- United States

- /

- Capital Markets

- /

- NYSE:BRDG

US Stocks That May Be Trading At A Discount In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, the U.S. stock market is experiencing a notable downturn, with major indices like the S&P 500 and Nasdaq Composite extending their slump amid significant declines in technology shares. In this climate of uncertainty, investors may find opportunities in stocks that are potentially undervalued, offering a chance to buy at a discount as market volatility continues to shape investment decisions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SouthState (NYSE:SSB) | $98.74 | $193.86 | 49.1% |

| Brookline Bancorp (NasdaqGS:BRKL) | $11.58 | $22.29 | 48% |

| Northwest Bancshares (NasdaqGS:NWBI) | $12.42 | $24.55 | 49.4% |

| Old National Bancorp (NasdaqGS:ONB) | $23.27 | $45.45 | 48.8% |

| Cadre Holdings (NYSE:CDRE) | $33.35 | $64.79 | 48.5% |

| Similarweb (NYSE:SMWB) | $9.45 | $18.06 | 47.7% |

| Advanced Micro Devices (NasdaqGS:AMD) | $108.11 | $214.13 | 49.5% |

| Fluence Energy (NasdaqGS:FLNC) | $6.59 | $12.84 | 48.7% |

| Verra Mobility (NasdaqCM:VRRM) | $25.84 | $49.08 | 47.4% |

| Nutanix (NasdaqGS:NTNX) | $68.43 | $133.03 | 48.6% |

Let's explore several standout options from the results in the screener.

Bridge Investment Group Holdings (NYSE:BRDG)

Overview: Bridge Investment Group Holdings Inc is a publicly owned real estate investment manager with a market cap of approximately $959 million.

Operations: Bridge Investment Group Holdings Inc generates revenue primarily as a fully integrated real estate investment manager, with this segment contributing $404.93 million.

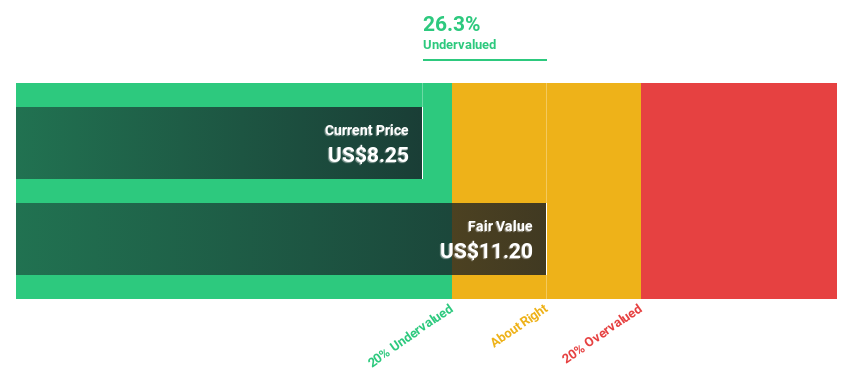

Estimated Discount To Fair Value: 10.8%

Bridge Investment Group Holdings is currently trading slightly below its estimated fair value of US$11.89, with a share price around US$10.6, suggesting potential undervaluation based on cash flows. The company recently became profitable and reported significant earnings growth, with forecasts indicating continued strong profit expansion at 51.4% annually over the next three years. However, it has a high level of debt and experienced significant insider selling recently. Apollo Global Management's acquisition could impact future public trading status as Bridge transitions to private ownership later this year.

- Our growth report here indicates Bridge Investment Group Holdings may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Bridge Investment Group Holdings.

Haemonetics (NYSE:HAE)

Overview: Haemonetics Corporation is a healthcare company that offers a range of medical products and solutions both in the United States and internationally, with a market cap of approximately $3.17 billion.

Operations: The company's revenue segments include Plasma at $544.70 million, Hospital at $538.02 million, and Blood Center at $272.17 million.

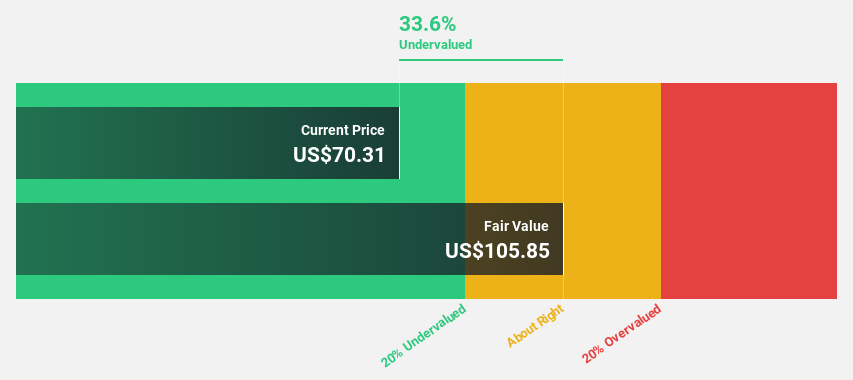

Estimated Discount To Fair Value: 46.1%

Haemonetics is trading at US$65.92, significantly below its estimated fair value of US$122.24, highlighting potential undervaluation based on cash flows. Despite slower revenue growth forecasts compared to the market, its earnings are expected to grow significantly at 21.1% annually over the next three years. Recent earnings reports show steady income growth; however, debt coverage by operating cash flow remains a concern. The company is also pursuing strategic acquisitions to enhance its portfolio further.

- Our comprehensive growth report raises the possibility that Haemonetics is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Haemonetics' balance sheet health report.

National Fuel Gas (NYSE:NFG)

Overview: National Fuel Gas Company operates as a diversified energy company with a market cap of approximately $6.58 billion.

Operations: The company's revenue is primarily derived from its Exploration and Production segment at $955.92 million, followed by the Utility segment at $723.86 million, Pipeline and Storage at $424.59 million, and Gathering at $242.77 million.

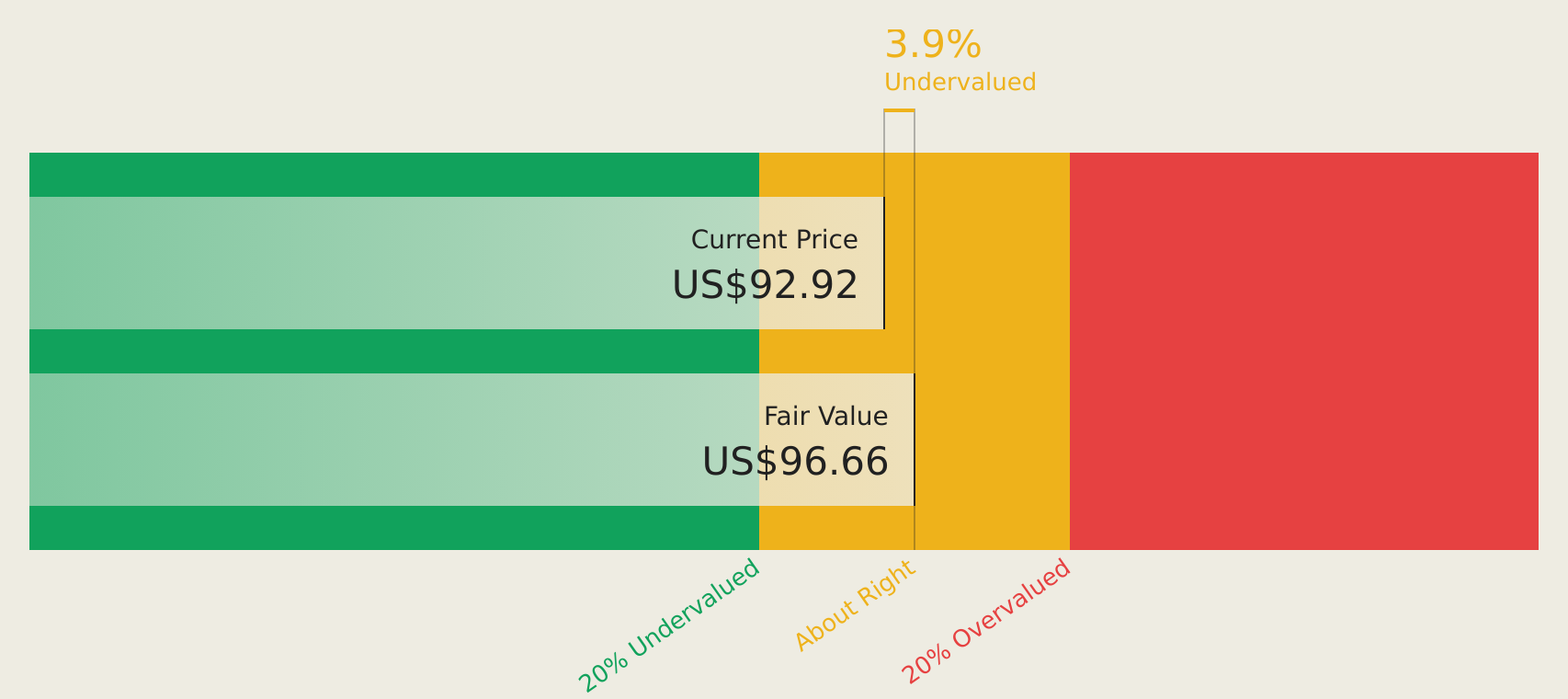

Estimated Discount To Fair Value: 31.3%

National Fuel Gas is trading at US$73.32, below its estimated fair value of US$106.72, indicating potential undervaluation based on cash flows. The company forecasts above-average profit growth and revenue expansion of 13.3% annually, although debt levels are high and recent insider selling occurred. Recent fixed-income offerings totaling nearly $1 billion could impact financial flexibility, while revised production guidance reflects operational improvements despite a significant asset impairment reported in the last quarter.

- Our earnings growth report unveils the potential for significant increases in National Fuel Gas' future results.

- Take a closer look at National Fuel Gas' balance sheet health here in our report.

Make It Happen

- Explore the 172 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bridge Investment Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRDG

Bridge Investment Group Holdings

Bridge Investment Group Holdings Inc is a publicly owned real estate investment manager..

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives