- United States

- /

- Mortgage REITs

- /

- NYSE:RC

Exploring Arrow Financial And 2 Other Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 4.4% decline, though it remains up by 7.5% over the past year with earnings projected to grow by 14% annually. In this fluctuating environment, identifying stocks that are considered undervalued and show insider buying can be a strategic approach for investors seeking potential opportunities in small-cap companies like Arrow Financial and others.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First Mid Bancshares | 10.7x | 2.6x | 41.09% | ★★★★★★ |

| Eagle Financial Services | 7.4x | 1.6x | 40.64% | ★★★★★☆ |

| Shore Bancshares | 10.1x | 2.3x | 10.48% | ★★★★★☆ |

| Arrow Financial | 14.6x | 3.2x | 41.62% | ★★★★☆☆ |

| Quanex Building Products | 73.5x | 0.6x | 47.14% | ★★★★☆☆ |

| S&T Bancorp | 10.9x | 3.7x | 42.14% | ★★★★☆☆ |

| Columbus McKinnon | 54.1x | 0.5x | 43.00% | ★★★☆☆☆ |

| Union Bankshares | 14.7x | 2.7x | 33.70% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -167.06% | ★★★☆☆☆ |

| Thryv Holdings | NA | 0.8x | 9.99% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Arrow Financial (NasdaqGS:AROW)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Arrow Financial is a community banking organization with operations focused on providing financial services, and it has a market capitalization of approximately $0.44 billion.

Operations: Arrow Financial's revenue primarily comes from its community banking segment, which generated $134.63 million in the most recent period. The company's financials show a consistent gross profit margin of 100% over multiple periods, indicating that all revenue translates directly to gross profit without any cost of goods sold reported. Operating expenses have been increasing over time, with general and administrative expenses being a significant component, reaching $79.24 million in the latest quarter. The net income margin has shown fluctuations, recently recorded at 22.07%.

PE: 14.6x

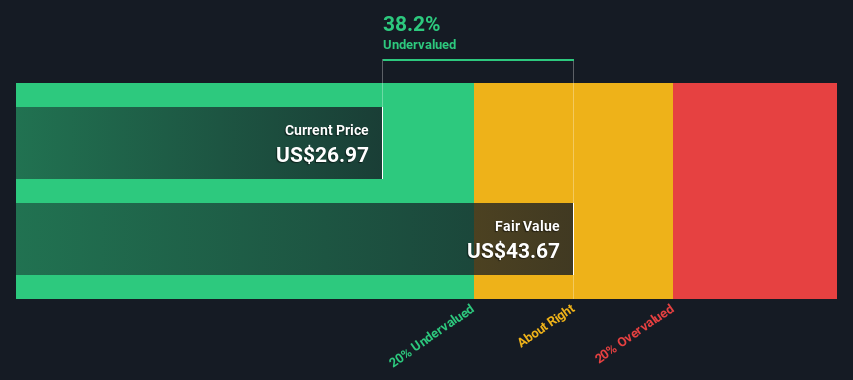

Arrow Financial, a smaller company in the financial sector, has recently shown insider confidence with Daniel White purchasing 3,668 shares for approximately US$99,880. Despite a drop in quarterly net income to US$4.47 million from US$7.72 million the previous year, annual earnings per share remained stable at US$1.78. The company's strategic board appointments and consistent dividend payments underscore its commitment to future growth as it anticipates earnings growth of 22.67% annually.

- Delve into the full analysis valuation report here for a deeper understanding of Arrow Financial.

Evaluate Arrow Financial's historical performance by accessing our past performance report.

Midland States Bancorp (NasdaqGS:MSBI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Midland States Bancorp operates as a diversified financial holding company providing commercial and retail banking services, wealth management, and other financial solutions with a market cap of approximately $0.47 billion.

Operations: Midland States Bancorp generates its revenue entirely from gross profit, which consistently maintains a gross profit margin of 100% over the observed periods. The company's operating expenses, including significant general and administrative costs, have varied but generally increased over time. Notably, the net income margin has shown fluctuations, with a peak of 30.32% in Q3 2022 before decreasing to 21.28% by Q1 2024 and resulting in a negative net income of -$22.34 million by Q4 2024 (in millions of $).

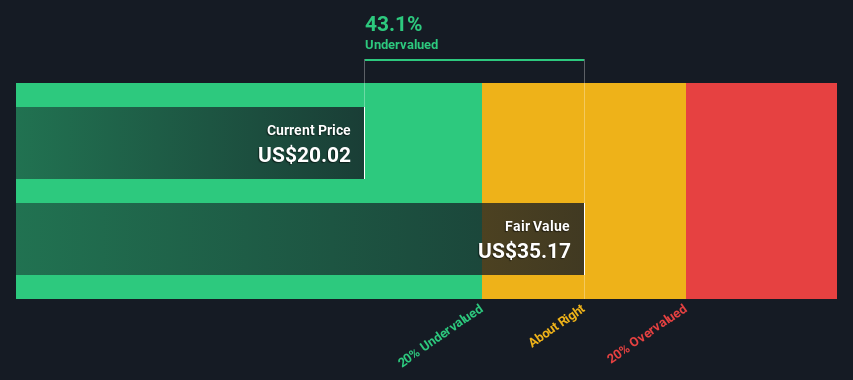

PE: -17.6x

Midland States Bancorp, a smaller U.S. financial institution, currently displays characteristics of being undervalued. Despite a high bad loan ratio of 2.7% and a low allowance for bad loans at 54%, the company is projected to grow earnings by over 90% annually. Insider confidence is evident with recent share purchases, suggesting belief in future prospects. Additionally, dividends remain steady with $0.31 per share declared recently, reinforcing shareholder value amidst executive changes and past charge-offs totaling US$102 million in Q4 2024.

