- United States

- /

- Diversified Financial

- /

- NasdaqGS:WSBF

US Market's Undiscovered Gems Three Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.1%, yet it remains up by 9.1% over the past year, with earnings anticipated to grow by 14% annually in the coming years. In this dynamic environment, identifying promising small-cap stocks can be key to uncovering potential opportunities that align with these growth expectations and market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -25.87% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Pioneer Bancorp (NasdaqCM:PBFS)

Simply Wall St Value Rating: ★★★★★★

Overview: Pioneer Bancorp, Inc. serves as the holding company for Pioneer Bank, National Association, offering a range of banking products and services in New York with a market cap of approximately $295.80 million.

Operations: Pioneer Bancorp, Inc. generates revenue primarily from its banking segment, which totals $88.64 million. The company's market capitalization is approximately $295.80 million.

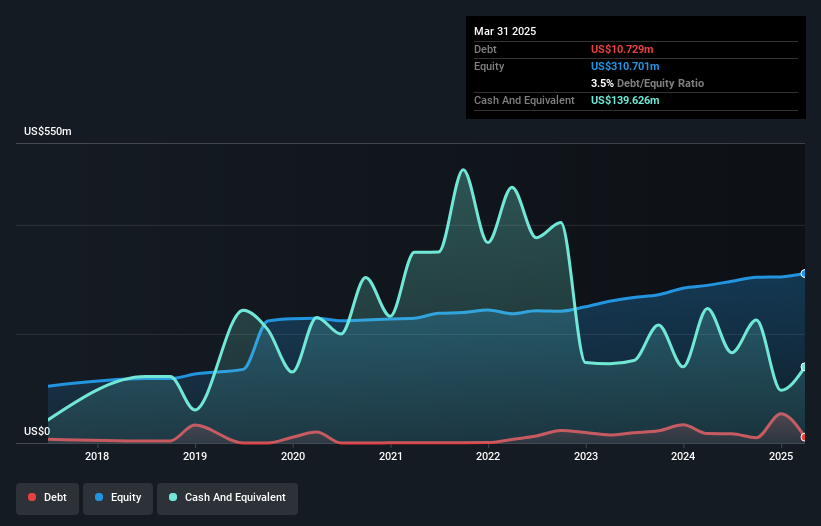

Pioneer Bancorp, with assets totaling $2.1 billion and equity of $310.7 million, stands out for its robust financial health. The bank's deposits amount to $1.7 billion against loans of $1.5 billion, reflecting a stable funding base primarily from customer deposits—considered less risky than external borrowing. Its allowance for bad loans is sufficient at 0.7% of total loans, ensuring solid risk management practices are in place. Pioneer has demonstrated impressive earnings growth of 27.8%, surpassing the industry average by a wide margin and showcasing high-quality past earnings with a favorable price-to-earnings ratio of 14.6x compared to the broader market's 18.1x.

- Delve into the full analysis health report here for a deeper understanding of Pioneer Bancorp.

Understand Pioneer Bancorp's track record by examining our Past report.

AIFU (NasdaqGS:AIFU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: AIFU Inc., along with its subsidiary, focuses on distributing insurance products in China and has a market cap of approximately $345.30 million.

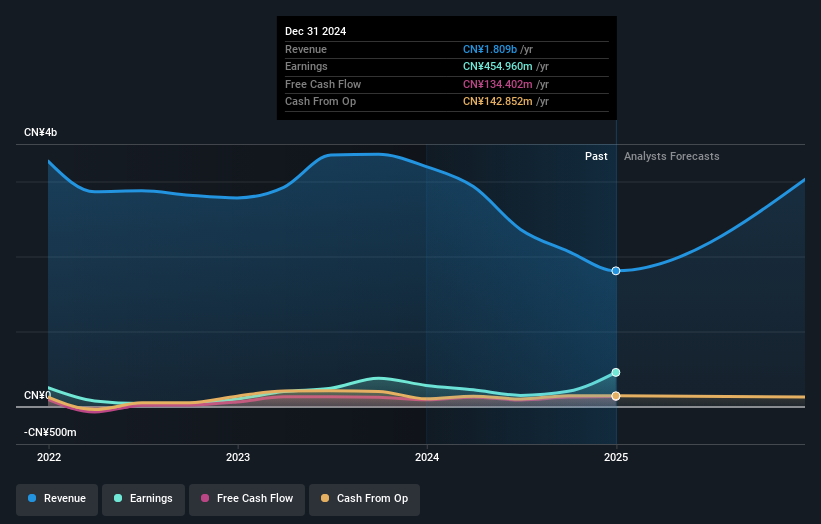

Operations: AIFU generates revenue primarily from two segments: Agency, contributing CN¥1.33 billion, and Claims Adjusting, adding CN¥477.05 million. The company's net profit margin is 12%.

AIFU's earnings surged by 62.2% over the past year, outpacing the Insurance industry's growth of 5.3%. The company trades at a significant discount, approximately 50.8% below its estimated fair value, suggesting potential for value investors. Despite a volatile share price recently, AIFU boasts strong financial health with more cash than debt and positive free cash flow. Although its debt-to-equity ratio rose to 5.1% over five years, it remains manageable given their high-quality non-cash earnings. Recent leadership changes saw Ms. Mingxiu Luan appointed CEO following Ms. Wei Chen's resignation for personal reasons.

- Unlock comprehensive insights into our analysis of AIFU stock in this health report.

Review our historical performance report to gain insights into AIFU's's past performance.

Waterstone Financial (NasdaqGS:WSBF)

Simply Wall St Value Rating: ★★★★★★

Overview: Waterstone Financial, Inc. is a bank holding company for WaterStone Bank SSB, offering a range of financial services in southeastern Wisconsin, with a market cap of approximately $250.08 million.

Operations: Waterstone Financial generates revenue primarily from mortgage banking, contributing $78.43 million, and community banking, adding $55.20 million.

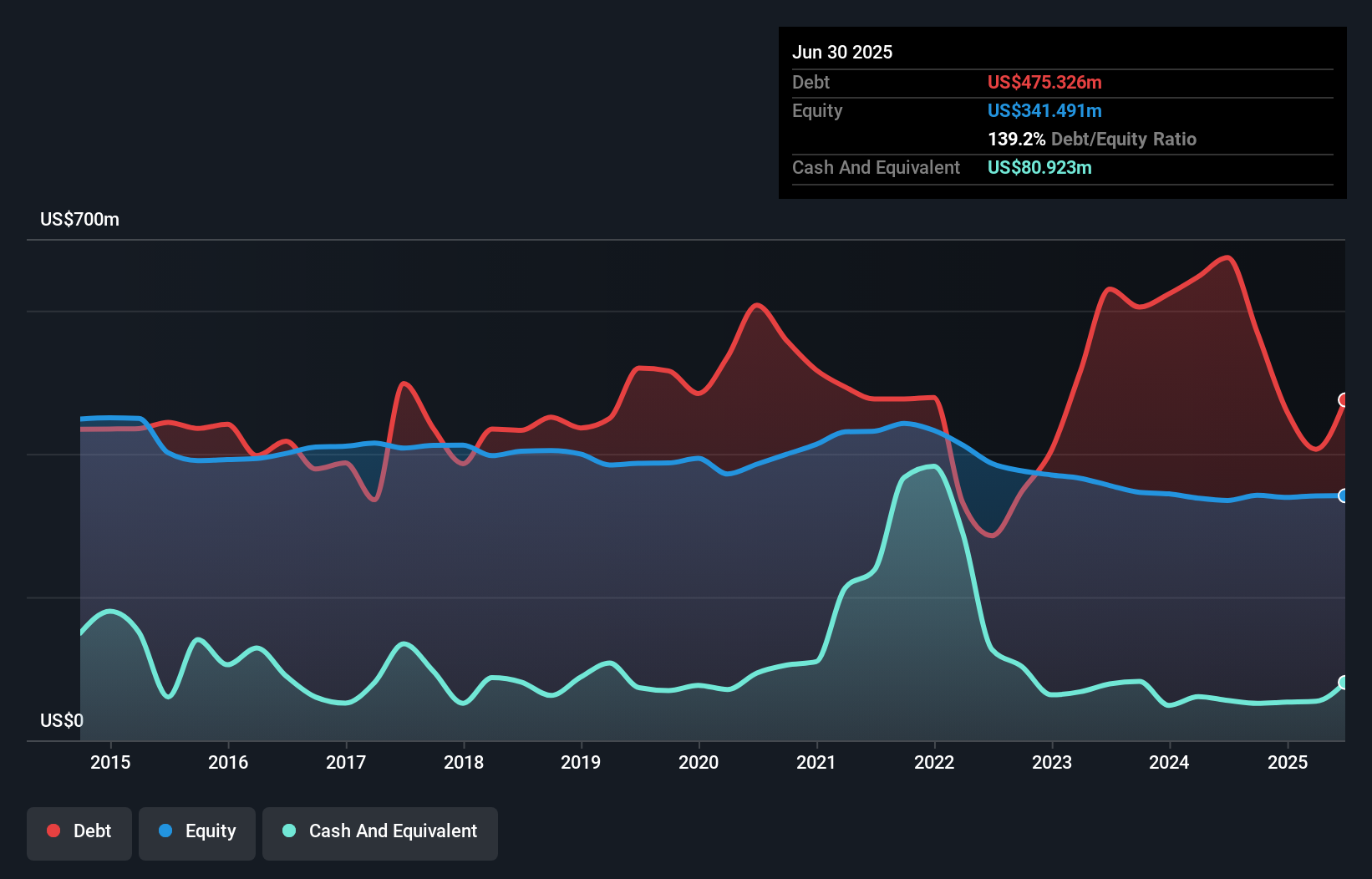

Waterstone Financial, with assets of US$2.2 billion and equity of US$341.4 million, stands out for its robust financial health. The company boasts a sufficient allowance for bad loans at 241%, covering 0.4% of total loans, indicating prudent risk management. Earnings surged by 82% last year, surpassing the industry average growth of 10%, though they faced a yearly decline of 36% over five years. The bank's liabilities are primarily low-risk customer deposits (75%), ensuring stability in funding sources. Recently, Waterstone repurchased shares worth US$3.2 million this quarter as part of an ongoing buyback program initiated in May 2023.

Next Steps

- Click through to start exploring the rest of the 275 US Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Waterstone Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waterstone Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBF

Waterstone Financial

Operates as a bank holding company for WaterStone Bank SSB that provides various financial services to customers in southeastern Wisconsin, the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives