnings growth, with net income rising to US$25.08 million in Q2 2025 from US$5.1 million the previous year, and basic EPS increasing to US$0.19 from US$0.04. The company raised its production guidance by 10% for the year, driven by strong performance in the Permian and Utica regions. Insider confidence is evident as Matthew Miller recently purchased 41,000 shares worth US$250,100, suggesting belief in future potential despite current high debt levels impacting profit margins.

- Dive into the specifics of Granite Ridge Resources here with our thorough valuation report.

Assess Granite Ridge Resources' past performance with our detailed historical performance reports.

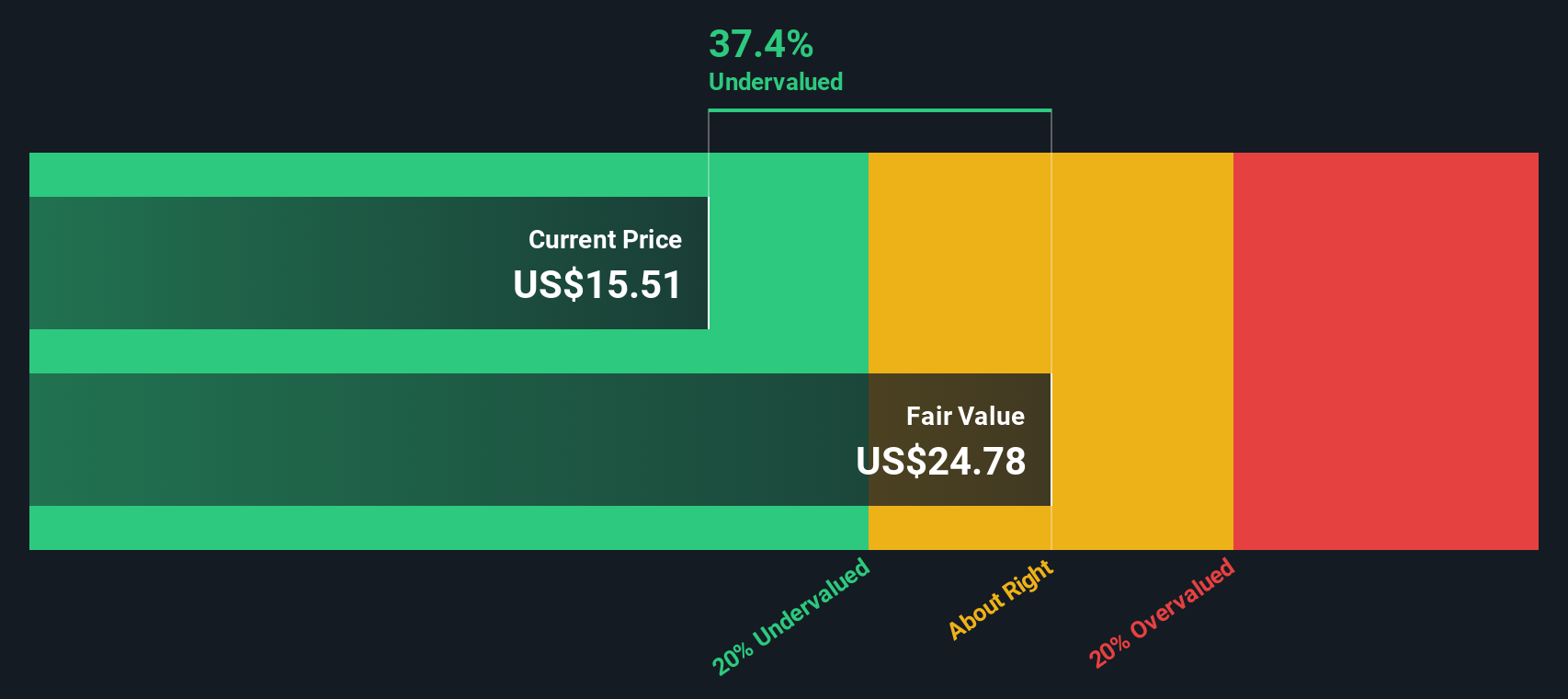

Sally Beauty Holdings (SBH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sally Beauty Holdings operates as a retailer and distributor of professional beauty supplies through its Sally Beauty Supply and Beauty Systems Group segments, with a market cap of approximately $1.25 billion.

Operations: SBS and BSG are the primary revenue segments, contributing $2.09 billion and $1.60 billion respectively. The gross profit margin has shown a trend of fluctuating between 49% and 51% over recent periods, reflecting variations in cost management efficiency. Operating expenses, primarily driven by general and administrative costs, consistently impact profitability levels across the observed periods.

PE: 7.5x

Sally Beauty Holdings, a US-based company with a market cap under $2 billion, has shown resilience despite high debt levels and external borrowing risks. For Q3 2025, net income rose to US$45.72 million from US$37.72 million the previous year, with earnings per share increasing to US$0.46 from US$0.37. Insider confidence is evident as executives have purchased shares recently, reflecting belief in future prospects amidst flat sales projections and ongoing share buybacks totaling 1.4% of outstanding shares this quarter for US$13.02 million.

Turning Ideas Into Actions

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 78 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AENT

Alliance Entertainment Holding

Operates as a wholesaler and e-commerce provider for the entertainment industry worldwide.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)