- United States

- /

- Diversified Financial

- /

- NYSE:APO

Three Stocks Estimated To Be Trading Below Intrinsic Value In October 2025

Reviewed by Simply Wall St

As the United States stock market grapples with renewed trade tensions with China, overshadowing robust bank earnings, investors are keenly observing market movements for opportunities. In this environment of uncertainty and volatility, identifying stocks that may be trading below their intrinsic value can offer potential avenues for strategic investment.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trade Desk (TTD) | $50.73 | $96.49 | 47.4% |

| Peapack-Gladstone Financial (PGC) | $28.58 | $56.16 | 49.1% |

| Metropolitan Bank Holding (MCB) | $79.01 | $152.30 | 48.1% |

| McGraw Hill (MH) | $12.60 | $25.04 | 49.7% |

| Investar Holding (ISTR) | $22.905 | $45.39 | 49.5% |

| Horizon Bancorp (HBNC) | $15.95 | $31.46 | 49.3% |

| First Busey (BUSE) | $23.75 | $45.91 | 48.3% |

| e.l.f. Beauty (ELF) | $132.49 | $252.80 | 47.6% |

| Comstock Resources (CRK) | $19.21 | $37.95 | 49.4% |

| AGNC Investment (AGNC) | $10.01 | $19.61 | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

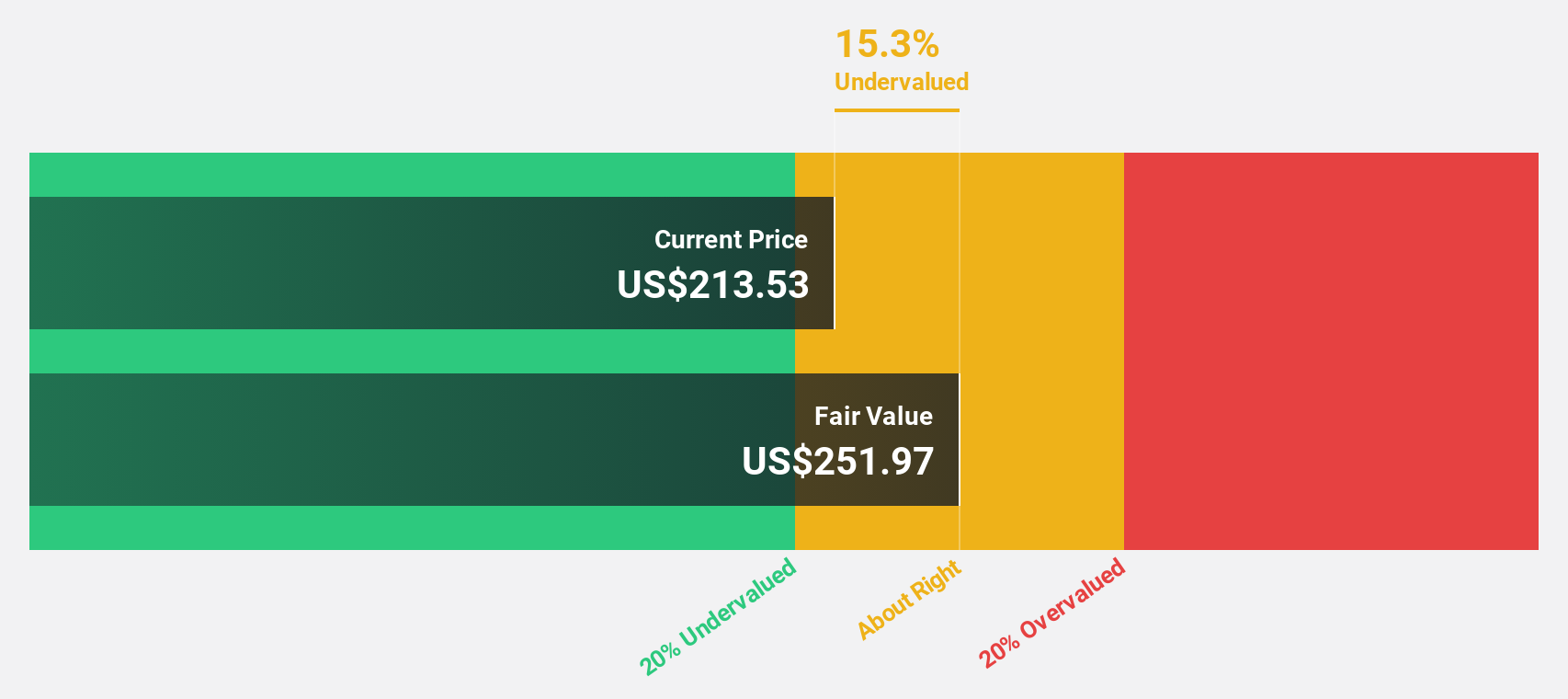

Atlassian (TEAM)

Overview: Atlassian Corporation offers collaboration software designed to enhance productivity across organizations globally, with a market cap of approximately $39.19 billion.

Operations: The company generates revenue of $5.22 billion from its Software & Programming segment.

Estimated Discount To Fair Value: 44.2%

Atlassian appears undervalued based on cash flow analysis, trading at US$156.37, significantly below its estimated fair value of US$280.33. Despite a net loss of US$256.69 million for the year ended June 2025, Atlassian's earnings are expected to grow by 52.97% annually and become profitable within three years, outpacing average market growth rates. However, recent insider selling could be a concern for potential investors evaluating its long-term prospects amidst strategic partnerships like the one with Google Cloud.

- Our comprehensive growth report raises the possibility that Atlassian is poised for substantial financial growth.

- Navigate through the intricacies of Atlassian with our comprehensive financial health report here.

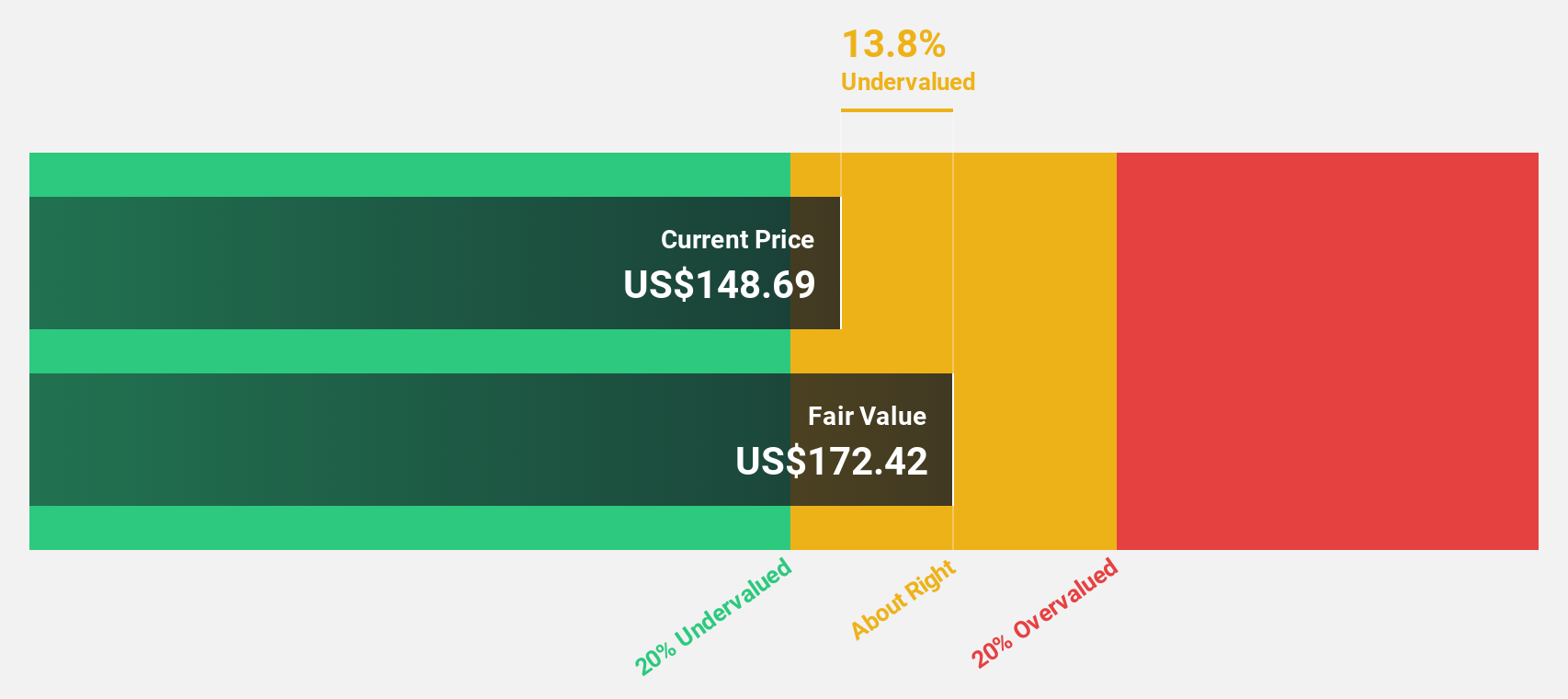

Apollo Global Management (APO)

Overview: Apollo Global Management, Inc. is a private equity firm that specializes in investments across credit, private equity, infrastructure, secondaries and real estate markets with a market cap of $70.04 billion.

Operations: Apollo Global Management generates revenue through three primary segments: Asset Management ($5.24 billion), Principal Investing ($1.15 billion), and Retirement Services ($21.40 billion).

Estimated Discount To Fair Value: 26.5%

Apollo Global Management is trading at US$127.64, notably below its estimated fair value of US$173.61, suggesting it may be undervalued based on cash flows. Despite a decline in net profit margins from 20.9% to 12.5%, earnings are projected to grow significantly at 28.7% annually over the next three years, outpacing market averages. However, significant insider selling and an unstable dividend track record could pose risks for investors considering long-term commitments amidst ongoing M&A discussions and strategic expansions.

- Our earnings growth report unveils the potential for significant increases in Apollo Global Management's future results.

- Get an in-depth perspective on Apollo Global Management's balance sheet by reading our health report here.

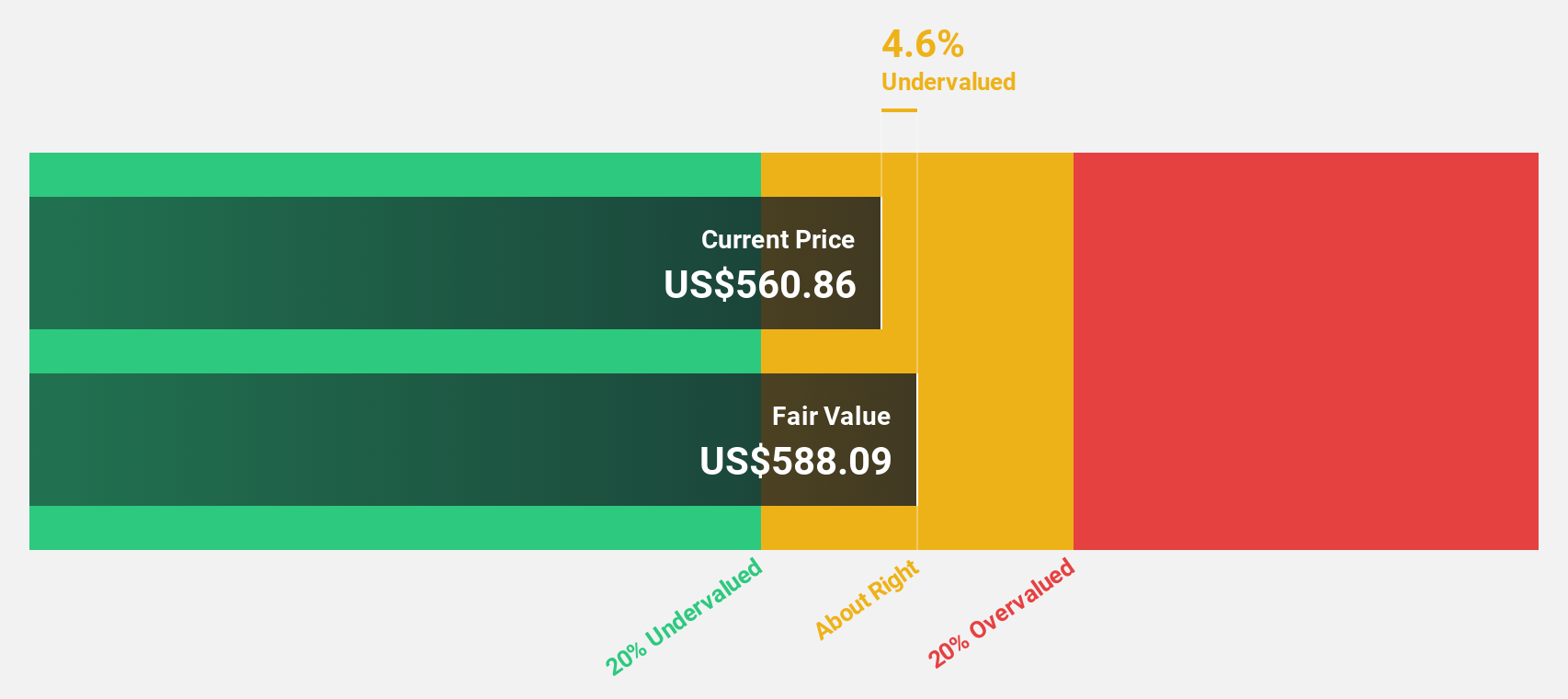

HubSpot (HUBS)

Overview: HubSpot, Inc. offers a cloud-based customer relationship management (CRM) platform for businesses across the Americas, Europe, and the Asia Pacific, with a market capitalization of approximately $23.71 billion.

Operations: The company generates revenue from its Internet Software & Services segment, totaling $2.85 billion.

Estimated Discount To Fair Value: 20.4%

HubSpot is trading at US$456.58, below its estimated fair value of US$573.9, indicating potential undervaluation based on cash flows. The company forecasts a strong revenue growth rate of 14.5% annually and expects to become profitable within three years, surpassing market averages in profitability growth. Recent integrations with partners like Talkdesk and CallRail enhance HubSpot's platform capabilities, streamlining customer interactions and data management for improved operational efficiency amidst ongoing product innovations in AI-driven marketing strategies.

- Upon reviewing our latest growth report, HubSpot's projected financial performance appears quite optimistic.

- Click here to discover the nuances of HubSpot with our detailed financial health report.

Turning Ideas Into Actions

- Access the full spectrum of 181 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)