Ready Capital (NYSE:RC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ready Capital is a financial services company specializing in small business lending and commercial real estate financing, with a market cap of approximately $1.12 billion.

Operations: Ready Capital's revenue streams include Small Business Lending, contributing $131.83 million, and LMM Commercial Real Estate, which showed a negative contribution of -$361.02 million. The company has experienced fluctuations in its financial performance over recent periods, with the net income margin reaching as high as 98.65% in Q3 2023 before dropping to -1.90% by Q4 2024. Operating expenses have been a significant part of their cost structure, with general and administrative expenses consistently being the largest component within operating costs across multiple periods analyzed.

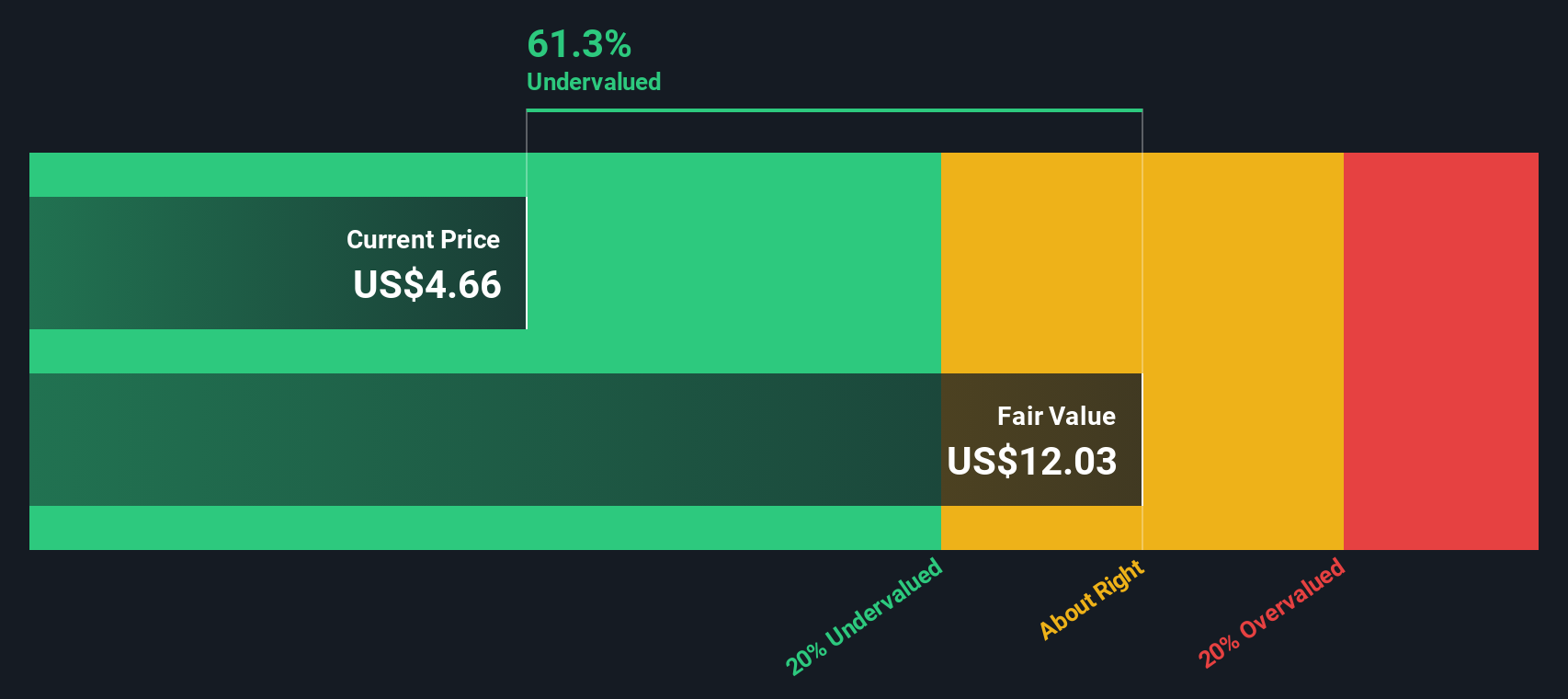

PE: -1.9x

Ready Capital, operating in the U.S. market, has faced challenges with a net loss of US$435.76 million for 2024 and increased leverage to 3.8x, partly due to reserving US$284 million for non-performing loans in its CRE portfolio. Despite these hurdles, the company completed a share buyback of nearly 12 million shares worth US$100 million by December 2024 and issued fixed-income offerings totaling US$220 million in February 2025, indicating strategic financial maneuvers amid legal scrutiny over alleged misleading disclosures during late 2024 to early 2025.

- Click here and access our complete valuation analysis report to understand the dynamics of Ready Capital.

Review our historical performance report to gain insights into Ready Capital's's past performance.

Make It Happen

- Click this link to deep-dive into the 63 companies within our Undervalued US Small Caps With Insider Buying screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RC

Ready Capital

Operates as a real estate finance company in the United States.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives