- United States

- /

- Consumer Finance

- /

- NYSE:XYF

Discovering US Market's Hidden Gems with 3 Promising Stocks

Reviewed by Simply Wall St

The United States market has shown positive momentum, rising 2.3% in the last week and 5.9% over the past year, with all sectors experiencing gains and earnings projected to grow by 14% annually. In this environment, identifying promising stocks involves looking for companies that not only benefit from current trends but also possess unique qualities that set them apart as potential hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

MetroCity Bankshares (NasdaqGS:MCBS)

Simply Wall St Value Rating: ★★★★★★

Overview: MetroCity Bankshares, Inc. is the bank holding company for Metro City Bank, offering a range of banking products and services across the United States, with a market cap of $725.25 million.

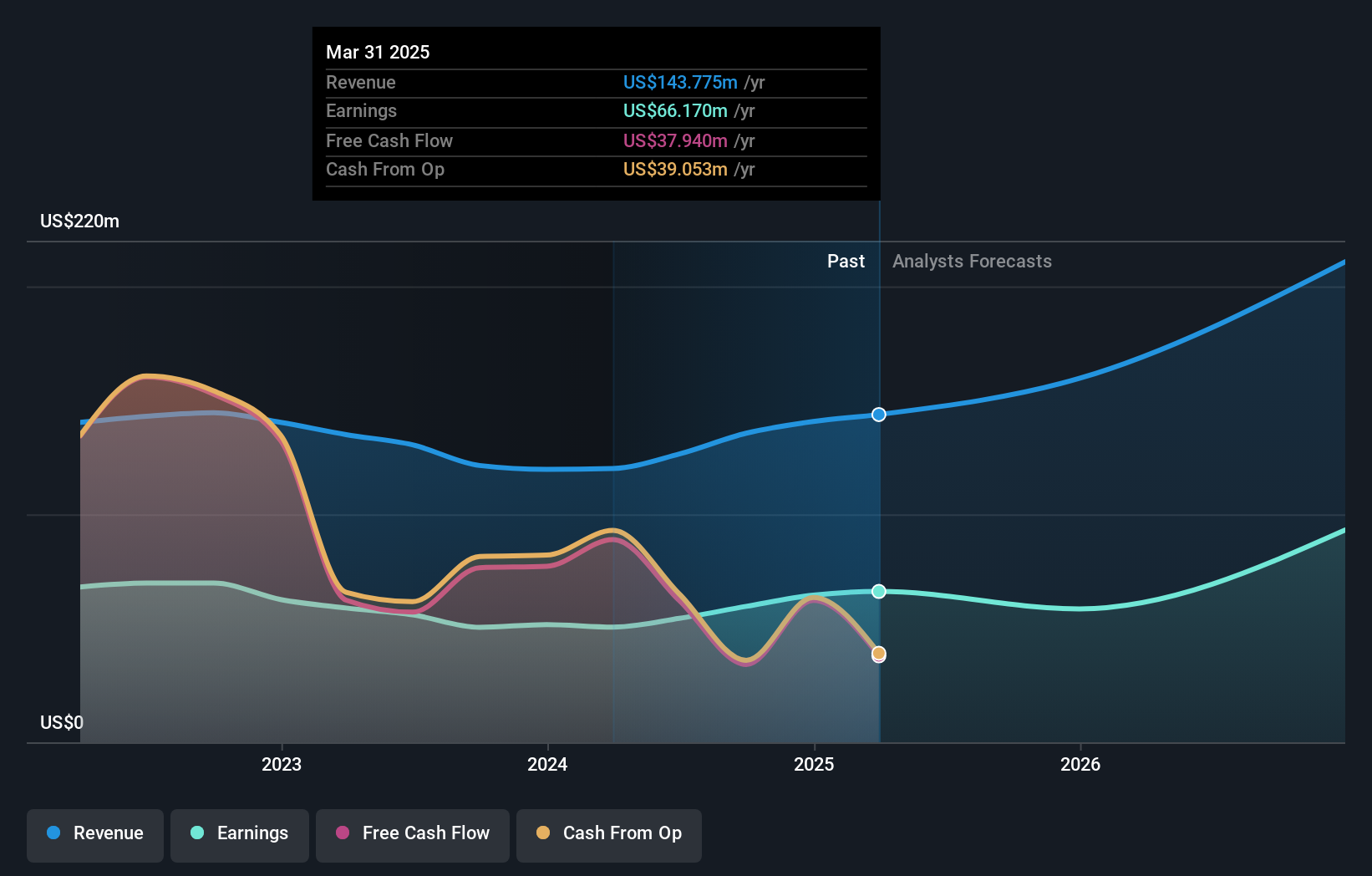

Operations: MetroCity Bankshares generates revenue primarily through its community banking segment, which contributed $143.78 million. The company's net profit margin is a key financial indicator to consider when evaluating its overall profitability.

MetroCity Bankshares, with assets totaling US$3.7 billion and equity of US$428 million, stands out for its robust financial health. The company boasts a sufficient allowance for bad loans at 156% and maintains an appropriate level of non-performing loans at 0.5%. Its earnings growth over the past year surged by 31%, significantly outpacing the industry average of 0.5%. Primarily funded through low-risk customer deposits, which make up 85% of its liabilities, MetroCity appears undervalued trading at nearly half below its estimated fair value. Despite no share repurchases in recent months, the bank continues to deliver high-quality earnings consistently.

- Click here to discover the nuances of MetroCity Bankshares with our detailed analytical health report.

Understand MetroCity Bankshares' track record by examining our Past report.

Central Pacific Financial (NYSE:CPF)

Simply Wall St Value Rating: ★★★★★★

Overview: Central Pacific Financial Corp. is a bank holding company for Central Pacific Bank, offering various commercial banking products and services to businesses, professionals, and individuals in the United States with a market cap of $708.54 million.

Operations: Central Pacific Financial generates revenue primarily through its commercial banking services. The company's financial performance is reflected in its market capitalization of $708.54 million.

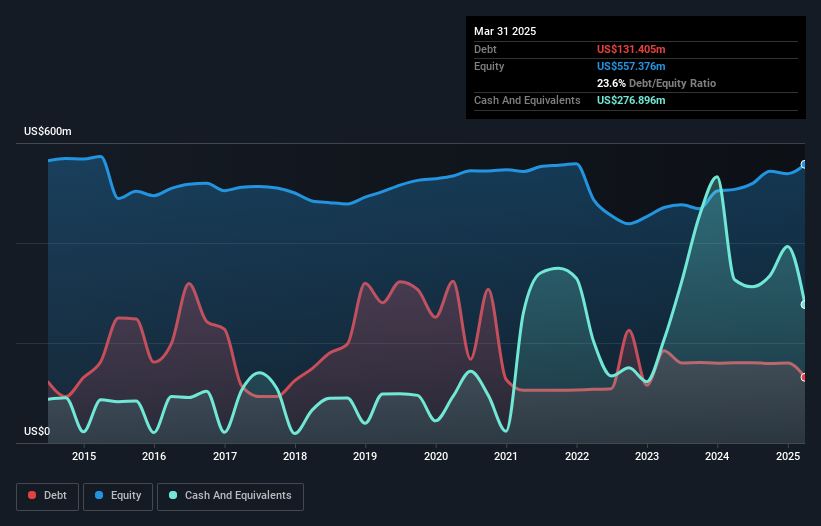

Central Pacific Financial, a bank holding company with total assets of US$7.4 billion and equity of US$557.4 million, is making strategic moves to boost its future earnings potential. With deposits at US$6.6 billion and loans totaling US$5.3 billion, it maintains a net interest margin of 3%. The bank's allowance for bad loans is sufficient at 0.2% of total loans, indicating robust credit risk management. Recent earnings growth outpaced the industry average at 5.1%, while a share repurchase program reflects management's confidence in their trajectory amidst Hawaii's strengthening economy and new opportunities in the banking sector.

X Financial (NYSE:XYF)

Simply Wall St Value Rating: ★★★★★☆

Overview: X Financial offers personal finance services in the People's Republic of China with a market capitalization of $551.88 million.

