- United States

- /

- Oil and Gas

- /

- NYSE:CVX

3 US Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the S&P 500 retreats from record highs and major indices show mixed performance, investors are increasingly looking for stability amid market fluctuations. In this context, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option to enhance investment portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.17% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.10% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.16% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.48% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.74% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.82% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.44% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

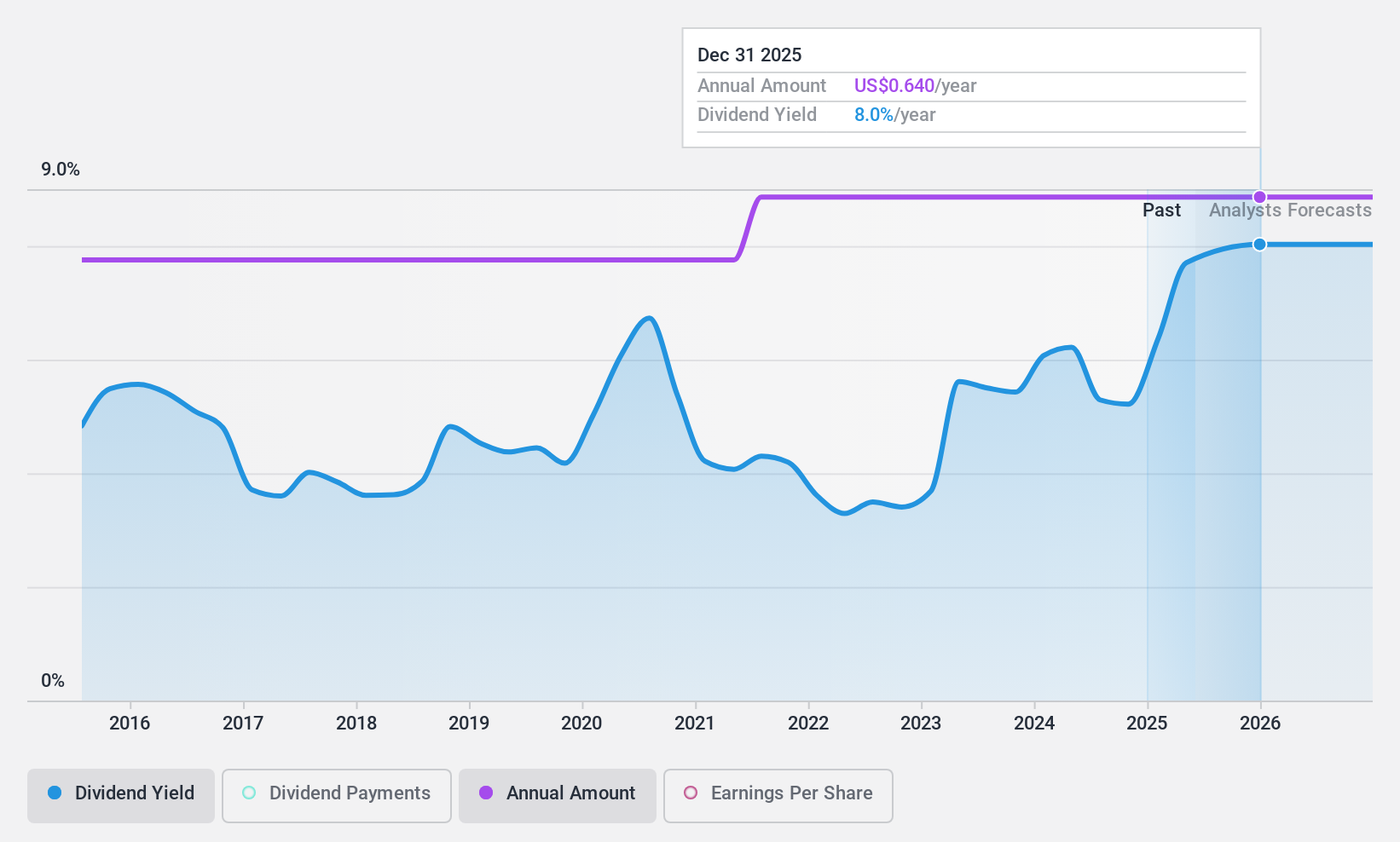

BCB Bancorp (NasdaqGM:BCBP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: BCB Bancorp, Inc. is a bank holding company for BCB Community Bank, providing banking products and services to businesses and individuals in the United States, with a market cap of approximately $176.28 million.

Operations: BCB Bancorp, Inc. generates revenue primarily through its banking operations, with a reported revenue of $83.39 million.

Dividend Yield: 6.1%

BCB Bancorp offers a high dividend yield of 6.12%, ranking in the top 25% of US dividend payers, supported by a sustainable payout ratio currently at 64.8%, forecasted to improve to 40.1% in three years. Despite stable and growing dividends over the past decade, recent financials show declining net interest income and net income for 2024, with significant insider selling noted recently. The company declared a regular quarterly cash dividend of $0.16 per share payable on February 24, 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of BCB Bancorp.

- Our valuation report unveils the possibility BCB Bancorp's shares may be trading at a discount.

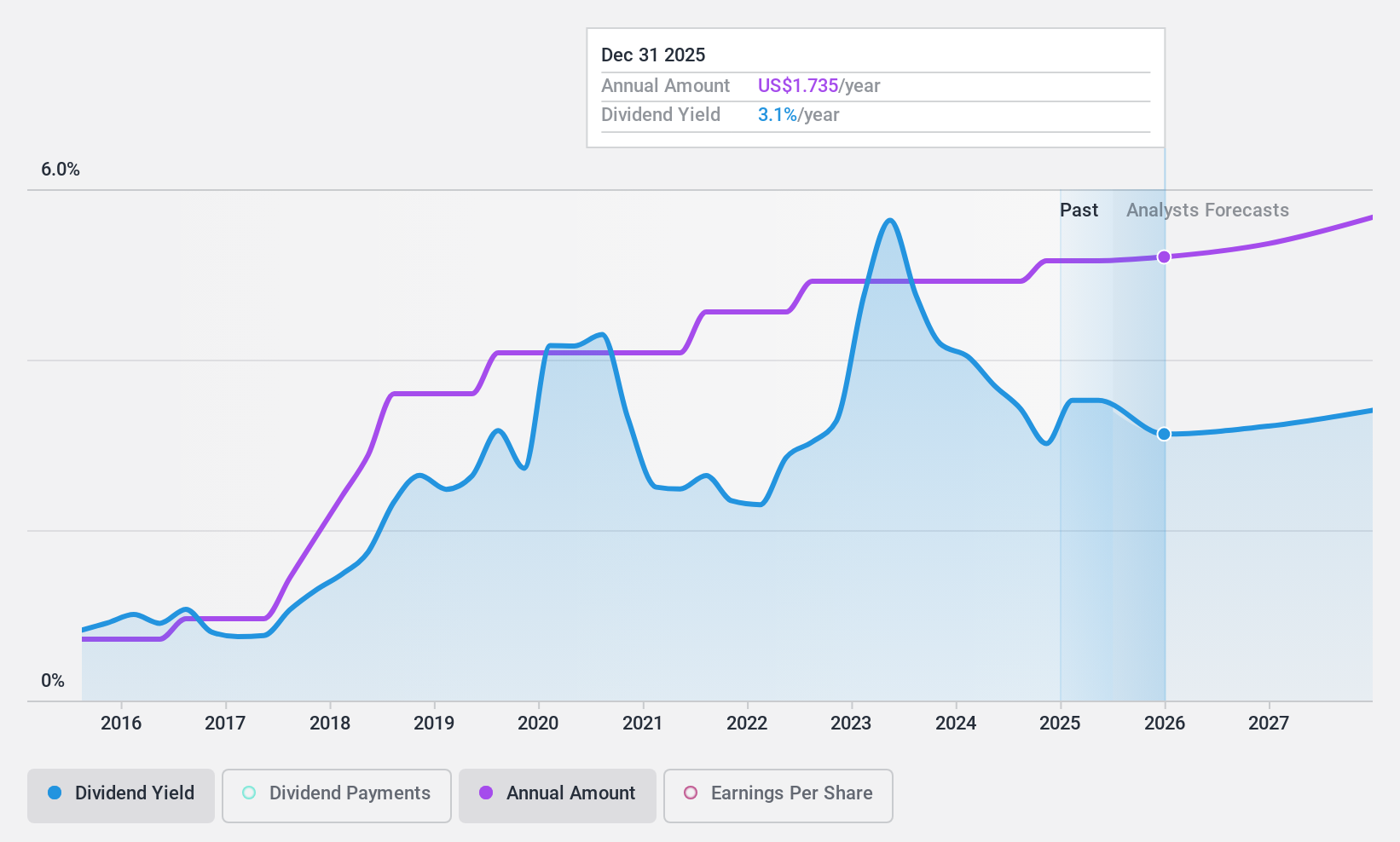

Zions Bancorporation National Association (NasdaqGS:ZION)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zions Bancorporation, National Association offers a range of banking products and services across several western U.S. states, with a market cap of approximately $8.24 billion.

Operations: Zions Bancorporation, National Association generates revenue through a variety of banking products and services across its primary operational regions in the western United States.

Dividend Yield: 3%

Zions Bancorporation's dividend payments have been stable and growing over the past decade, with a current yield of 3.03%, which is lower than the top 25% of US dividend payers. The dividends are well covered by earnings, with a payout ratio of 33.2%, forecasted to remain sustainable at 34.2% in three years. Trading at good value compared to peers, Zions recently declared a regular cash dividend of US$0.43 per share payable on February 13, 2025.

- Dive into the specifics of Zions Bancorporation National Association here with our thorough dividend report.

- Our expertly prepared valuation report Zions Bancorporation National Association implies its share price may be lower than expected.

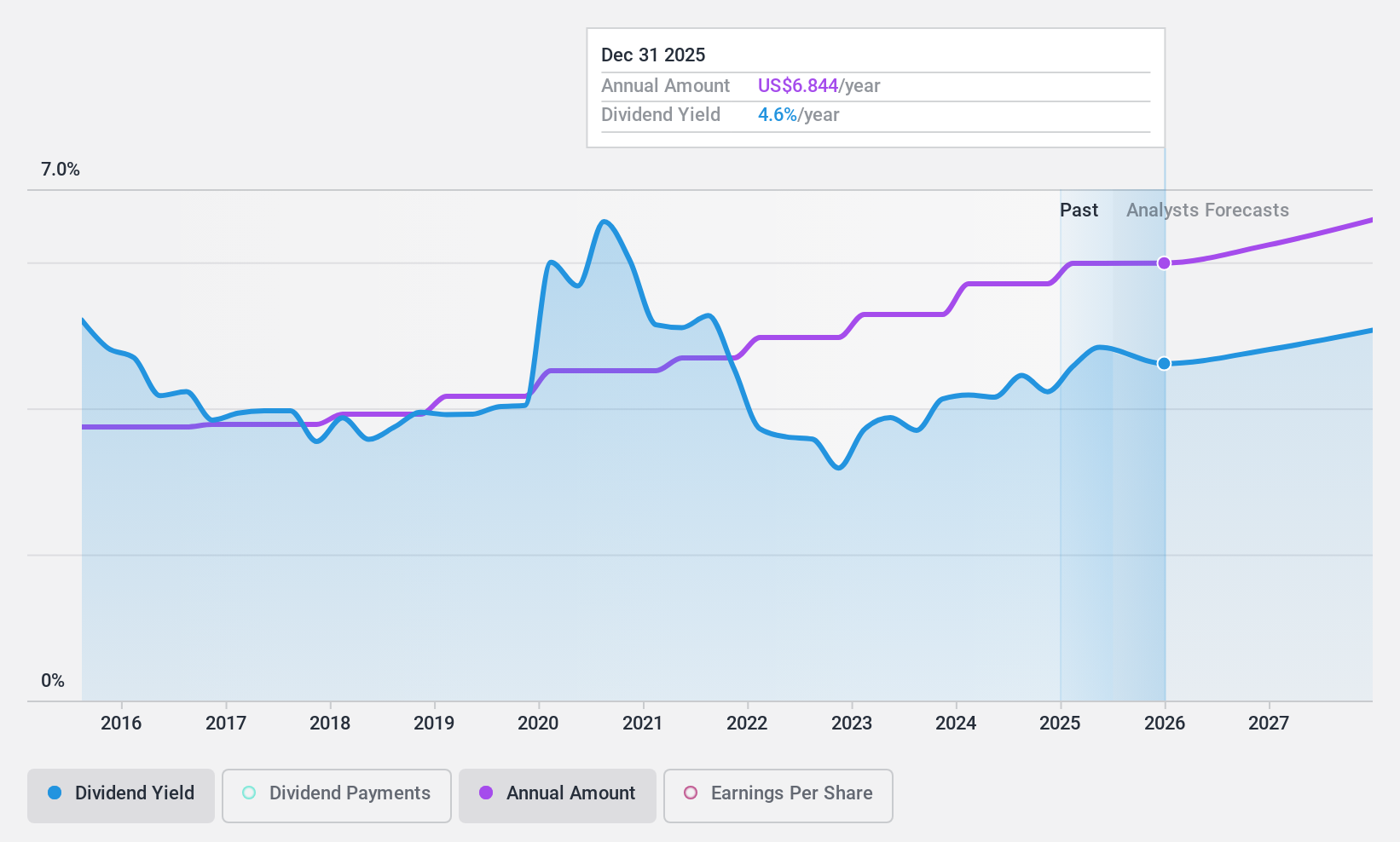

Chevron (NYSE:CVX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chevron Corporation operates through its subsidiaries in integrated energy and chemicals sectors both in the United States and internationally, with a market cap of $279.16 billion.

Operations: Chevron Corporation generates revenue primarily from its upstream operations, which include the exploration and production of crude oil and natural gas, as well as its downstream activities that involve refining, marketing, and distribution of petroleum products.

Dividend Yield: 4.4%

Chevron's dividend payments have been stable and growing over the past decade, with a current yield of 4.38%, slightly below the top 25% of US dividend payers. The dividends are covered by both earnings and cash flows, with payout ratios of 66.8% and 81.4%, respectively. Recently, Chevron increased its quarterly dividend by 5% to US$1.71 per share, reflecting confidence in its financial health despite a slight decline in annual net income to US$17.66 billion for 2024.

- Navigate through the intricacies of Chevron with our comprehensive dividend report here.

- According our valuation report, there's an indication that Chevron's share price might be on the cheaper side.

Seize The Opportunity

- Delve into our full catalog of 135 Top US Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives