- United States

- /

- Oil and Gas

- /

- NYSE:BSM

Black Stone Minerals (BSM): Margin Decline to 57.1% Reinforces Scrutiny of Valuation and Dividend Narratives

Reviewed by Simply Wall St

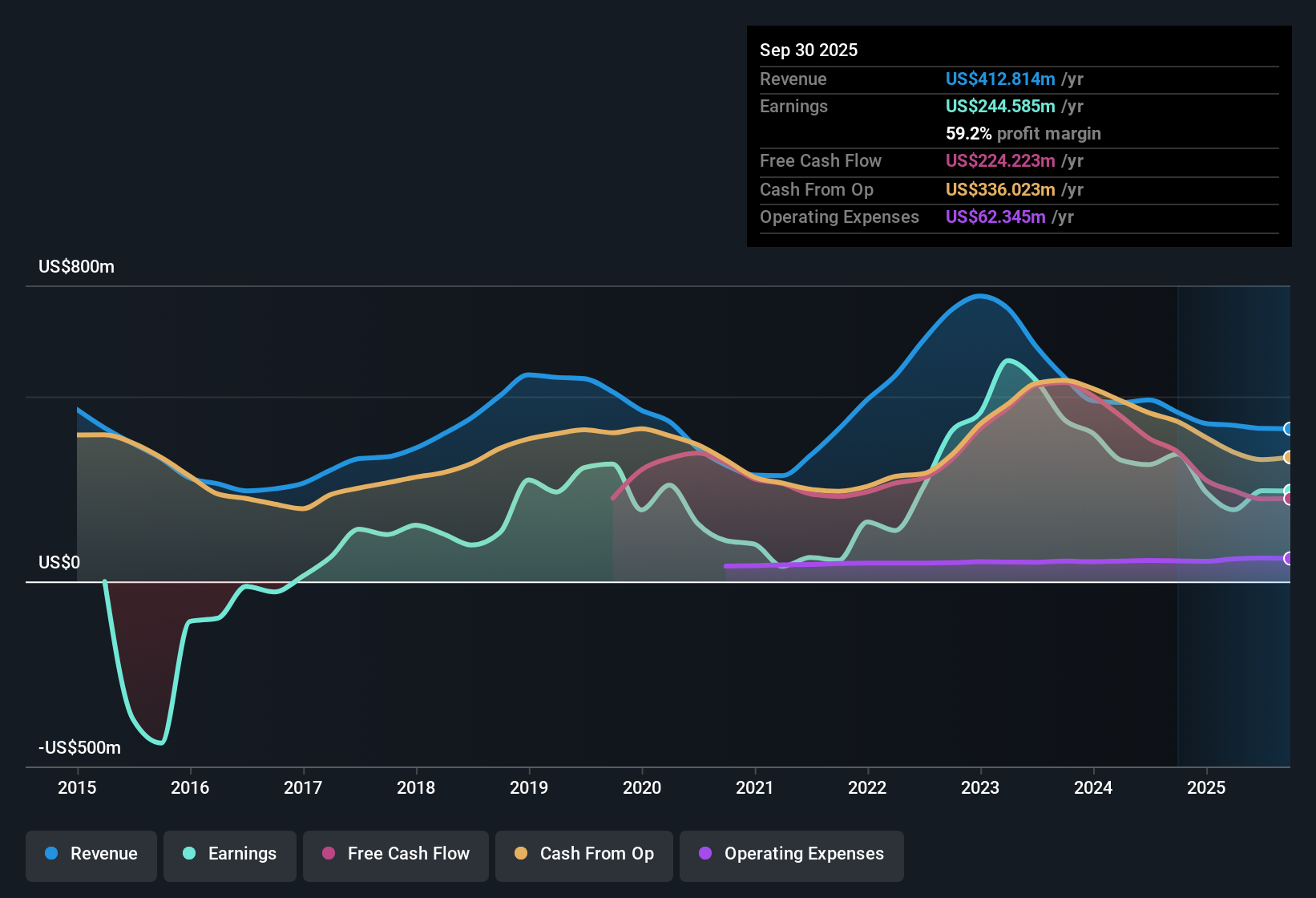

Black Stone Minerals (BSM) reported net profit margins of 57.1%, a drop from last year’s 75.3%, as annual earnings growth over the past five years hit 17.2%. Current forecasts project the company’s earnings will grow by 7.8% per year, with revenue set to rise 7.9% per year. Both figures are below the US market averages of 16% and 10.5%, respectively. Investors are likely weighing the robust margin level and appealing valuation against a modest outlook for forward growth and recent pressure on profitability.

See our full analysis for Black Stone Minerals.Now let’s see how these results compare to the latest narratives shaping sentiment around Black Stone Minerals. Some community beliefs may get confirmed, while others could come under fresh scrutiny.

See what the community is saying about Black Stone Minerals

Margin Compression Meets Ongoing Portfolio Growth

- The latest figures show net profit margins have fallen from last year’s 75.3% to 57.1%, marking a notable decline even as the margin base remains high compared to many peers.

- According to the analysts' consensus view, management's focus on expanding the Shelby Trough and onboarding multiple new operators is expected to boost drilling activity, supporting long-term revenue growth but also pressuring margins.

- The consensus narrative notes that ramping up drilling obligations, which are expected to more than double over the next five years, could increase natural gas volumes and raise future distributable cash flows.

- However, analysts also expect profit margins to dip further, from a current 59.4% toward 53.4% in three years, as concentrated assets and dependency on third parties heighten operational risk.

- The resilience of high margins amid increased development costs highlights the tension: expanded scale may bring long-term rewards, but the margin trend is drawing more scrutiny from both sides of the bullish-bearish debate.

- Portfolio and operator diversification lower risk, yet the shift away from a single operator model means Black Stone Minerals is more exposed to variance in partner performance and drilling discipline.

- Consensus expects that investment in new acreage and operator diversity will offset some margin pressure, but even small operational hiccups in core basins like Haynesville or Bossier may lead to further margin volatility.

For a deeper breakdown of how these margin and drilling trends play into the balanced view about Black Stone Minerals’ long-term prospects, see the full consensus narrative and discover what’s driving analyst expectations. 📊 Read the full Black Stone Minerals Consensus Narrative.

Dividend Sustainability Flagged as a Caution

- Only a single minor risk is flagged in filings: uncertainty around the ongoing sustainability of the dividend, highlighting that while fundamentals look strong, long-term payout reliability is not guaranteed.

- Analysts' consensus view draws attention to several risks that could impact distribution growth, including potential underperformance in natural gas production and concentrated exposure to key basins.

- If drilling by third-party operators in Shelby Trough or Haynesville slows again or disappoints, both revenues and distributable cash flow could stagnate, challenging future payouts.

- High dependence on new acquisitions, with $172 million deployed since September 2023, makes earnings growth and distribution sustainability more sensitive to finding accretive deals, an area that consensus notes warrants close investor attention.

Valuation Discount to Peers but Not to Sector

- Black Stone Minerals trades at a price-to-earnings ratio of 11.6x, which is cheaper than the US Oil and Gas industry average of 12.8x but slightly more expensive than its closest peers (11x), suggesting a nuanced position between value and quality.

- Consensus narrative underscores that the current share price of $13.34 is just 2.6% above the analyst target of $13.00, indicating that the stock may be fairly valued after factoring in near-term growth and risk.

- Despite trading below an estimated DCF fair value of $36.72 per share, the modest gap to the $13.00 price target signals analysts do not expect significant upside at current levels.

- This modest premium may reflect faith in the company’s stable royalty-driven model, yet muted expectations for market-beating capital gains unless operations or commodity prices materially outperform projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Black Stone Minerals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique view on these figures? Share your perspective and build your own narrative in under three minutes by selecting Do it your way

A great starting point for your Black Stone Minerals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Black Stone Minerals faces uncertainty around long-term dividend sustainability. Profit margins are coming under pressure, and payouts are increasingly reliant on acquisitions and drilling success.

If you want greater peace of mind around future income, check out these 1982 dividend stocks with yields > 3% to discover companies offering more reliable dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Black Stone Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSM

Black Stone Minerals

Owns and manages oil and natural gas mineral interests.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)