- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

3 US Stocks Estimated To Be Undervalued For Savvy Investors

Reviewed by Simply Wall St

As the U.S. market hovers near record highs, investors are closely monitoring the upcoming January jobs report for insights into economic health and interest rate trends. In this environment, identifying stocks that may be undervalued can offer potential opportunities for those looking to navigate the fluctuating landscape with informed decision-making.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CareTrust REIT (NYSE:CTRE) | $26.37 | $50.43 | 47.7% |

| AGNC Investment (NasdaqGS:AGNC) | $10.14 | $19.41 | 47.8% |

| Old National Bancorp (NasdaqGS:ONB) | $24.45 | $48.78 | 49.9% |

| Northwest Bancshares (NasdaqGS:NWBI) | $13.39 | $26.26 | 49% |

| AbbVie (NYSE:ABBV) | $192.97 | $385.39 | 49.9% |

| BBB Foods (NYSE:TBBB) | $27.02 | $52.36 | 48.4% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $113.10 | $217.07 | 47.9% |

| Privia Health Group (NasdaqGS:PRVA) | $22.69 | $44.59 | 49.1% |

| Coastal Financial (NasdaqGS:CCB) | $89.51 | $172.68 | 48.2% |

| Verra Mobility (NasdaqCM:VRRM) | $25.88 | $51.66 | 49.9% |

Let's dive into some prime choices out of the screener.

Zscaler (NasdaqGS:ZS)

Overview: Zscaler, Inc. is a global cloud security company with a market cap of approximately $31.45 billion.

Operations: The company's revenue primarily comes from sales of subscription services to its cloud platform and related support services, amounting to approximately $2.30 billion.

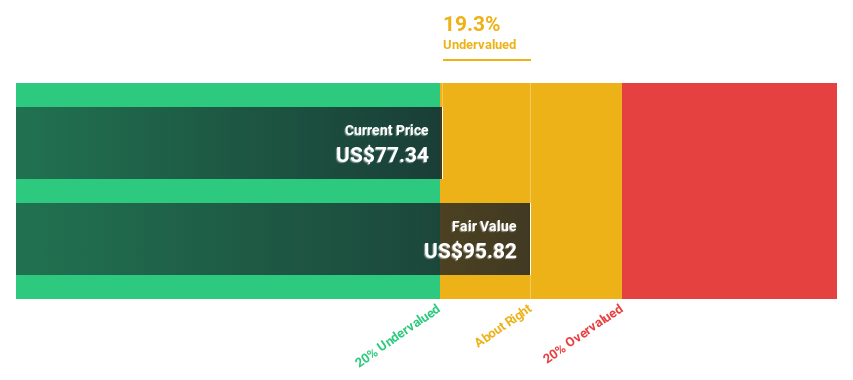

Estimated Discount To Fair Value: 38.2%

Zscaler is trading at US$204.23, significantly below its estimated fair value of US$330.49, suggesting it may be undervalued based on cash flows. The company's revenue is forecast to grow at 16.1% annually, outpacing the broader U.S. market's growth rate of 8.8%. Recent integrations with SAP and Nokia highlight Zscaler's strategic partnerships and technological advancements in zero trust security solutions, enhancing its appeal in the cybersecurity sector despite insider selling concerns.

- Our growth report here indicates Zscaler may be poised for an improving outlook.

- Dive into the specifics of Zscaler here with our thorough financial health report.

Corpay (NYSE:CPAY)

Overview: Corpay, Inc. is a payments company facilitating the management of vehicle-related expenses, lodging expenses, and corporate payments for businesses and consumers in the United States, Brazil, the United Kingdom, and internationally with a market cap of $27.09 billion.

Operations: Corpay's revenue segments include vehicle-related expenses, lodging expenses, and corporate payments across the United States, Brazil, the United Kingdom, and other international markets.

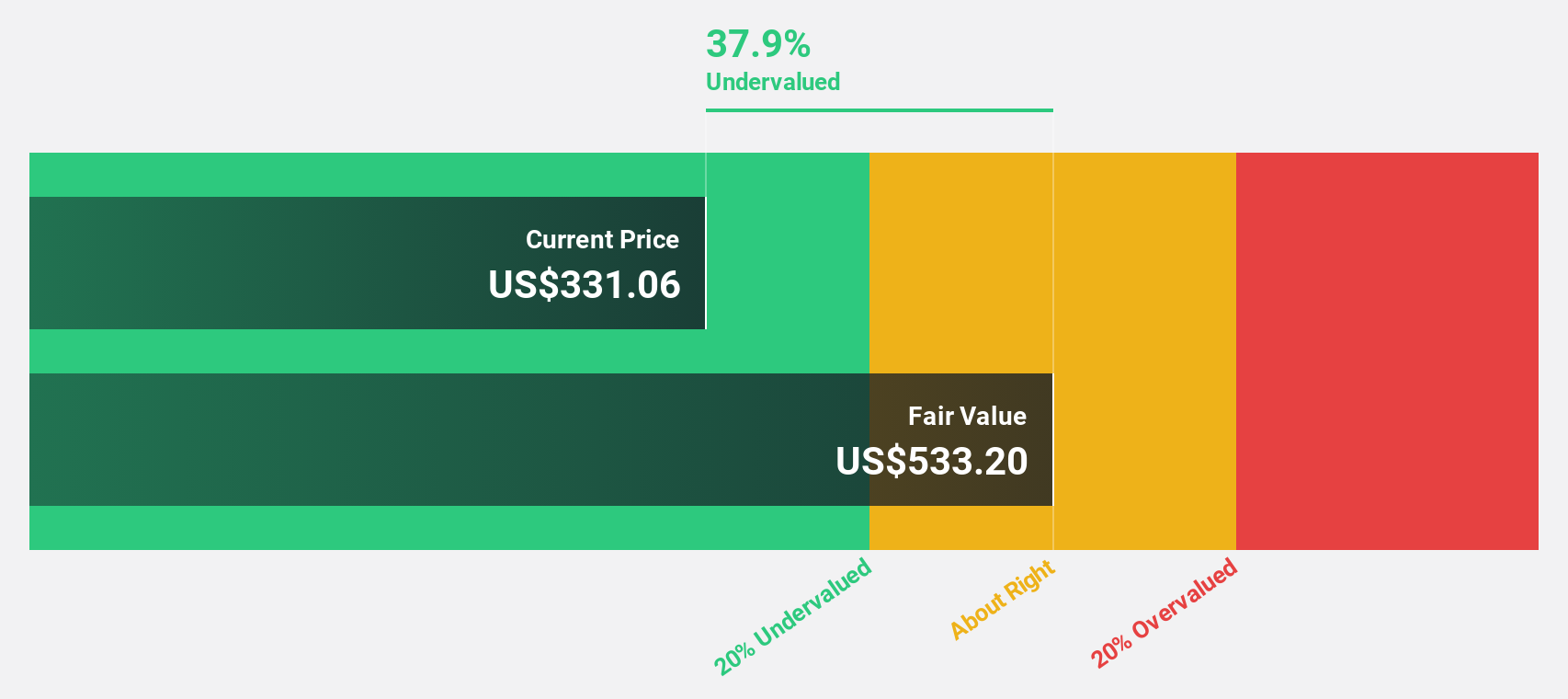

Estimated Discount To Fair Value: 31.2%

Corpay, trading at US$389.55, is undervalued with an estimated fair value of US$565.89. Despite a high debt level, its earnings are projected to grow by 15.6% annually, exceeding the U.S. market average growth rate of 14.8%. The company has authorized nearly $1.3 billion for share repurchases and is actively pursuing M&A opportunities to strengthen its core segments in corporate payments while managing insider selling activities recently reported.

- Our expertly prepared growth report on Corpay implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Corpay with our detailed financial health report.

Moelis (NYSE:MC)

Overview: Moelis & Company is an investment banking advisory firm with a market cap of $6.11 billion.

Operations: The firm's revenue segments are not specified in the provided text.

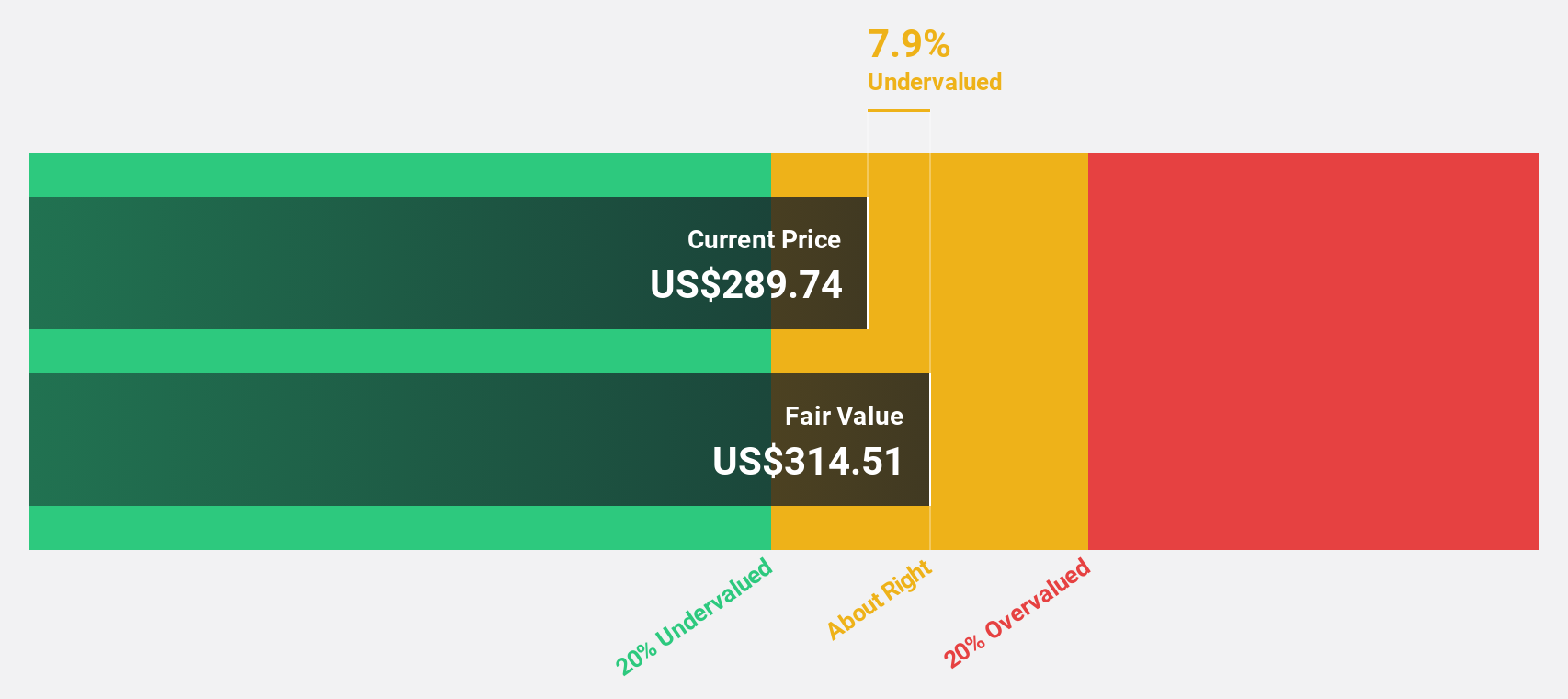

Estimated Discount To Fair Value: 16.7%

Moelis & Company, trading at US$81.20, is undervalued with an estimated fair value of US$97.52. The firm reported a net income of US$136.02 million for 2024, marking profitability after a previous loss. Earnings are projected to grow significantly by 31.1% annually over the next three years, outpacing the U.S. market average growth rate of 14.8%. However, its dividend yield of 2.96% is not well covered by earnings or free cash flows.

- The growth report we've compiled suggests that Moelis' future prospects could be on the up.

- Take a closer look at Moelis' balance sheet health here in our report.

Summing It All Up

- Access the full spectrum of 177 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives