Last Update 29 May 25

Fair value Increased 2.77%Veren Acquisition Offers Scale And Diversification

- Whitecap closed Veren acquisition two weeks ago, creating one of the largest oi-weighted producers in Canada with a combined output exceeding 370,000 boe/day, giving the company greater resilience and optionality across commodity cycles.

- With a pro forma base of 20,000 drilling locations and more than 10 years of inventory at current development pace, Whitecap can achieve sustainable, long-term growth.

- The company expects meaningful cost efficiencies post-merger, including $50–$70 million in annual G&A and operational savings. Early integration efforts are already underway, with a focus on capturing value within the first 12 months of combined operations.

- One weakness remains in near-term debt metrics due to merger-related adjustments and elevated capital programs. However, management acknowledged balance sheet commitments and plans to prioritize debt repayment in the second half of the year through funds flow.

Q1 Production Delivers Despite Downtime

- Whitecap Resources posted record average production of 179,051 boe/d in Q1 2025, exceeding guidance despite downtime due to extreme cold. Liquids accounted for 76% of output.

- The company generated C$435 million ($315 million) in funds flow during the quarter, while maintaining capital discipline with C$293 million ($212 million) in expenditures. Free funds flow of C$142 million ($102 million) positioned Whitecap well ahead of its annual budget targets.

- Firm drilled 86 wells, with 74 brought on production across several high-impact regions including Montney, Kakwa and Southeast Saskatchewan. These assets delivered above-average type curves, validating Whitecap’s technical models and portfolio quality.

- Despite weather-related disruptions and power outages in the Montney, strong well performance and cycle time improvements supported results. The Kakwa area in particular saw better-than-expected liquids yields and well productivity, reinforcing its importance in Whitecap’s long-term strategy.

Key Takeaways

- I believe the Canadian oil and gas sector is overlooked, mainly because of Donald Trump's upcoming second term.

- Regardless of Trump tariff risk, which I deem overblown due to economic recoil to the American Midwest, I believe Canadians have hedged their risk, improving exporting infrastructure.

- I believe WhiteCap Resources is a well-managed company with steadfast growth and reasonable planned milestones.

- The firm's orientation toward monthly dividend returns makes it attractive in the face of lower interest rates.

INDUSTRY CATALYSTS

Canadian Oil Is The Integral Part Of The American Midwest

Canadian oil is a cornerstone of the American Midwest’s energy infrastructure, supplying refineries uniquely configured to process Canada’s heavier crude. In 2023, the U.S. imported approximately 4 million barrels of Canadian crude oil daily, representing over half of its total oil imports. This supply is critical for Midwest refineries like BP’s Whiting Refinery in Indiana, which processes over 250,000 barrels of Canadian crude daily. These refineries rely on Canada’s heavy crude because U.S. shale production predominantly yields lighter grades, which are unsuitable for their configurations.

President-elect Donald Trump’s proposal to impose a 25% tariff on Canadian oil imports would disrupt this essential trade relationship, significantly raising costs for refineries and consumers. Experts estimate pump prices in the Midwest could rise by 30 cents per gallon or more. Tariffs would hurt both countries, straining the Midwest’s energy supply while making Canadian exports less competitive in their largest market.

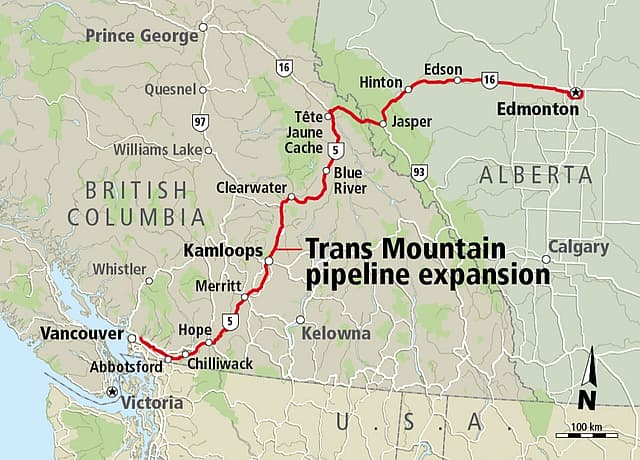

Trans Mountain Pipeline Expansion Enhances Export Capacity

The Trans Mountain pipeline expansion, completed in 2024, has tripled its shipping capacity from 300,000 to nearly 900,000 barrels per day, significantly boosting Canada’s ability to export crude oil.

This $24 billion project stretches from Edmonton, Alberta, to a marine terminal near Vancouver, providing Canadian producers with direct access to global markets via the Pacific. This alternative is crucial as it reduces reliance on U.S. buyers, especially amid the looming threat of tariffs proposed by President-elect Donald Trump.

Trans Mountain pipeline route, Source: TimesColonist

By diversifying export routes, the expansion allows Canada to bypass potential economic disruptions tied to U.S. trade policies and tap into demand in Asian markets, such as China and India.

The pipeline offers a vital economic lifeline for Canada’s oil sector, which accounts for approximately 10% of the country's GDP. It enhances pricing leverage, as Canadian producers no longer need to sell at a discount due to limited access to non-U.S. buyers.

COMPANY'S CATALYSTS

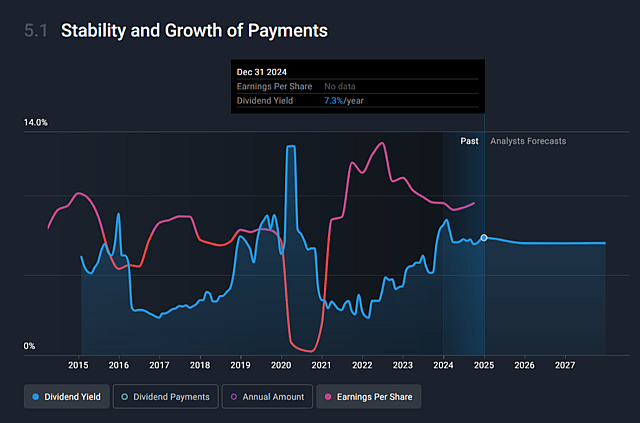

Stable Dividend Yield Is Attractive Facing Lower Interest Rates

Canadian interest rates have been declining, with five rate cuts in 2024, including two 50 bps cuts in October and December. This trend makes domestic dividend payers more attractive. Meanwhile, Whitecap has been paying stable monthly dividends, as its business objective is to focus on profitable production growth with sustainable dividends paid out from funds flow.

Its current dividend yield is 7.6%, which is well above the industry average of 4.7%. The earning payout ratio is a viable 49%, and the cash payout ratio of 53% indicates good coverage by free cash flow and a potential for further dividend growth.

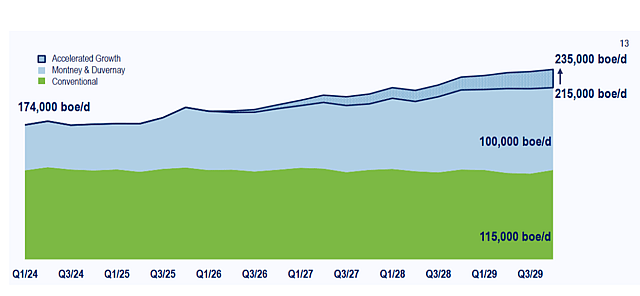

Growing Production With An Improving Resource Base

Whitecap has been successful in its growth targets, expanding its production year over year by 13% and 5% above the original guidance. Management budgeted around $1 billion in capex while maintaining a sound balance sheet and risk management. To provide downside protection, it targeted 25%—35% hedged production.

WhiteCap production growth projection, Source: CompanyPresentation

With a strong resource base spread across Alberta and Saskatchewan, the firm has the potential to double its capacity growth by Q3 2029, averaging a 5% annual growth rate to the target of 215,00 barrels of oil equivalent per day.

RISKS (To my Thesis)

Oil Price Volatility Is An Unknown Variable

Oil is a significantly volatile commodity, owing to the inelasticity of both supply and demand in the short term. It takes years to develop new supply sources and change production while switching to other fuel sources remains difficult for consumers. Large price changes remain a natural response to the rebalance of physical supply and demand following market shocks. The negative oil futures price from April 20, 2020, remains one of the best examples.

Goldman Sachs expects oil prices to hover around $76 per barrel, which is slightly above current prices. The bank sees a 400,000 barrels per day surplus in 2025 and $71 in 2026—expecting a larger surplus. Naturally, this scenario could change given the unstable geopolitical situation in the Middle East, yet falling oil prices remain a factor for every oil producer.

Canadian Elections And Trump's Second Term Could Shift The Market

Donald Trump will begin his second term on January 20. His tariff policy will be closely watched, as the nearest US trade partners (Canada and Mexico) could be hit with as much as 25% tariffs. Although tariffs are a political weapon designed to force these countries to even balance their trade with the US, Trump should not be taken lightly. While Canadian oil exports could eventually find other markets via seaborne routes, the short-term negative sentiment from tariffs would likely hurt the oil sector.

Canada is due to hold the next election by October 2025, with the opposition comfortably ahead of Prime Minister Justin Trudeau's Liberal Party. The Conservative Party, headed by Pierre Poilievre, is in prime spot to reclaim the leadership. However, given his ”bring it home“ stance, his election risks further cross-border trade escalation.

ASSUMPTIONS

- Oil prices will be above $70 on average for the next five years owing to an unstable situation in the Middle East; however, Donald Trump's influence will tone the conflicts down.

- Trump's foreign policies won't involve tariffs on its closest trading partners (Canada and Mexico), but they will serve as an instrument to level the balance of trade. Even if Trump clashes with the new Canadian government, I expect the conflict to quickly resolve, while the oil sector hedges its risks through increased maritime exports. Furthermore, I expect the Canadian dollar, a commodity currency, to do well during that period.

- Whitecap will grow its capacity at an average of 5% over the next 5 years, reaching 215,000 barrels of oil equivalent per day by 2029.

- $1 billion capex will be enough to achieve that goal, leaving plenty of cash for distribution. The firm will keep and continue to grow its quality monthly dividend, which is a big selling point for its investors.

- A sound approach to costs and external stability will result in quality net margins remaining in the high 20s.

VALUATION

Valuing Whitecap is not a simple task. Regardless of the company's prospects, its success is closely tied to oil prices, which are historically very volatile and prone to sudden macroeconomic shocks.

Since Whitecap Resources strongly emphasizes shareholder returns through dividends, I'm using the Dividend Discount Model for stock valuation, in this case, Gordon's simple model that assumes the constant growth of dividends.

V0 = D1 / r-g

Where,

· V0 equals the fair value of the stock,

· D1 = dividend paid out in the next period

· R= estimated cost of equity, and

· g=constant dividend growth rate into perpetuity.

Assuming the dividend growth rate will follow the company growth rate of 5%, the values equal

· D1= $0.73

· R= 8.54%

· g=5%

Using the formula above, V0 =0.73 / 8.54-5, results in a stock price of CA$20.6.

Since the stock currently trades around CA$10.3, this value represents an upside potential of around 100%.

Per more broadly used valuation, the cornerstone assumption would be a stable net margin of around 26%. A conservative revenue growth of 4% would result in revenue of around CA$ 3.86 billion by 2030, or net revenue of $CA1 billion.

Assuming an annual buyback of around 3.4% of issued shares, this equates to around 500 million shares outstanding by 2030 or an EPS of CA$2. Using the industry peer average of 16x, this equals a share price of CA$ 32 - discounted by the Simply Wall St’s rate of 7% - this equals a present price of approximately CA$22.8

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst StjepanK has a position in TSX:WCP. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.