- United States

- /

- Software

- /

- NYSE:DT

US Value Stocks Trading Below Estimated Worth In January 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a pause in its recent rally, with major indexes like the S&P 500 and Nasdaq Composite taking a breather from record highs, investors are keenly observing corporate earnings and economic policies under the new administration. Despite this temporary slowdown, opportunities remain for discerning investors to identify stocks trading below their estimated worth, particularly those that demonstrate solid fundamentals and potential for long-term growth amidst evolving market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $24.50 | $48.66 | 49.6% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.32 | $56.60 | 50% |

| German American Bancorp (NasdaqGS:GABC) | $39.23 | $78.06 | 49.7% |

| Meridian (NasdaqGS:MRBK) | $15.90 | $31.42 | 49.4% |

| Privia Health Group (NasdaqGS:PRVA) | $22.58 | $44.59 | 49.4% |

| FrontView REIT (NYSE:FVR) | $16.84 | $33.05 | 49% |

| BeiGene (NasdaqGS:ONC) | $222.08 | $438.07 | 49.3% |

| Bilibili (NasdaqGS:BILI) | $16.89 | $33.13 | 49% |

| Tenable Holdings (NasdaqGS:TENB) | $43.39 | $86.65 | 49.9% |

| Equifax (NYSE:EFX) | $268.82 | $534.36 | 49.7% |

We'll examine a selection from our screener results.

DoorDash (NasdaqGS:DASH)

Overview: DoorDash, Inc. operates a commerce platform facilitating connections between merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of approximately $76.15 billion.

Operations: Revenue for the company is primarily generated from its Internet Information Providers segment, amounting to $10.15 billion.

Estimated Discount To Fair Value: 27.1%

DoorDash is trading at US$183.32, significantly below its estimated fair value of US$251.36, suggesting it may be undervalued based on discounted cash flow analysis. Recent strategic partnerships with companies like The Home Depot and Ibotta enhance its market reach and consumer engagement. Despite insider selling, DoorDash's revenue growth forecast of 14.4% annually surpasses the broader U.S. market average of 9%, and profitability is expected within three years, indicating potential for significant earnings growth.

- Our growth report here indicates DoorDash may be poised for an improving outlook.

- Navigate through the intricacies of DoorDash with our comprehensive financial health report here.

Ally Financial (NYSE:ALLY)

Overview: Ally Financial Inc. is a digital financial-services company offering a range of digital financial products and services in the United States, Canada, and Bermuda, with a market cap of approximately $11.91 billion.

Operations: The company's revenue segments include $1.62 billion from Insurance operations, $571 million from Corporate Finance Operations, and $3.93 billion from Automotive Finance Operations.

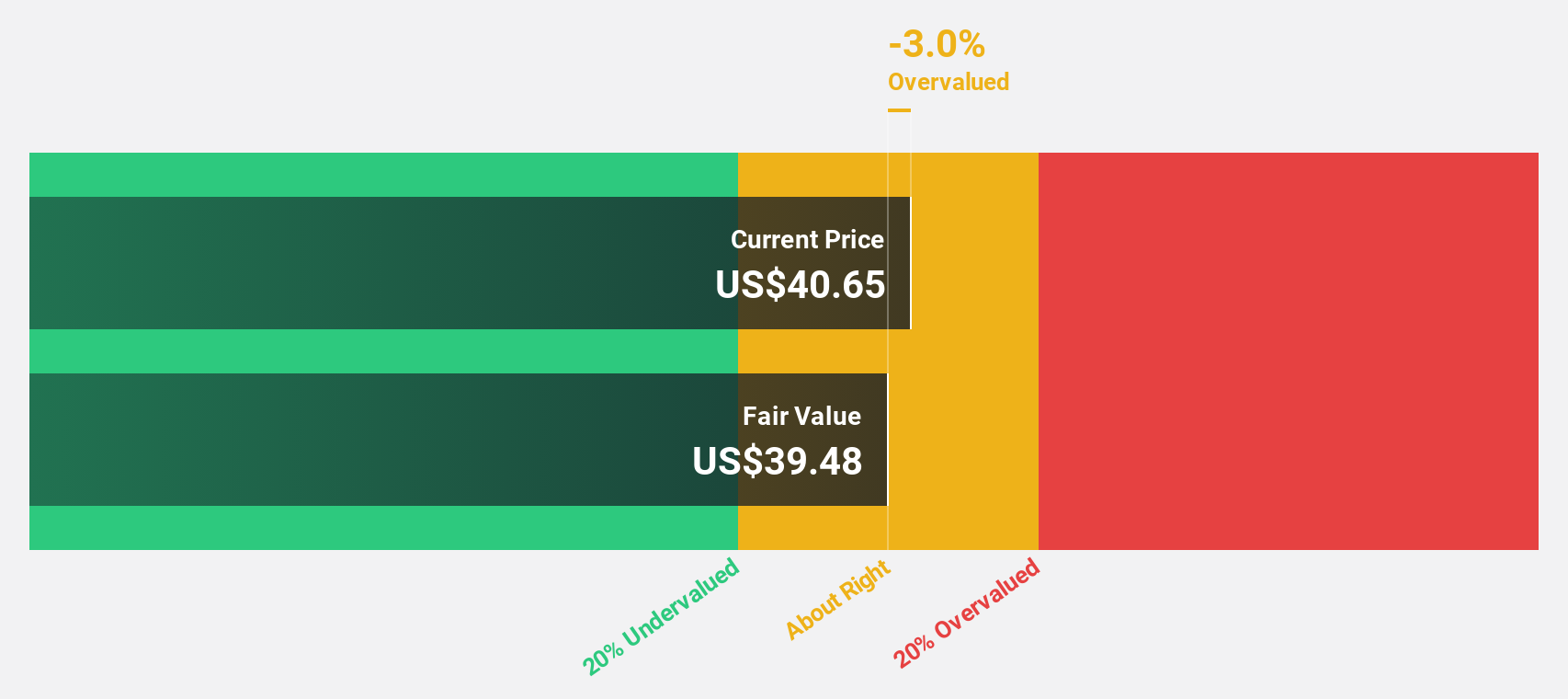

Estimated Discount To Fair Value: 18.6%

Ally Financial is trading at US$39.01, below its estimated fair value of US$47.92, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow 33% annually, outpacing the broader U.S. market's growth rate of 14.7%. Despite a decline in profit margins from 12.8% to 8.2%, Ally recently reported an increase in quarterly net income to US$108 million and continues strategic efforts with fixed-income offerings totaling billions in recent months.

- Our comprehensive growth report raises the possibility that Ally Financial is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Ally Financial stock in this financial health report.

Dynatrace (NYSE:DT)

Overview: Dynatrace, Inc. offers a security platform for multicloud environments across various regions globally, with a market cap of $16.61 billion.

Operations: The company generates revenue of $1.56 billion from its Internet Software & Services segment.

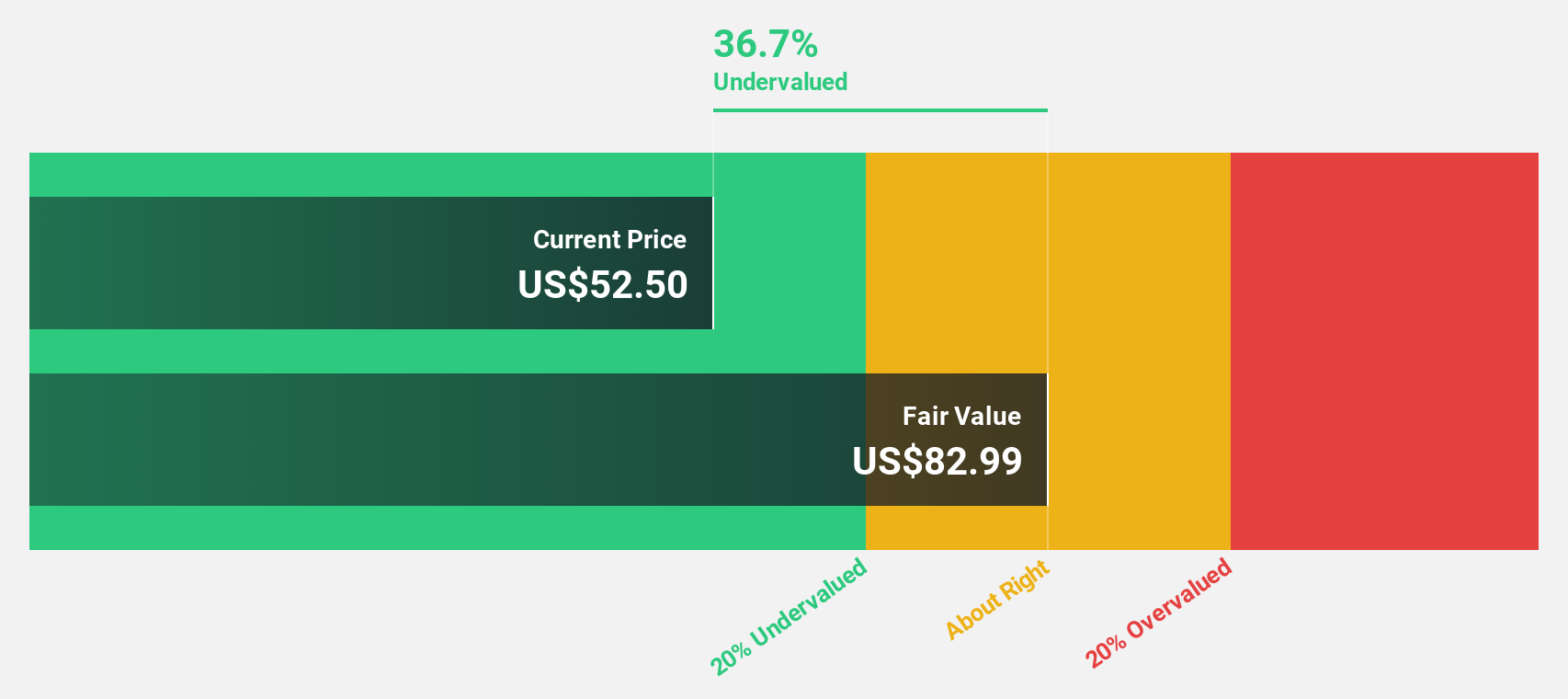

Estimated Discount To Fair Value: 42.1%

Dynatrace's current trading price of US$55.64 is significantly below its estimated fair value of US$96.16, suggesting it may be undervalued based on cash flows. The company forecasts strong annual earnings growth exceeding 20%, outpacing the U.S. market average of 14.7%. Recent partnerships, such as with Pyramid Consulting and Visa Cash App Racing Bulls, enhance Dynatrace's capabilities in digital transformation and analytics technology, potentially driving future revenue and profitability improvements.

- The analysis detailed in our Dynatrace growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Dynatrace.

Summing It All Up

- Explore the 169 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DT

Dynatrace

Engages in the advancement of observability for digital businesses, which transforms the complexity of modern digital ecosystems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives