- United States

- /

- Hospitality

- /

- NYSE:FLUT

Vertex Pharmaceuticals Leads 3 Value Stocks Offering Estimated Intrinsic Value

Reviewed by Simply Wall St

As U.S. markets grapple with the implications of newly imposed tariffs and economic uncertainties, investors are increasingly seeking opportunities in undervalued stocks that may offer intrinsic value amid broader market declines. In this environment, a good stock is often characterized by strong fundamentals and the potential for growth despite external pressures, making it an attractive consideration for those looking to navigate current market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $17.76 | $34.77 | 48.9% |

| MINISO Group Holding (NYSE:MNSO) | $20.29 | $40.47 | 49.9% |

| Brookline Bancorp (NasdaqGS:BRKL) | $11.18 | $22.02 | 49.2% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $26.97 | $53.19 | 49.3% |

| Pure Storage (NYSE:PSTG) | $50.11 | $99.37 | 49.6% |

| Archrock (NYSE:AROC) | $25.11 | $49.33 | 49.1% |

| Five9 (NasdaqGM:FIVN) | $33.35 | $65.87 | 49.4% |

| JBT Marel (NYSE:JBTM) | $131.88 | $259.85 | 49.2% |

| Nutanix (NasdaqGS:NTNX) | $77.08 | $153.67 | 49.8% |

| Mobileye Global (NasdaqGS:MBLY) | $14.39 | $28.77 | 50% |

Let's take a closer look at a couple of our picks from the screened companies.

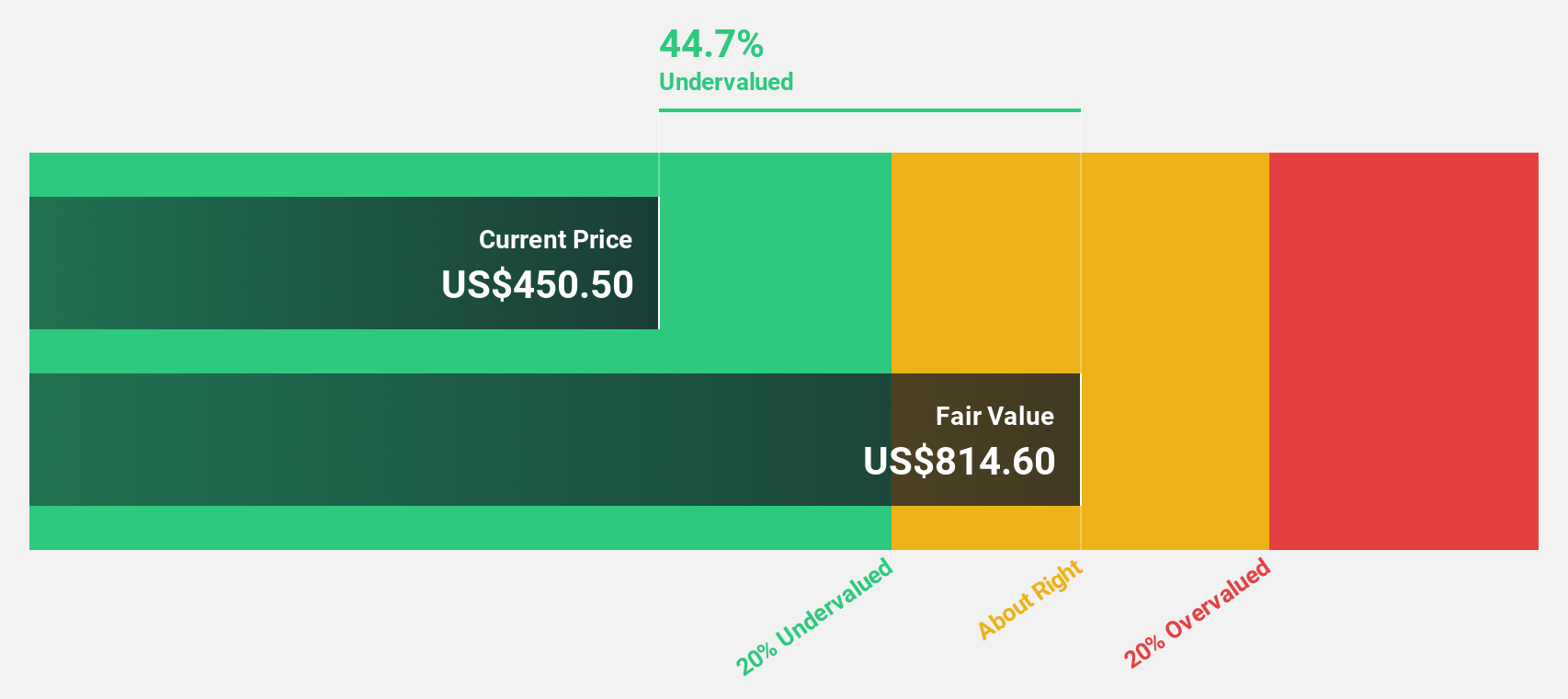

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for treating cystic fibrosis, with a market cap of approximately $124.11 billion.

Operations: The company generates its revenue primarily from its pharmaceuticals segment, which amounted to $11.02 billion.

Estimated Discount To Fair Value: 41.3%

Vertex Pharmaceuticals is currently trading at a significant discount to its estimated fair value of US$828.23, with shares priced at US$486.22, reflecting a valuation gap over 40%. This undervaluation is underpinned by strong cash flow potential, despite recent net losses and executive changes. The company anticipates robust revenue growth driven by new product launches like JOURNAVX and expanded indications for TRIKAFTA. Vertex's strategic buybacks and collaborations further enhance its financial positioning amidst ongoing investments in innovative therapies.

- In light of our recent growth report, it seems possible that Vertex Pharmaceuticals' financial performance will exceed current levels.

- Click here to discover the nuances of Vertex Pharmaceuticals with our detailed financial health report.

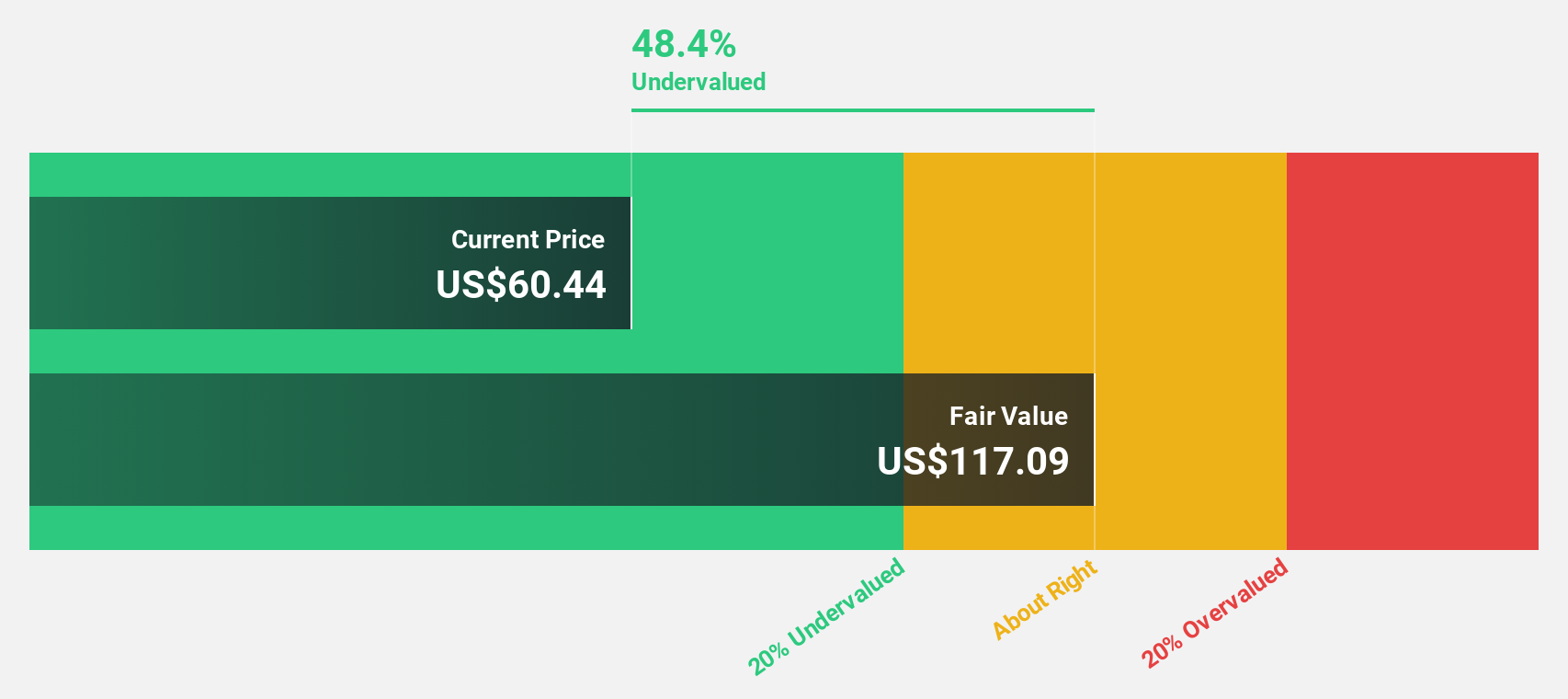

EQT (NYSE:EQT)

Overview: EQT Corporation is involved in the production, gathering, and transmission of natural gas with a market cap of $29.10 billion.

Operations: The company generates revenue of $5.04 billion from its Oil & Gas - Integrated segment.

Estimated Discount To Fair Value: 42.1%

EQT is trading at US$50, significantly below its estimated fair value of US$86.32, highlighting a valuation gap over 40%. Despite recent shareholder dilution and lower profit margins, EQT's earnings are projected to grow substantially at 33.1% annually, outpacing the US market. The company has initiated strategic debt restructuring and joint ventures to strengthen its financial position while maintaining robust revenue growth forecasts exceeding market averages.

- According our earnings growth report, there's an indication that EQT might be ready to expand.

- Navigate through the intricacies of EQT with our comprehensive financial health report here.

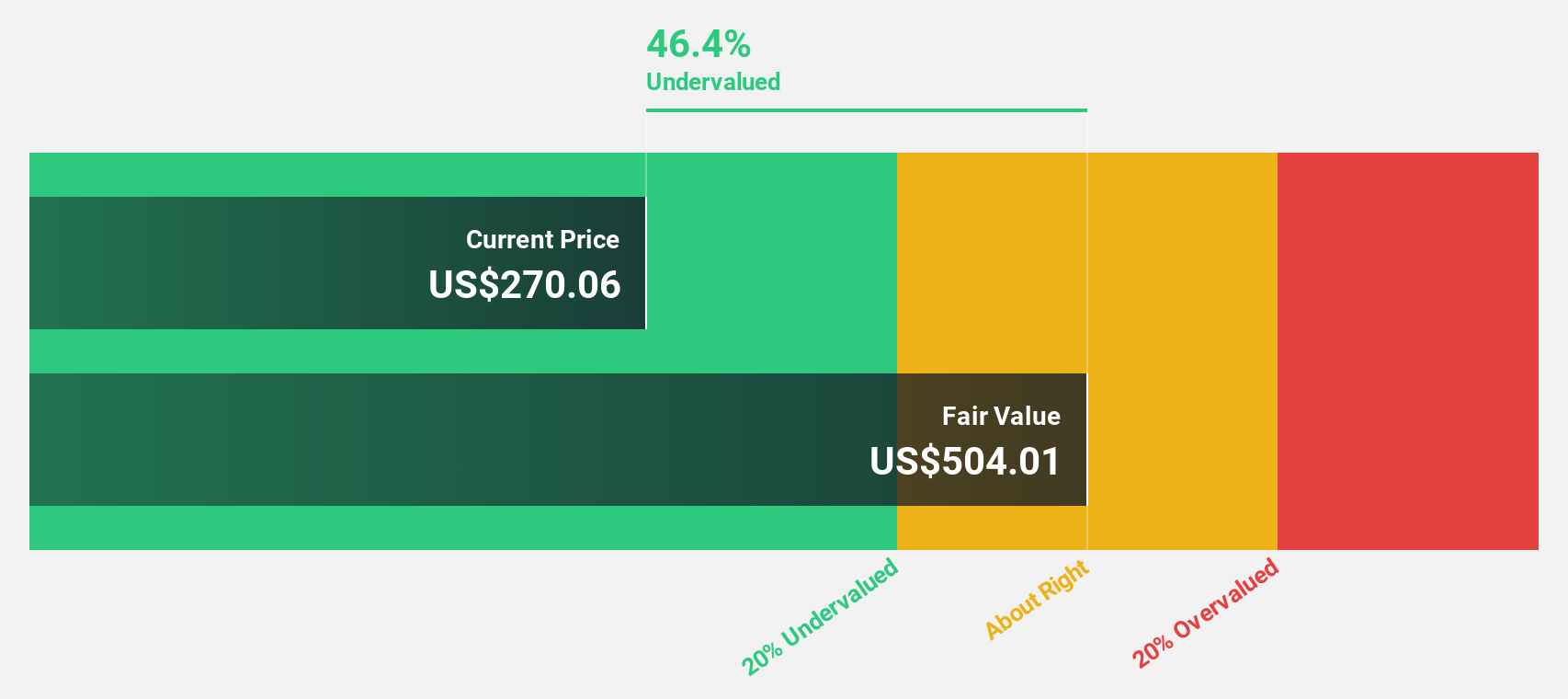

Flutter Entertainment (NYSE:FLUT)

Overview: Flutter Entertainment plc is a sports betting and gaming company with operations in the United Kingdom, Ireland, Australia, the United States, Italy, and other international markets, and it has a market cap of approximately $48.13 billion.

Operations: The company's revenue segments are comprised of $5.68 billion from the US, $3.44 billion from the UK and Ireland, $1.42 billion from Australia, and $3.03 billion from international markets.

Estimated Discount To Fair Value: 10.5%

Flutter Entertainment is trading at US$266.15, below its estimated fair value of US$297.26, reflecting a moderate valuation gap. The company reported significant revenue growth to US$14.05 billion in 2024 from the previous year's US$11.79 billion and turned a net income of US$43 million from a prior loss of over one billion dollars. With projected annual earnings growth of 62.53% and expected profitability within three years, Flutter shows strong cash flow potential despite trading slightly under fair value estimates.

- Our earnings growth report unveils the potential for significant increases in Flutter Entertainment's future results.

- Unlock comprehensive insights into our analysis of Flutter Entertainment stock in this financial health report.

Where To Now?

- Get an in-depth perspective on all 196 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Flutter Entertainment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLUT

Flutter Entertainment

Operates as a sports betting and gaming company in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives