- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Value Opportunities: Stocks Estimated Below Intrinsic Worth For May 2025

Reviewed by Simply Wall St

The United States market has experienced a notable upswing, rising 4.5% over the last week and showing an 11% increase over the past year, with earnings projected to grow by 14% annually. In such a climate, identifying stocks that are estimated to be below their intrinsic worth can present valuable opportunities for investors seeking to capitalize on potential growth while maintaining a focus on value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $17.86 | $35.51 | 49.7% |

| Quaker Chemical (NYSE:KWR) | $106.23 | $211.15 | 49.7% |

| Brookline Bancorp (NasdaqGS:BRKL) | $11.11 | $22.22 | 50% |

| Valley National Bancorp (NasdaqGS:VLY) | $9.16 | $18.18 | 49.6% |

| Flowco Holdings (NYSE:FLOC) | $19.38 | $37.99 | 49% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.35 | $18.49 | 49.4% |

| Insteel Industries (NYSE:IIIN) | $36.81 | $72.27 | 49.1% |

| Bel Fuse (NasdaqGS:BELF.A) | $71.89 | $142.60 | 49.6% |

| Carvana (NYSE:CVNA) | $297.40 | $586.29 | 49.3% |

| Mobileye Global (NasdaqGS:MBLY) | $15.94 | $31.09 | 48.7% |

We'll examine a selection from our screener results.

DLocal (NasdaqGS:DLO)

Overview: DLocal Limited operates a global payment processing platform and has a market capitalization of approximately $2.91 billion.

Operations: The company's revenue segments are not specified in the provided text.

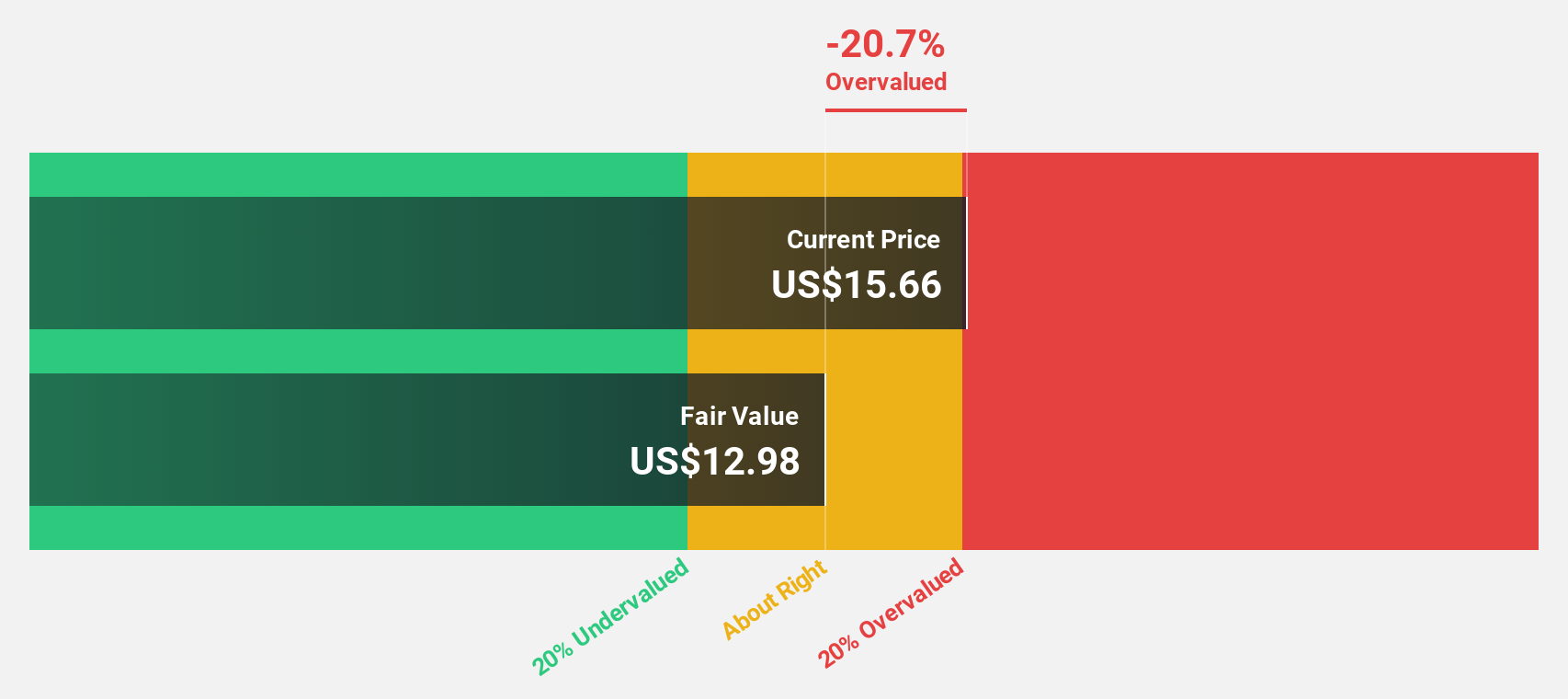

Estimated Discount To Fair Value: 10.4%

DLocal's recent earnings report shows strong financial performance with Q1 2025 net income rising to US$46.63 million from US$17.71 million a year ago, reflecting significant growth in profitability. The stock trades at approximately 10% below its estimated fair value of US$12.55, suggesting some undervaluation based on cash flows. Despite past volatility and large one-off items impacting results, DLocal's revenue and earnings are projected to grow significantly above market averages over the next few years.

- Insights from our recent growth report point to a promising forecast for DLocal's business outlook.

- Click here to discover the nuances of DLocal with our detailed financial health report.

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for treating cystic fibrosis, with a market cap of approximately $108.15 billion.

Operations: The company's revenue primarily comes from its Pharmaceuticals segment, generating $11.10 billion.

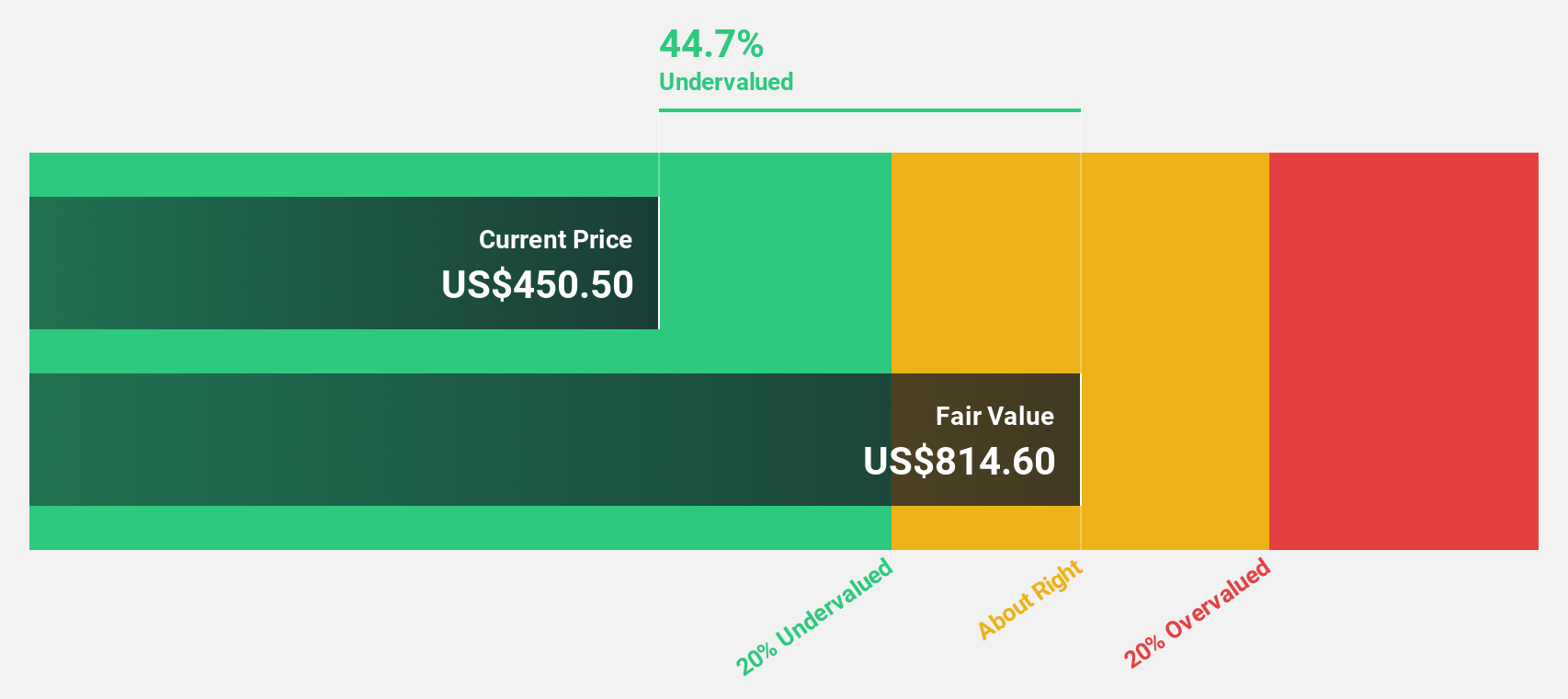

Estimated Discount To Fair Value: 47.2%

Vertex Pharmaceuticals' Q1 2025 results show revenue of US$2.77 billion, a slight increase from the previous year, but net income fell due to a US$379 million impairment charge. Despite this, Vertex is trading at approximately 47% below its estimated fair value of US$823.12 based on discounted cash flows. With raised revenue guidance and expected annual profit growth surpassing market averages, Vertex remains a compelling consideration for investors focused on undervalued stocks with strong cash flow potential.

- According our earnings growth report, there's an indication that Vertex Pharmaceuticals might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Vertex Pharmaceuticals.

Corpay (NYSE:CPAY)

Overview: Corpay, Inc. is a payments company that facilitates the management of vehicle-related expenses, lodging expenses, and corporate payments for businesses and consumers across the United States, Brazil, the United Kingdom, and internationally with a market cap of $24.87 billion.

Operations: Corpay's revenue is primarily generated from vehicle payments at $2.00 billion, corporate payments at $1.31 billion, and lodging payments at $487.52 million.

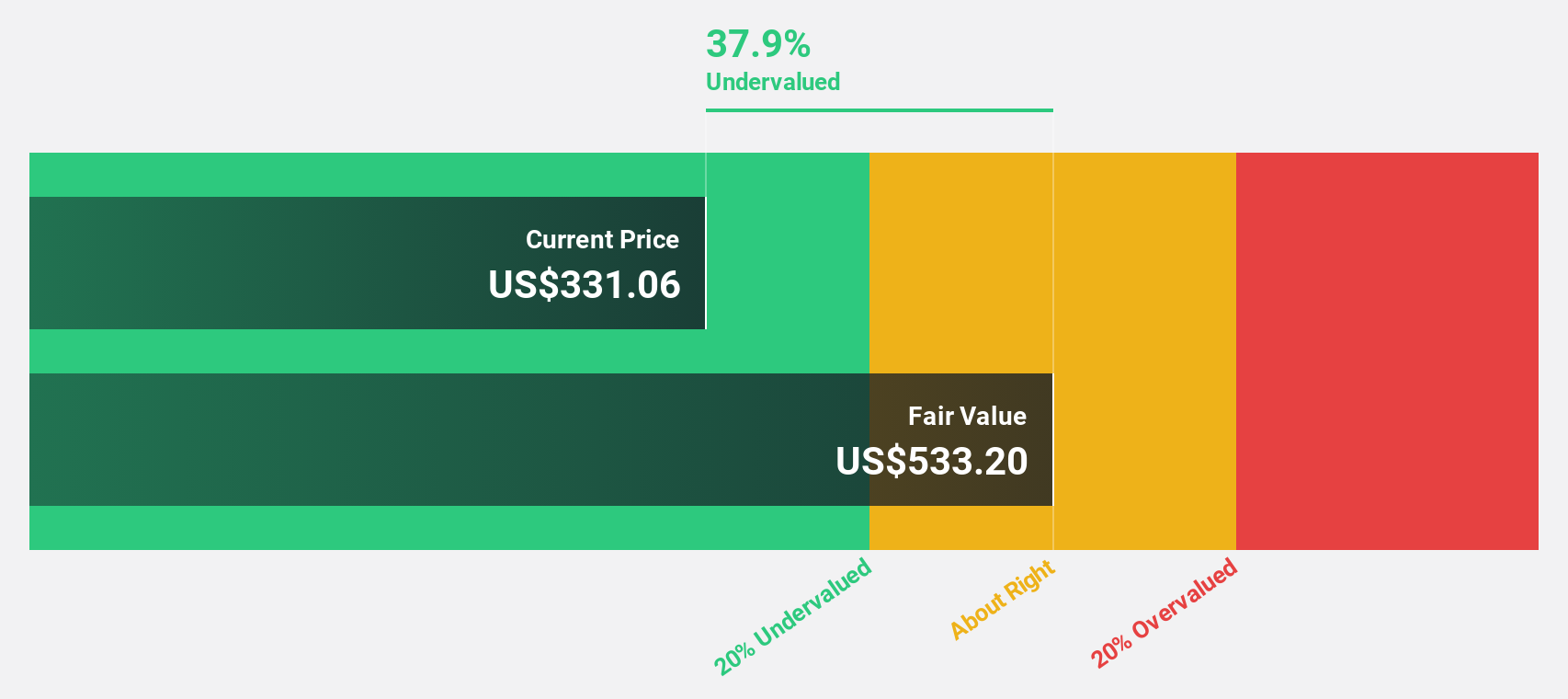

Estimated Discount To Fair Value: 34.7%

Corpay's Q1 2025 earnings report highlights a net income of US$243.23 million with sales reaching over US$1 billion, reflecting steady growth. The company is trading at approximately 34.7% below its estimated fair value of US$531.35 based on discounted cash flows, underscoring its undervaluation potential. With ample cash reserves exceeding $2.5 billion for acquisitions and strategic expansions in Europe, Corpay continues to strengthen its position in the corporate payments sector amidst ongoing M&A discussions.

- Upon reviewing our latest growth report, Corpay's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Corpay's balance sheet by reading our health report here.

Next Steps

- Embark on your investment journey to our 171 Undervalued US Stocks Based On Cash Flows selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Vertex Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives