- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Is It Too Late To Consider Charles Schwab After Its Strong 2025 Share Price Rally?

Reviewed by Bailey Pemberton

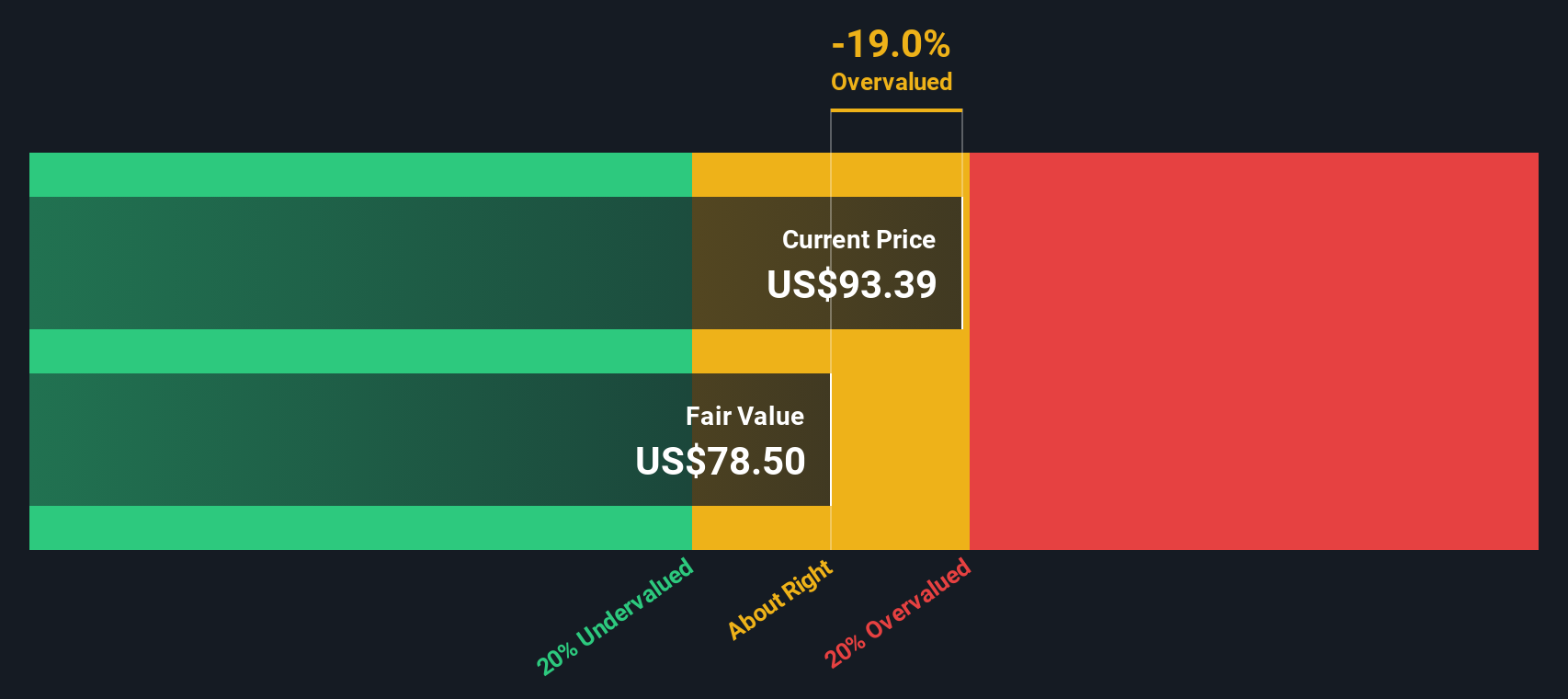

- If you are wondering whether Charles Schwab at around $96 is still a smart idea at this price or if most of the upside is already priced in, this breakdown will help you consider whether the current market tag makes sense.

- The stock is up 3.0% over the last week and 30.9% year to date, even after a softer patch that left the 30 day return at -1.1%. The 1 year and 5 year gains of 23.0% and 98.5% highlight how strong the longer term story has been.

- Recent moves have been shaped by a steady stream of headlines around interest rate expectations and trading activity on the platform, which both matter a lot for Schwab's core earnings engine. At the same time, management's ongoing integration of past acquisitions and shifts in client cash behavior have kept investors debating how sustainable those tailwinds really are.

- Right now Schwab only scores 2 out of 6 on our undervaluation checks. In the sections that follow we will walk through what different valuation methods are indicating, and then finish with a more nuanced way to think about what the market might be missing.

Charles Schwab scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Charles Schwab Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the return that investors demand on its equity, and then capitalizes those extra profits into an intrinsic value per share.

For Charles Schwab, the starting point is a Book Value of $23.85 per share and an Average Return on Equity of 19.82%. Based on analyst expectations, this translates into Stable EPS of $6.12 per share, while the Cost of Equity is estimated at $2.73 per share. The gap between these two, an Excess Return of $3.39 per share, represents the economic value Schwab is projected to create each year above its funding cost. Over time, that value compounds on a Stable Book Value that is expected to grow to $30.87 per share.

Aggregating these excess returns, the model arrives at an intrinsic value of about $91.51 per share. At the current price, this implies the stock is roughly 5.6% above fair value. This is a small premium and suggests the market is paying slightly up for Schwab's quality and growth profile.

Result: ABOUT RIGHT

Charles Schwab is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

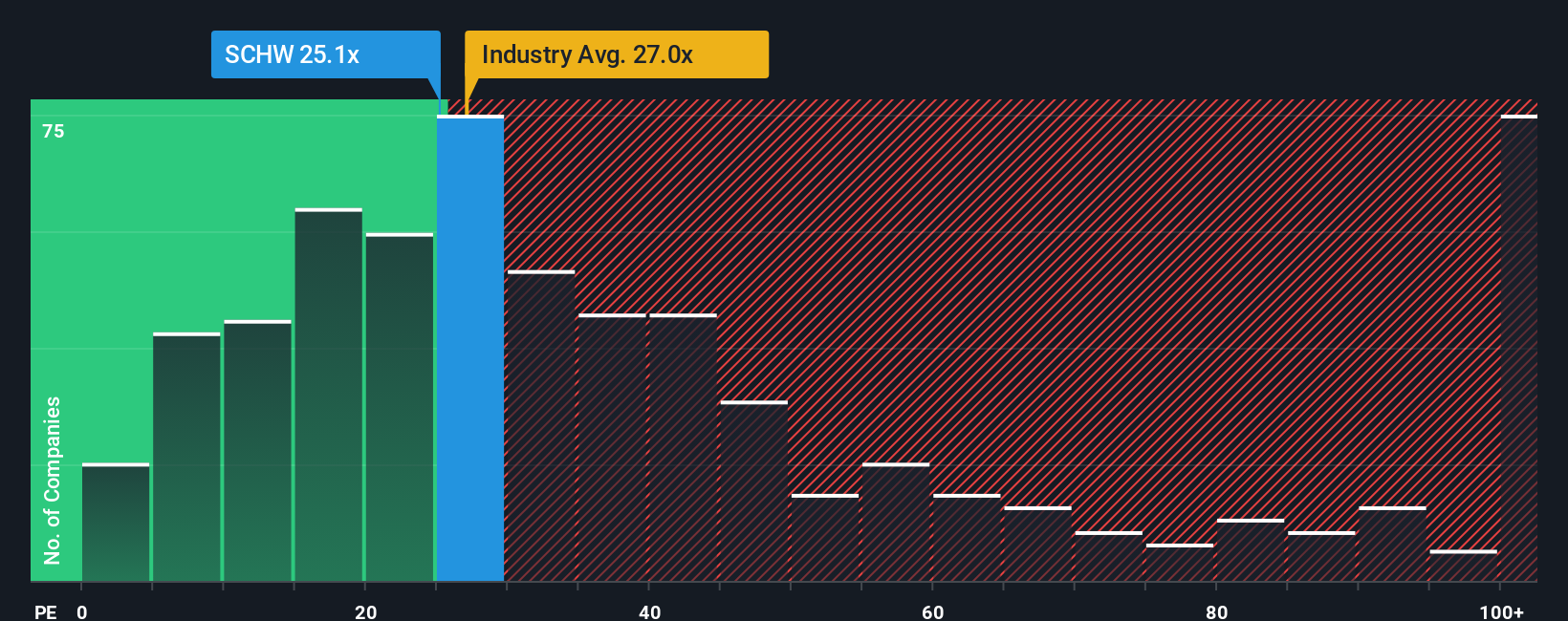

Approach 2: Charles Schwab Price vs Earnings

For a consistently profitable business like Charles Schwab, the price to earnings multiple is a straightforward way to judge how much investors are willing to pay for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE ratio, while slower growth or higher uncertainty usually call for a lower, more conservative multiple.

Schwab currently trades at about 22.1x earnings. That is below the Capital Markets industry average of roughly 25.4x and well under the peer group average of about 29.0x. At first glance this makes the stock look reasonably priced relative to competitors. However, Simply Wall St also calculates a Fair Ratio of 18.5x for Schwab, which reflects what investors might typically pay given its specific mix of earnings growth, margins, size, industry dynamics and risk profile.

This Fair Ratio is more tailored than simple peer or industry comparisons because it adjusts for Schwab's own fundamentals rather than assuming all firms deserve the same multiple. Comparing 22.1x to the 18.5x Fair Ratio suggests the market is paying a noticeable premium for the stock.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Charles Schwab Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to link your view of Charles Schwab’s story to a concrete financial forecast and fair value. Narratives help you tell the story behind your numbers, compare that Fair Value to the current Price to decide whether to buy, hold or sell, and then have that Narrative update dynamically as new news or earnings arrive. All of this happens within the Community page on Simply Wall St where millions of investors share their perspectives. For example, one Narrative sees Schwab’s expanding client base, digital adoption and margin gains justifying a higher fair value around $131. A more cautious Narrative focuses on competition, regulation and interest rate risk and lands closer to $84. This shows how different yet structured viewpoints can coexist and guide decisions in a clear, accessible way.

Do you think there's more to the story for Charles Schwab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)