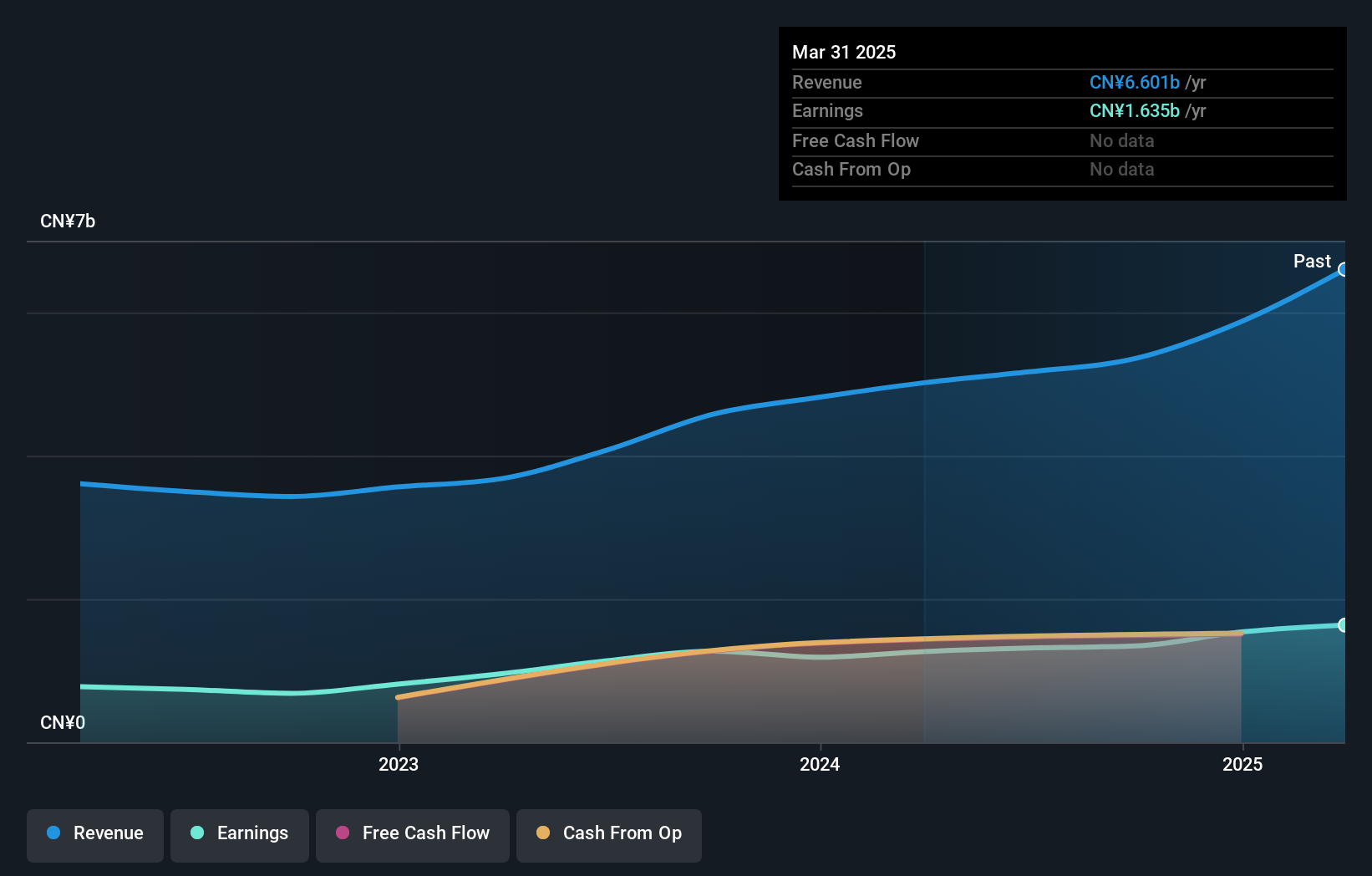

Operations: X Financial generates revenue from personal finance services, reporting CN¥5.87 billion in this segment.

X Financial, a nimble player in the consumer finance sector, has been making waves with its robust earnings growth of 29.8% over the past year, outpacing the industry average of 12.5%. The company recently completed a significant share buyback program, repurchasing 3.8 million shares for $34.1 million between December 2024 and March 2025, reflecting confidence in its valuation which trades at 75.3% below estimated fair value. Despite a volatile share price and a hefty one-off loss of CN¥1.8 billion impacting recent results, X Financial maintains an advantageous position with more cash than total debt and no concerns over interest coverage due to higher interest earnings than payments.

- Unlock comprehensive insights into our analysis of X Financial stock in this health report.

Review our historical performance report to gain insights into X Financial's's past performance.

Where To Now?

- Click through to start exploring the rest of the 286 US Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYF

X Financial

Operates as an online personal finance company in the People's Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives