- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:RCAT

December 2024 US Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As December 2024 unfolds, the U.S. stock market is experiencing notable volatility, with the Dow Jones Industrial Average marking its longest losing streak since 1978 amid anticipation of a Federal Reserve interest rate decision. Despite these fluctuations, growth companies with substantial insider ownership continue to capture investor interest due to their potential for aligned management interests and long-term value creation in uncertain economic environments.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Hesai Group (NasdaqGS:HSAI) | 24.4% | 72.7% |

Here we highlight a subset of our preferred stocks from the screener.

Liquidia (NasdaqCM:LQDA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company focused on developing, manufacturing, and commercializing products for unmet patient needs in the United States, with a market cap of $933.54 million.

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling $15.61 million.

Insider Ownership: 10.6%

Revenue Growth Forecast: 59.6% p.a.

Liquidia is experiencing significant revenue growth, forecasted at 59.6% annually, outpacing the US market's average. Despite past shareholder dilution and current net losses, the company is expected to become profitable within three years. Recent developments include an expanded licensing agreement with Pharmosa Biopharm for L606 in key global markets and ongoing clinical trials for YUTREPIA. These strategic moves could enhance Liquidia's position in treating pulmonary conditions using innovative inhalation technologies.

- Dive into the specifics of Liquidia here with our thorough growth forecast report.

- Our valuation report here indicates Liquidia may be overvalued.

Red Cat Holdings (NasdaqCM:RCAT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Red Cat Holdings, Inc. operates in the United States drone industry by offering a range of products, services, and solutions, with a market cap of approximately $837.68 million.

Operations: Red Cat Holdings, Inc. generates its revenue through diverse offerings in the U.S. drone sector, encompassing a variety of products, services, and solutions.

Insider Ownership: 21.4%

Revenue Growth Forecast: 87.2% p.a.

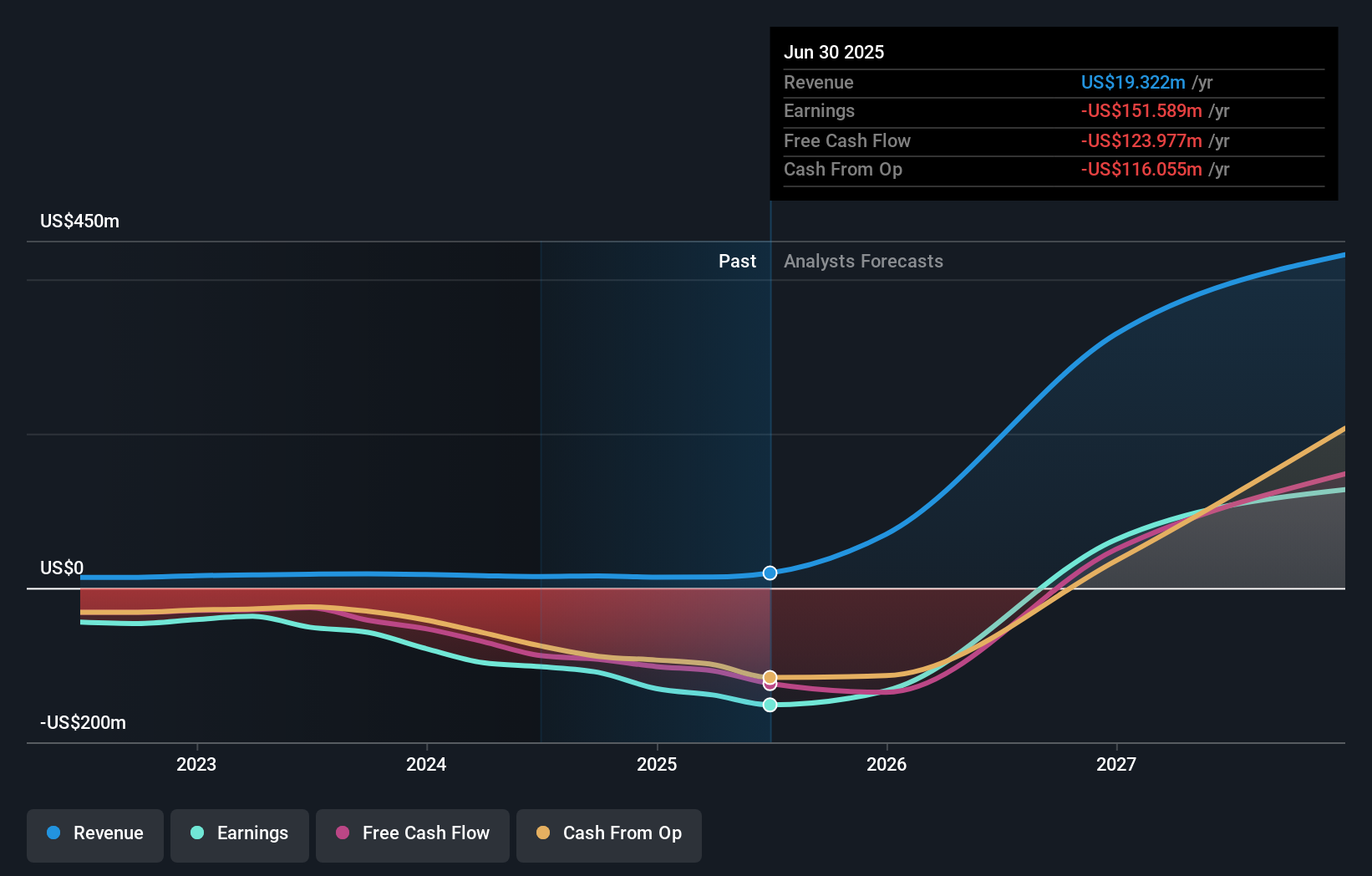

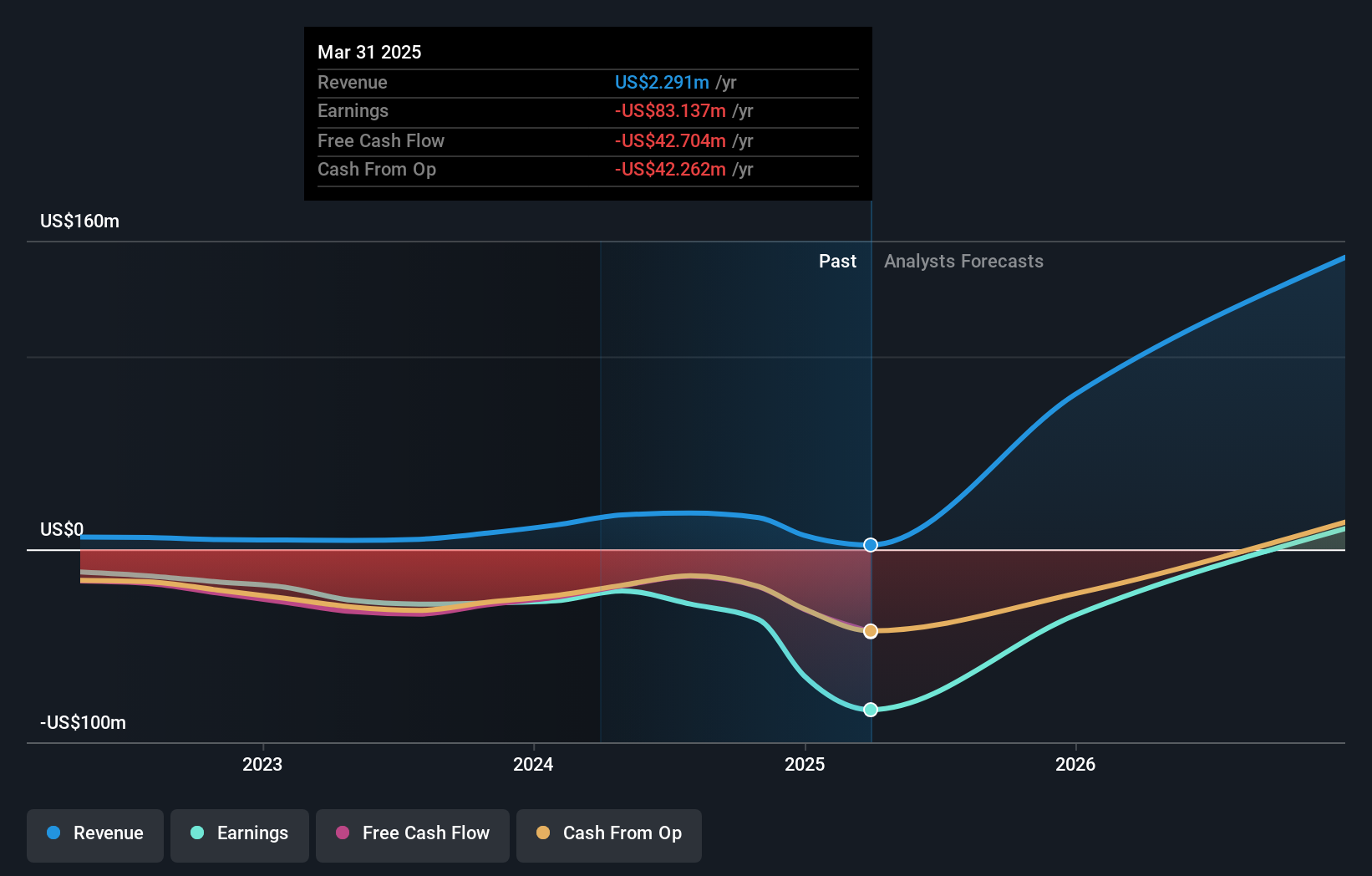

Red Cat Holdings is poised for substantial revenue growth, projected at 87.2% annually, significantly outpacing the US market. Despite recent financial challenges, including increased net losses and shareholder dilution, the company is expected to achieve profitability within three years. Recent strategic moves include securing contracts with military and government entities and leadership changes aimed at scaling operations. These initiatives support Red Cat's focus on advancing its position in the unmanned aerial systems industry.

- Unlock comprehensive insights into our analysis of Red Cat Holdings stock in this growth report.

- Our expertly prepared valuation report Red Cat Holdings implies its share price may be too high.

Paymentus Holdings (NYSE:PAY)

Simply Wall St Growth Rating: ★★★★☆☆

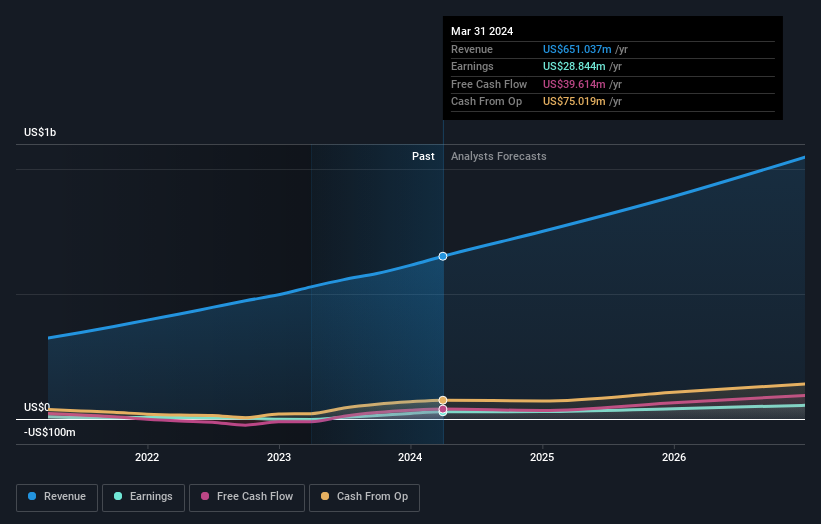

Overview: Paymentus Holdings, Inc. offers cloud-based bill payment technology and solutions both in the United States and internationally, with a market cap of approximately $4.46 billion.

Operations: The company generates revenue from providing services to financial companies, amounting to $778.67 million.

Insider Ownership: 20.1%

Revenue Growth Forecast: 19.7% p.a.

Paymentus Holdings demonstrates strong growth potential with earnings expected to rise significantly, outpacing the US market. Recent quarterly results showed notable revenue and net income increases, indicating robust financial health. Despite high share price volatility and significant insider selling recently, the company's innovative product developments like the Paymentus Disbursements Accelerator enhance operational efficiency and customer satisfaction. Revenue is forecast to grow faster than the US market, supporting its growth trajectory despite low projected return on equity.

- Click to explore a detailed breakdown of our findings in Paymentus Holdings' earnings growth report.

- The analysis detailed in our Paymentus Holdings valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Discover the full array of 202 Fast Growing US Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RCAT

Red Cat Holdings

Provides various products, services, and solutions to the drone industry in the United States.

High growth potential with excellent balance sheet.