- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

3 High Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. equities market rebounds from a recent slump, investors are closely watching for opportunities amid ongoing economic uncertainties and policy shifts. In such a landscape, companies with high insider ownership can be appealing as they often signal confidence in the company's growth prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.9% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.3% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Enovix (NasdaqGS:ENVX) | 12.2% | 56.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Let's review some notable picks from our screened stocks.

Upstart Holdings (NasdaqGS:UPST)

Simply Wall St Growth Rating: ★★★★★★

Overview: Upstart Holdings, Inc. operates a cloud-based AI lending platform in the United States and has a market cap of approximately $4.55 billion.

Operations: The company's revenue is primarily generated from its personal lending segment, which accounted for $625.31 million.

Insider Ownership: 12.7%

Revenue Growth Forecast: 21.8% p.a.

Upstart Holdings is experiencing significant revenue growth, forecasted at 21.8% annually, outpacing the US market's average. Despite recent volatility in its share price and no substantial insider buying over the past three months, Upstart has seen more insider buying than selling. The company is expected to become profitable within three years with a high return on equity. Recent partnerships with credit unions like Holyoke Credit Union enhance its consumer lending reach.

- Unlock comprehensive insights into our analysis of Upstart Holdings stock in this growth report.

- The valuation report we've compiled suggests that Upstart Holdings' current price could be inflated.

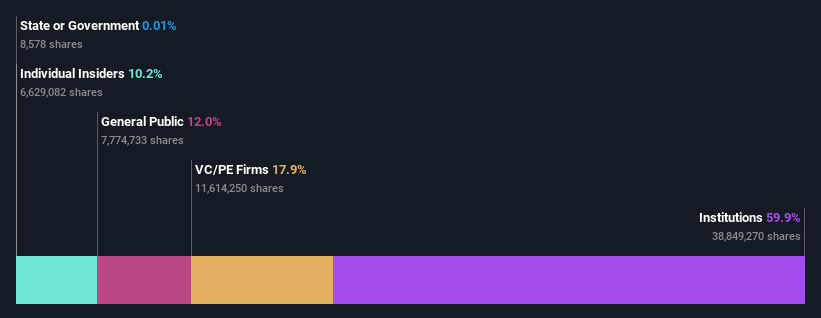

Victory Capital Holdings (NasdaqGS:VCTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Victory Capital Holdings, Inc., along with its subsidiaries, operates as an asset management company both in the United States and internationally with a market capitalization of approximately $3.69 billion.

Operations: The company's revenue of $893.48 million is derived from offering investment management services and products.

Insider Ownership: 10.2%

Revenue Growth Forecast: 19.2% p.a.

Victory Capital Holdings is poised for substantial earnings growth, projected at 27.8% annually, surpassing the US market average. Despite high debt levels, it trades below fair value and peer comparisons. Recent earnings showed strong performance with a net income increase to US$288.86 million for 2024. The company continues strategic capital deployment through acquisitions and share buybacks, supported by a US$200 million repurchase program while maintaining dividend increases.

- Click here and access our complete growth analysis report to understand the dynamics of Victory Capital Holdings.

- According our valuation report, there's an indication that Victory Capital Holdings' share price might be on the cheaper side.

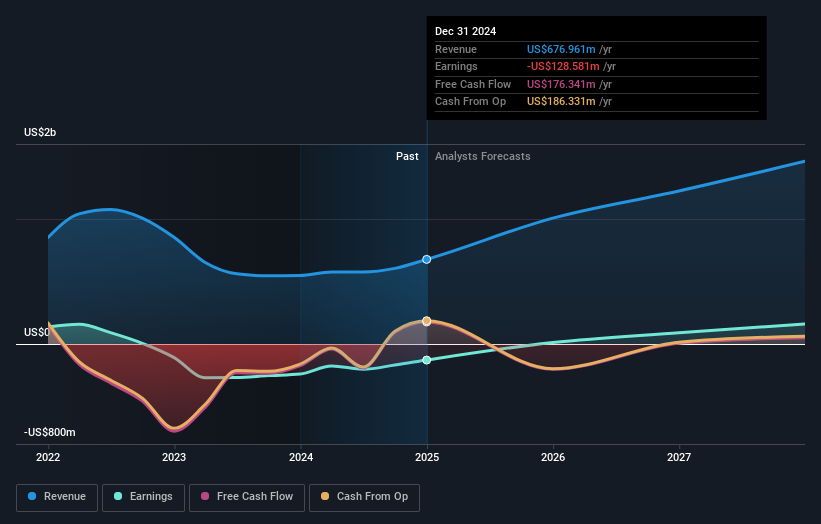

Sable Offshore (NYSE:SOC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sable Offshore Corp. operates in the oil and gas exploration and development sector within the United States, with a market capitalization of approximately $2.22 billion.

Operations: Sable Offshore Corp. generates its revenue through activities in oil and gas exploration and development within the United States.

Insider Ownership: 24.3%

Revenue Growth Forecast: 103.1% p.a.

Sable Offshore Corp. is forecasted for significant revenue and earnings growth, with revenue expected to increase over 100% annually, outpacing the US market. Despite this potential, the company faces challenges including a substantial net loss of US$629.07 million in 2024 and past shareholder dilution. Trading significantly below estimated fair value offers potential upside if profitability is achieved within three years as expected. Recent legal proceedings may impact operations but currently remain unaffected on key projects valued over $10 billion.

- Dive into the specifics of Sable Offshore here with our thorough growth forecast report.

- Our valuation report here indicates Sable Offshore may be overvalued.

Seize The Opportunity

- Access the full spectrum of 209 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives