- United States

- /

- Oil and Gas

- /

- NasdaqGM:HPK

Increases to HighPeak Energy, Inc.'s (NASDAQ:HPK) CEO Compensation Might Cool off for now

Key Insights

- HighPeak Energy's Annual General Meeting to take place on 3rd of June

- Total pay for CEO Jack Hightower includes US$2.40m salary

- Total compensation is 49% above industry average

- HighPeak Energy's three-year loss to shareholders was 70% while its EPS grew by 39% over the past three years

Shareholders of HighPeak Energy, Inc. (NASDAQ:HPK) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 3rd of June. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for HighPeak Energy

Comparing HighPeak Energy, Inc.'s CEO Compensation With The Industry

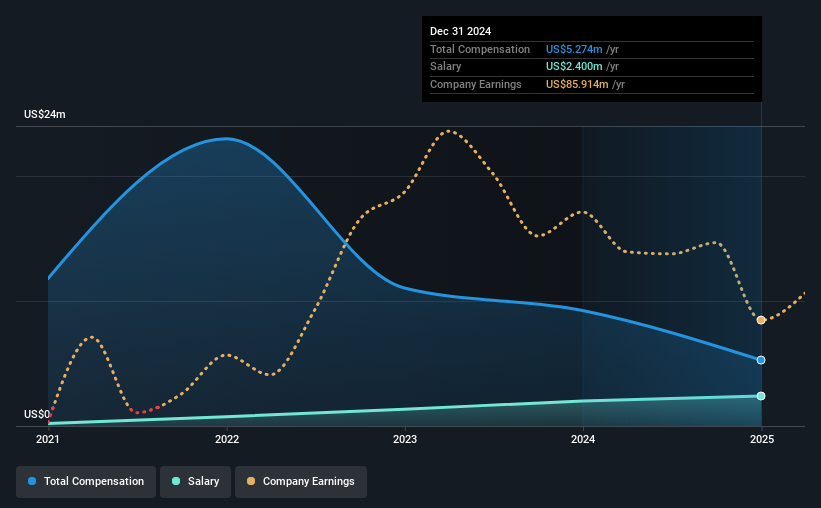

Our data indicates that HighPeak Energy, Inc. has a market capitalization of US$1.2b, and total annual CEO compensation was reported as US$5.3m for the year to December 2024. We note that's a decrease of 43% compared to last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$2.4m.

On examining similar-sized companies in the American Oil and Gas industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$3.5m. Accordingly, our analysis reveals that HighPeak Energy, Inc. pays Jack Hightower north of the industry median. Moreover, Jack Hightower also holds US$47m worth of HighPeak Energy stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$2.4m | US$2.0m | 46% |

| Other | US$2.9m | US$7.2m | 54% |

| Total Compensation | US$5.3m | US$9.2m | 100% |

Speaking on an industry level, nearly 14% of total compensation represents salary, while the remainder of 86% is other remuneration. HighPeak Energy pays out 46% of remuneration in the form of a salary, significantly higher than the industry average. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

HighPeak Energy, Inc.'s Growth

Over the past three years, HighPeak Energy, Inc. has seen its earnings per share (EPS) grow by 39% per year. Its revenue is down 12% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has HighPeak Energy, Inc. Been A Good Investment?

Few HighPeak Energy, Inc. shareholders would feel satisfied with the return of -70% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for HighPeak Energy you should be aware of, and 2 of them don't sit too well with us.

Important note: HighPeak Energy is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HighPeak Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HPK

HighPeak Energy

Operates as an independent crude oil and natural gas exploration and production company.

Moderate risk and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)