- United States

- /

- Mortgage REITs

- /

- NYSE:RC

3 US Stocks That Might Be Undervalued By Up To 39.3%

Reviewed by Simply Wall St

As U.S. stock futures inch higher ahead of a key Consumer Price Index inflation report, investors are closely watching how the Federal Reserve's potential interest rate decisions might impact market dynamics. In this environment, identifying undervalued stocks becomes crucial, as these opportunities can offer significant upside potential when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Argan (NYSE:AGX) | $142.45 | $277.95 | 48.8% |

| UMB Financial (NasdaqGS:UMBF) | $124.24 | $243.82 | 49% |

| NBT Bancorp (NasdaqGS:NBTB) | $50.97 | $99.93 | 49% |

| West Bancorporation (NasdaqGS:WTBA) | $23.65 | $46.42 | 49% |

| Equity Bancshares (NYSE:EQBK) | $47.67 | $92.60 | 48.5% |

| Privia Health Group (NasdaqGS:PRVA) | $21.62 | $43.17 | 49.9% |

| U.S. Physical Therapy (NYSE:USPH) | $96.29 | $187.03 | 48.5% |

| First Advantage (NasdaqGS:FA) | $19.65 | $39.02 | 49.6% |

| Vasta Platform (NasdaqGS:VSTA) | $2.205 | $4.33 | 49.1% |

| Marcus & Millichap (NYSE:MMI) | $40.94 | $81.25 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

German American Bancorp (NasdaqGS:GABC)

Overview: German American Bancorp, Inc. is a financial holding company for German American Bank, offering retail and commercial banking services, with a market cap of approximately $1.33 billion.

Operations: The company's revenue segments consist of Core Banking at $156.46 million, Insurance at $6.66 million, and Wealth Management Services at $14.07 million.

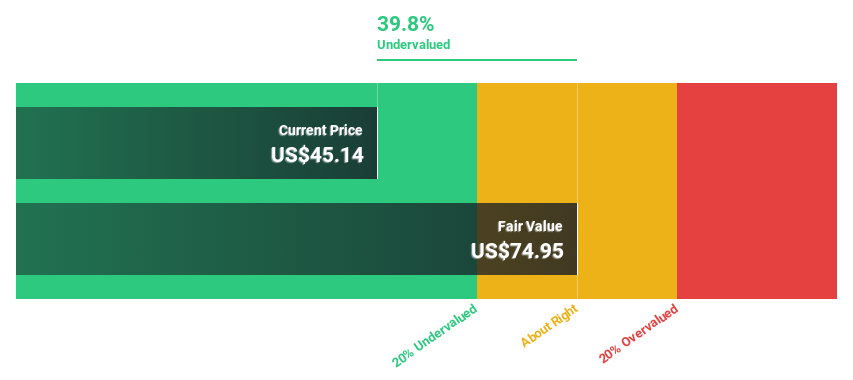

Estimated Discount To Fair Value: 39.3%

German American Bancorp is trading at US$45.48, significantly below its estimated fair value of US$74.95, suggesting it may be undervalued based on cash flows. Despite a slight decline in net income and earnings per share for the recent quarter, the company maintains a reliable dividend yield of 2.37%. Earnings are forecast to grow significantly at 22.3% annually, outpacing both its revenue growth and the broader U.S. market projections.

- Our earnings growth report unveils the potential for significant increases in German American Bancorp's future results.

- Click to explore a detailed breakdown of our findings in German American Bancorp's balance sheet health report.

Enfusion (NYSE:ENFN)

Overview: Enfusion, Inc. offers software-as-a-service solutions for the investment management industry across various regions including the United States, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $1.33 billion.

Operations: The company's revenue primarily stems from its online financial information providers segment, generating $195.16 million.

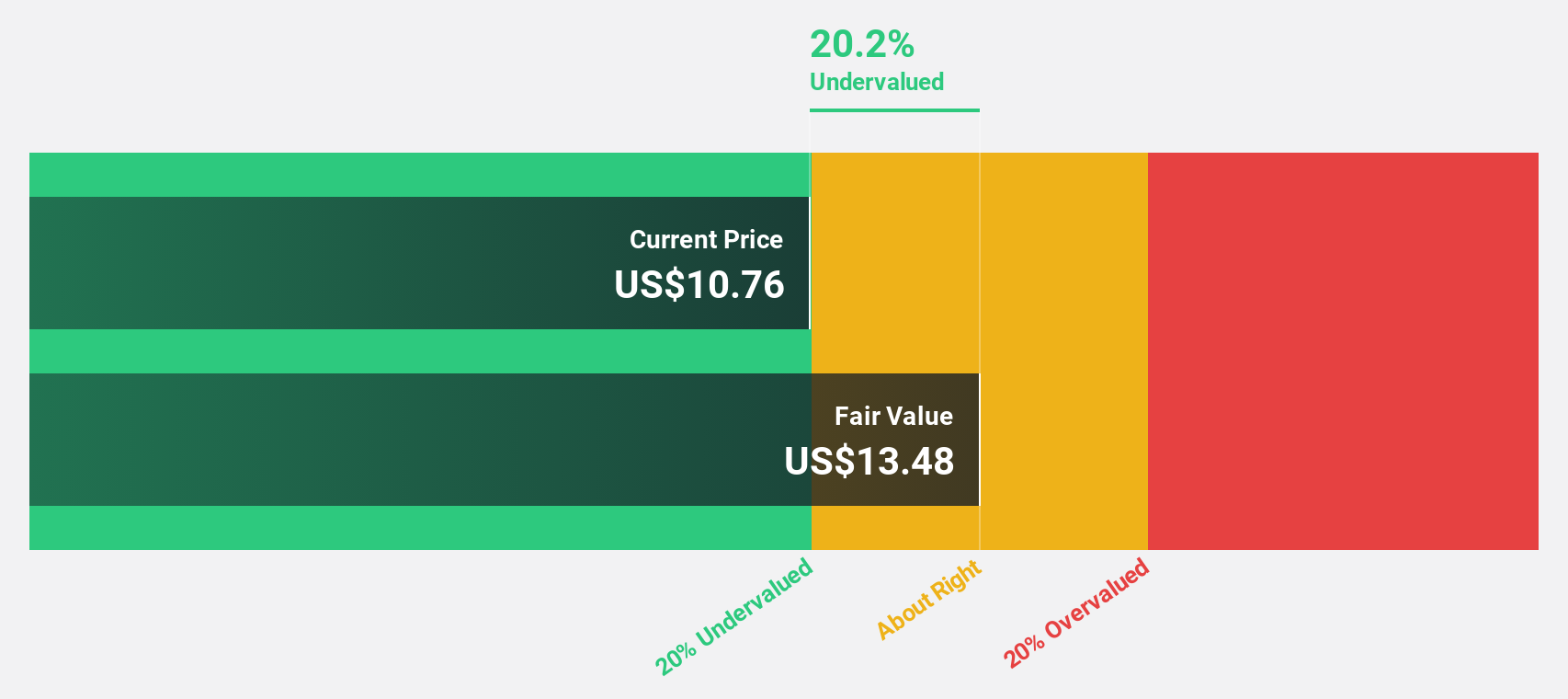

Estimated Discount To Fair Value: 30.2%

Enfusion is trading at US$10.56, significantly below its estimated fair value of US$15.14, indicating potential undervaluation based on cash flows. Despite a drop in net profit margin from 3.6% to 1.4%, earnings are projected to grow substantially at 74.8% annually, surpassing the broader U.S. market's expectations. Recent leadership changes and M&A discussions could influence future performance, though insider selling has been significant over the past quarter.

- Our growth report here indicates Enfusion may be poised for an improving outlook.

- Get an in-depth perspective on Enfusion's balance sheet by reading our health report here.

Ready Capital (NYSE:RC)

Overview: Ready Capital Corporation is a real estate finance company in the United States with a market cap of approximately $1.26 billion.

Operations: The company's revenue segments include Small Business Lending, generating $152.93 million, and Lmm Commercial Real Estate, which reported -$43.58 million.

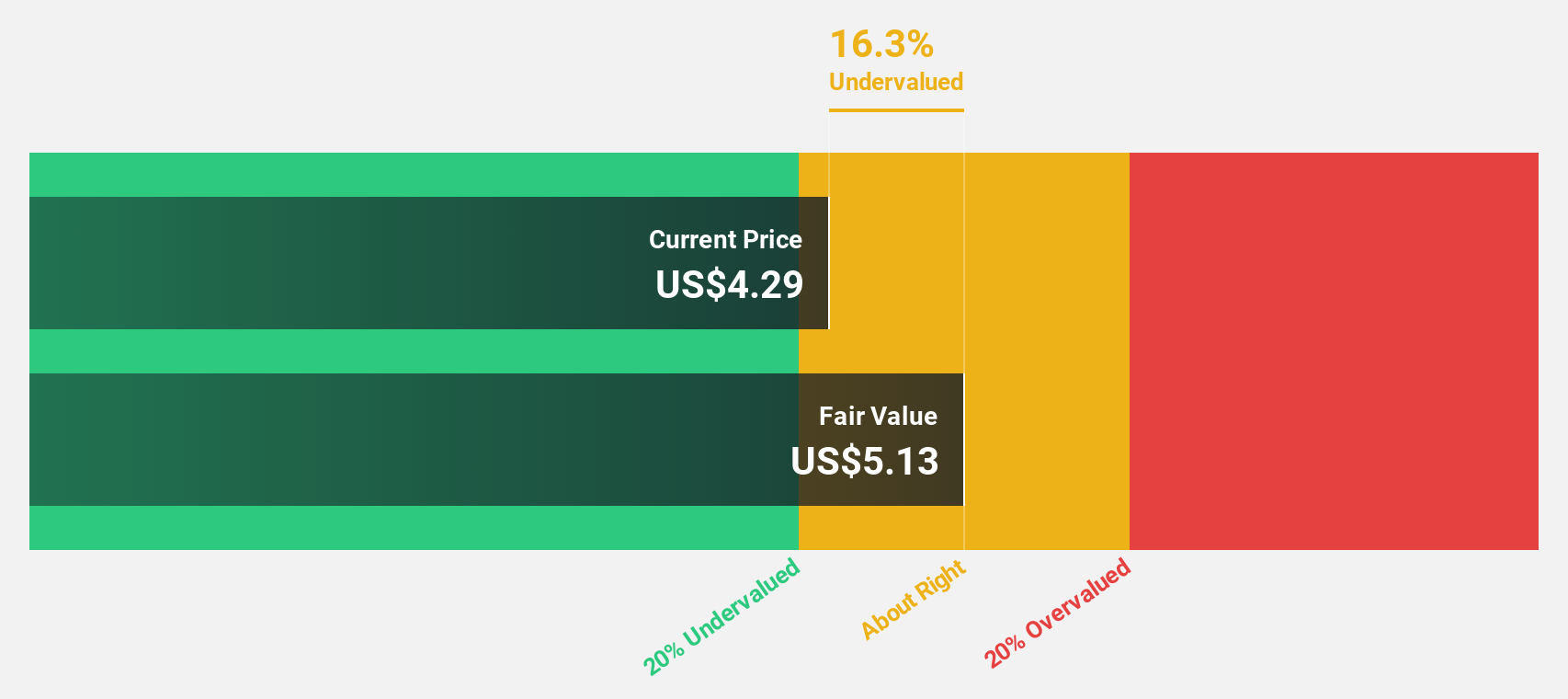

Estimated Discount To Fair Value: 14.2%

Ready Capital is trading at US$7.45, slightly below its estimated fair value of US$8.68, indicating potential undervaluation based on cash flows. Revenue is forecast to grow at 43.1% annually, outpacing the U.S. market's growth rate. However, the company reported a net loss for Q3 2024 and has a high dividend yield not covered by earnings. Recent issuance of US$115 million in senior unsecured notes may impact financial flexibility moving forward.

- In light of our recent growth report, it seems possible that Ready Capital's financial performance will exceed current levels.

- Take a closer look at Ready Capital's balance sheet health here in our report.

Where To Now?

- Delve into our full catalog of 198 Undervalued US Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ready Capital, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RC

Ready Capital

Operates as a real estate finance company in the United States.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives