- United States

- /

- Banks

- /

- NasdaqCM:ORRF

3 Reliable Dividend Stocks Yielding Up To 4.4%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indices like the S&P 500 and Nasdaq recently hitting record highs, investors are increasingly looking for stability in their portfolios amidst this volatility. In such an environment, dividend stocks can offer a reliable source of income and potential growth, making them an attractive option for those seeking to balance risk and reward.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 10.84% | ★★★★★☆ |

| PACCAR (PCAR) | 4.51% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.79% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.93% | ★★★★★★ |

| Ennis (EBF) | 5.66% | ★★★★★★ |

| DHT Holdings (DHT) | 8.28% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.62% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.73% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.55% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.28% | ★★★★★☆ |

Click here to see the full list of 128 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

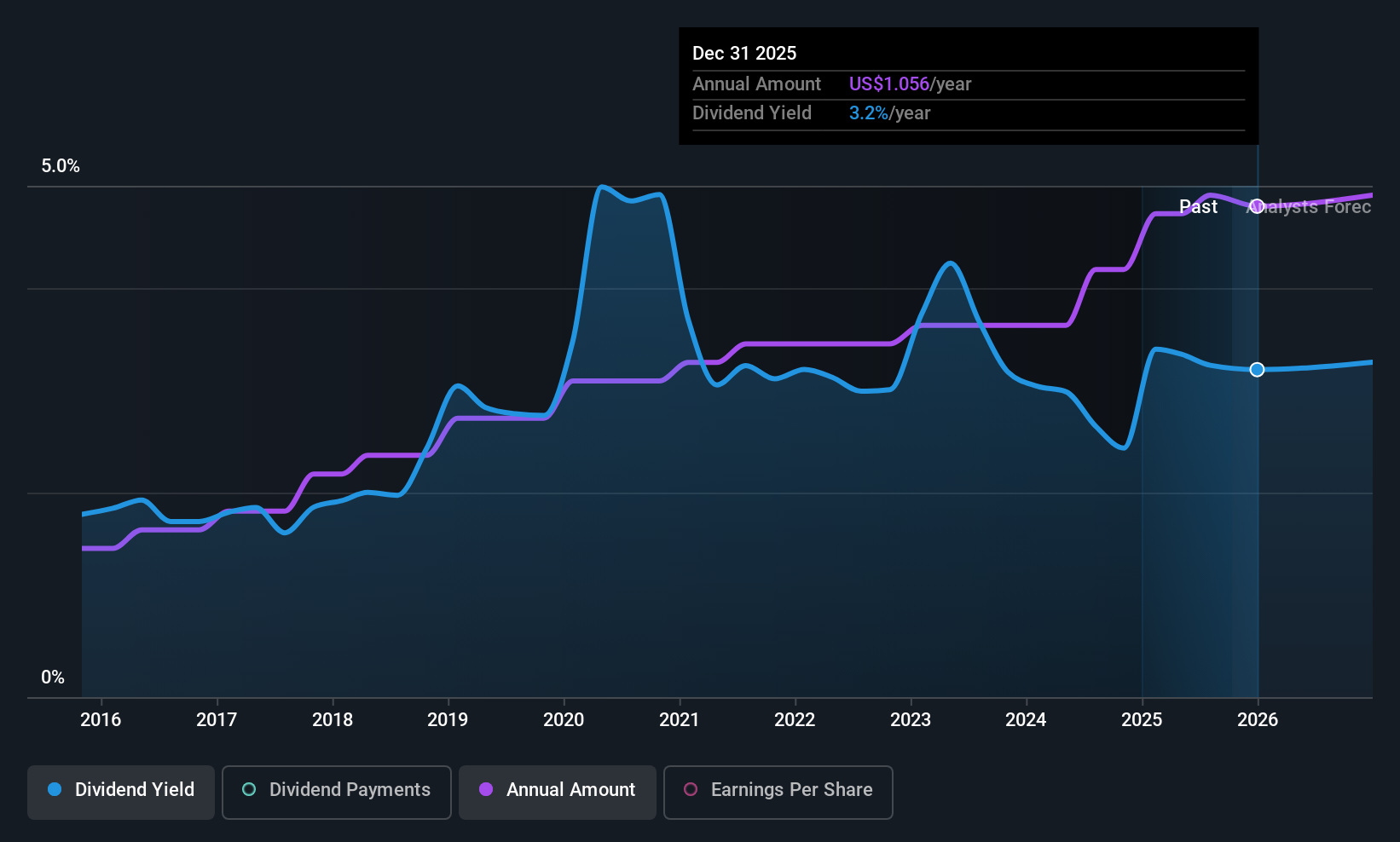

Orrstown Financial Services (ORRF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orrstown Financial Services, Inc. is the financial holding company for Orrstown Bank, offering commercial banking and financial advisory services to a diverse clientele in the United States, with a market cap of $657.04 million.

Operations: The company's revenue primarily comes from its Community Banking segment, which generated $233.72 million.

Dividend Yield: 3.2%

Orrstown Financial Services has demonstrated consistent dividend growth over the past decade, recently increasing its quarterly dividend by $0.01 to $0.27 per share. Despite a lower yield of 3.21% compared to top-tier U.S. dividend payers, the dividends are well-covered by earnings with a payout ratio of 43.4%. The company also redeemed $32.5 million in subordinated notes, reflecting strong financial management and potentially enhancing future dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Orrstown Financial Services.

- Our valuation report unveils the possibility Orrstown Financial Services' shares may be trading at a discount.

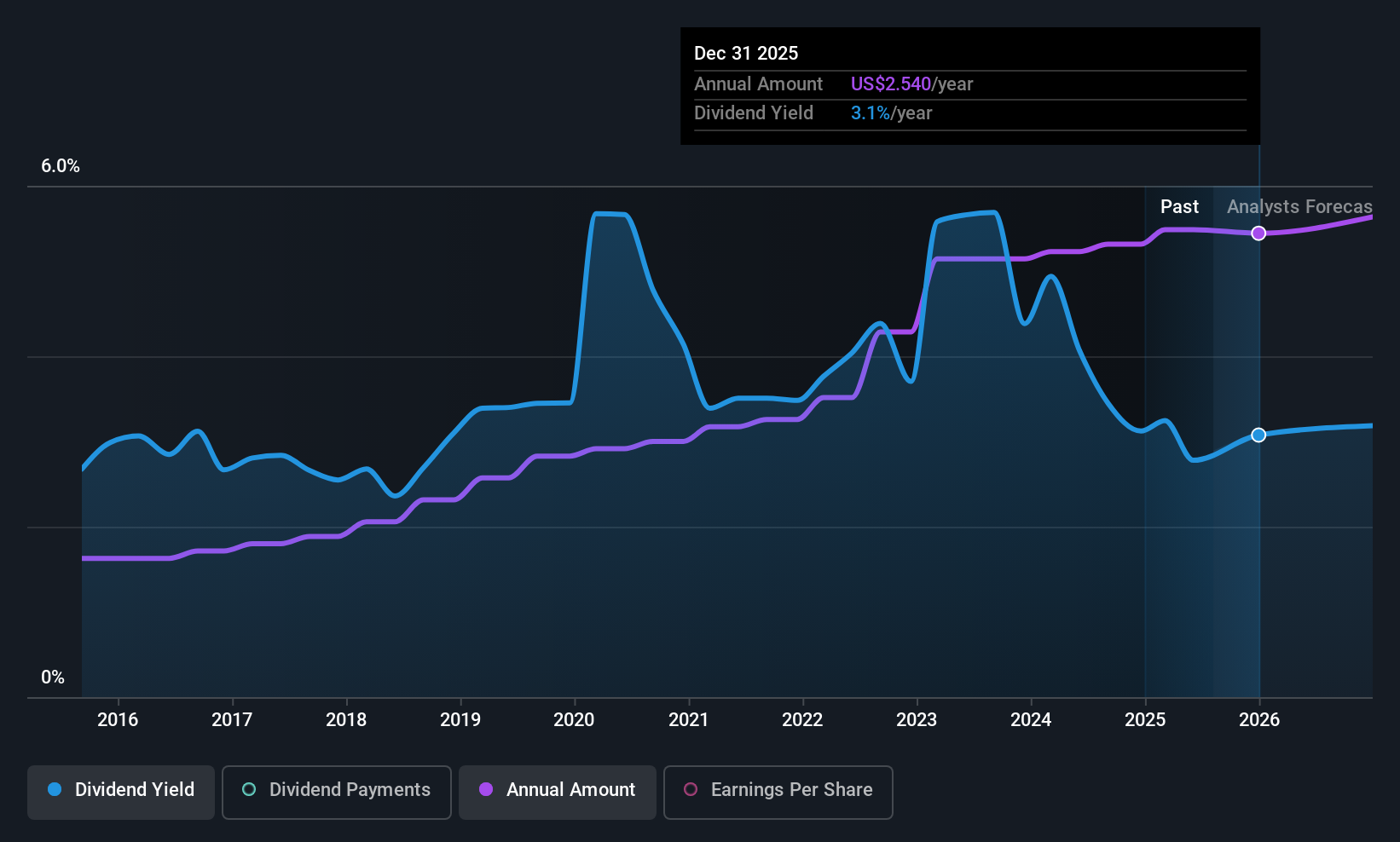

Northrim BanCorp (NRIM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Northrim BanCorp, Inc. is a bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professionals, with a market cap of $475.39 million.

Operations: Northrim BanCorp generates revenue through three primary segments: Specialty Finance ($6.39 million), Home Mortgage Lending ($35.57 million), and Community Banking excluding Specialty Finance ($121.89 million).

Dividend Yield: 3%

Northrim BanCorp's dividend payments have been stable and increasing over the past decade, with a recent quarterly dividend of US$0.64 per share. Despite a relatively modest yield of 3.01%, dividends are well-covered by earnings due to a low payout ratio of 31.2%. The company's stock is trading at an attractive value compared to peers, and its recent 4-for-1 stock split may improve liquidity, although it doesn't directly impact dividend yield or sustainability.

- Take a closer look at Northrim BanCorp's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Northrim BanCorp is trading behind its estimated value.

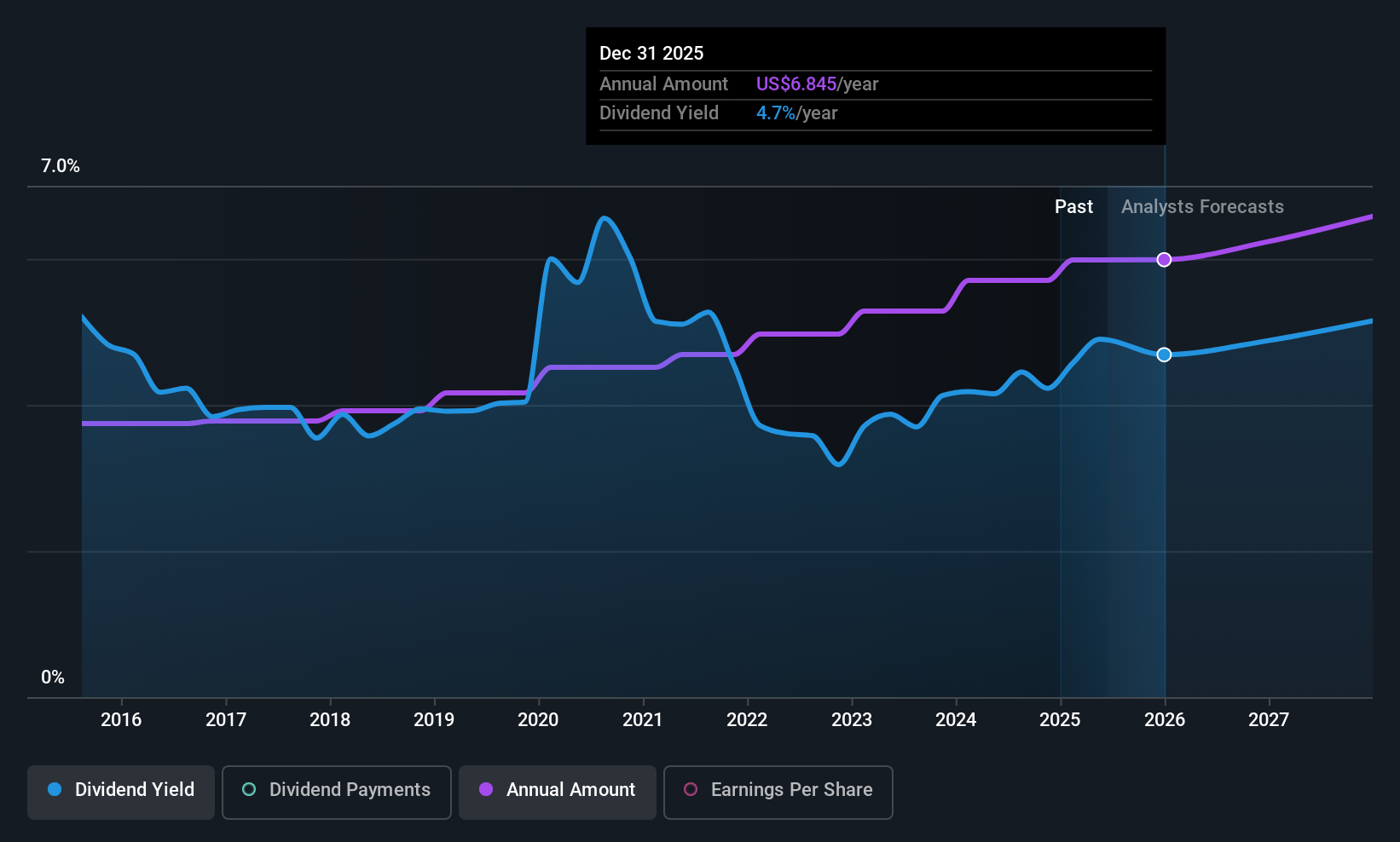

Chevron (CVX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chevron Corporation, with a market cap of $314.35 billion, operates through its subsidiaries in integrated energy and chemicals sectors both in the United States and internationally.

Operations: Chevron's revenue is primarily derived from its Upstream operations, with $46.48 billion internationally and $46.35 billion in the United States, and its Downstream operations, generating $73.13 billion internationally and $77.86 billion in the United States.

Dividend Yield: 4.4%

Chevron's dividend stability over the past decade is supported by a payout ratio of 85.7%, indicating dividends are well-covered by earnings and cash flows. The recent quarterly dividend stands at US$1.71 per share, with a yield of 4.45%. Despite legal challenges from refinery incidents, Chevron's strategic moves like the $53 billion Hess acquisition could bolster its exploration capabilities, potentially impacting future cash flow and dividend sustainability positively.

- Click to explore a detailed breakdown of our findings in Chevron's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Chevron shares in the market.

Key Takeaways

- Navigate through the entire inventory of 128 Top US Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ORRF

Orrstown Financial Services

Operates as the financial holding company for Orrstown Bank that provides commercial banking and financial advisory services to retail, commercial, non-profit, and government clients in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives