- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

3 Growth Companies With High Insider Ownership Seeing Up To 112% Earnings Growth

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 14% over the past year with earnings forecast to grow by 15% annually. In such a landscape, identifying growth companies with high insider ownership can be a promising strategy as it often indicates strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 47% |

| Eagle Financial Services (EFSI) | 15.8% | 82.8% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 12.9% | 44.4% |

Underneath we present a selection of stocks filtered out by our screen.

Pagaya Technologies (PGY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pagaya Technologies Ltd. is a technology company that uses data science and AI-powered technology to serve financial services, other service providers, their customers, and asset investors in the U.S., Israel, and the Cayman Islands, with a market cap of $2.36 billion.

Operations: The company generates revenue of $1.08 billion from its Software & Programming segment.

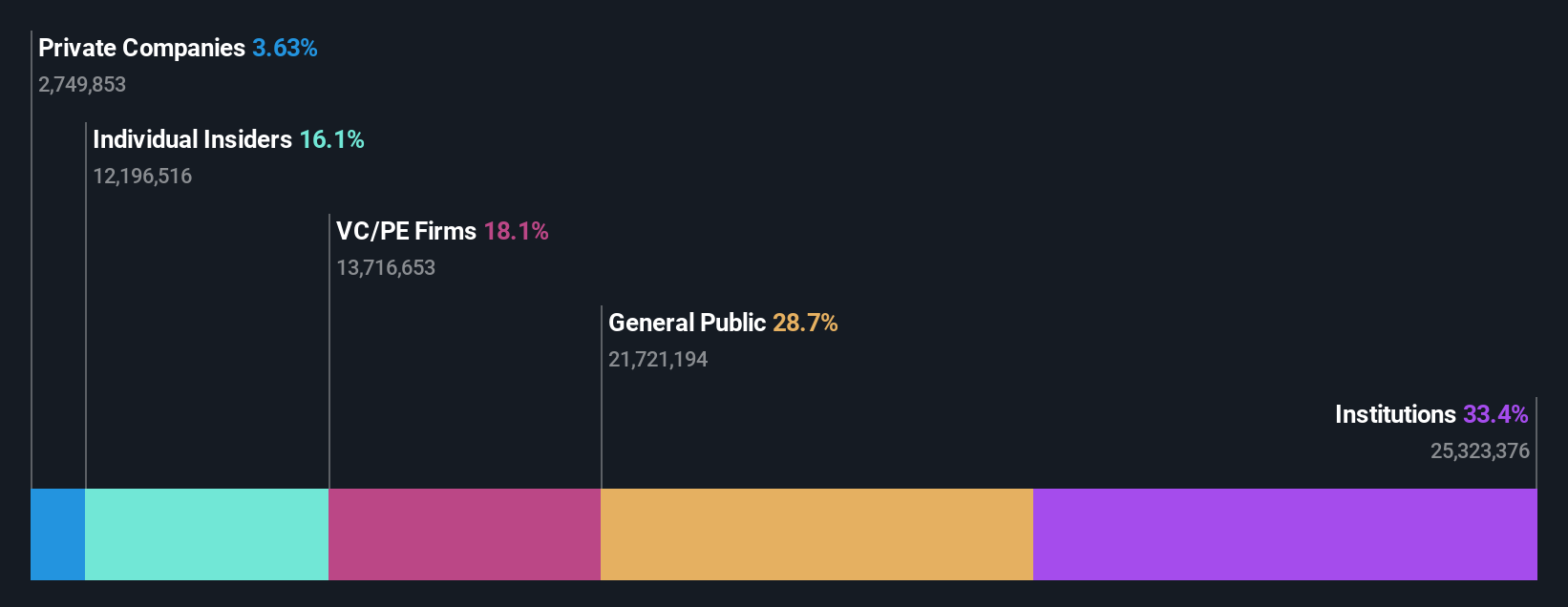

Insider Ownership: 16.1%

Earnings Growth Forecast: 112.2% p.a.

Pagaya Technologies has shown significant growth potential with its recent addition to multiple Russell Growth benchmarks, indicating a shift towards growth-oriented strategies. Despite high volatility and substantial insider selling, the company is expected to become profitable in three years, with earnings growing at over 100% annually. Revenue is forecasted to outpace the US market at 15.3% per year. The launch of its POSH securitization program signals strategic expansion in point-of-sale financing solutions.

- Delve into the full analysis future growth report here for a deeper understanding of Pagaya Technologies.

- Upon reviewing our latest valuation report, Pagaya Technologies' share price might be too pessimistic.

Victory Capital Holdings (VCTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Victory Capital Holdings, Inc. operates as an asset management company both in the United States and internationally, with a market cap of approximately $4.63 billion.

Operations: The company's revenue primarily comes from providing investment management services and products, totaling $897.22 million.

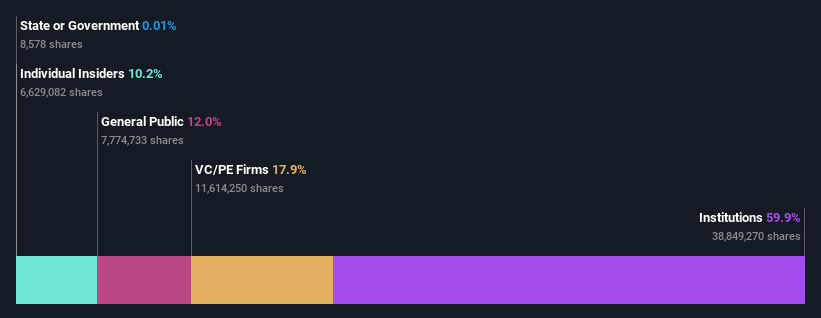

Insider Ownership: 10.1%

Earnings Growth Forecast: 32.3% p.a.

Victory Capital Holdings has recently been added to several S&P indices, highlighting its growth trajectory. The company forecasts annual earnings growth of 32.3%, outpacing the US market's 14.9%. Revenue is expected to grow at 20% annually, although it carries a high debt level. Despite trading slightly below fair value and showing no recent insider trading activity, Victory Capital's strategic financial positioning and strong forecasted return on equity underscore its potential in the growth sector.

- Dive into the specifics of Victory Capital Holdings here with our thorough growth forecast report.

- According our valuation report, there's an indication that Victory Capital Holdings' share price might be on the cheaper side.

BBB Foods (TBBB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BBB Foods Inc., with a market cap of $2.97 billion, operates a chain of grocery retail stores in Mexico through its subsidiaries.

Operations: The company generates revenue of MX$61.89 billion from the sale, acquisition, and distribution of all types of products and consumer goods through its grocery retail operations in Mexico.

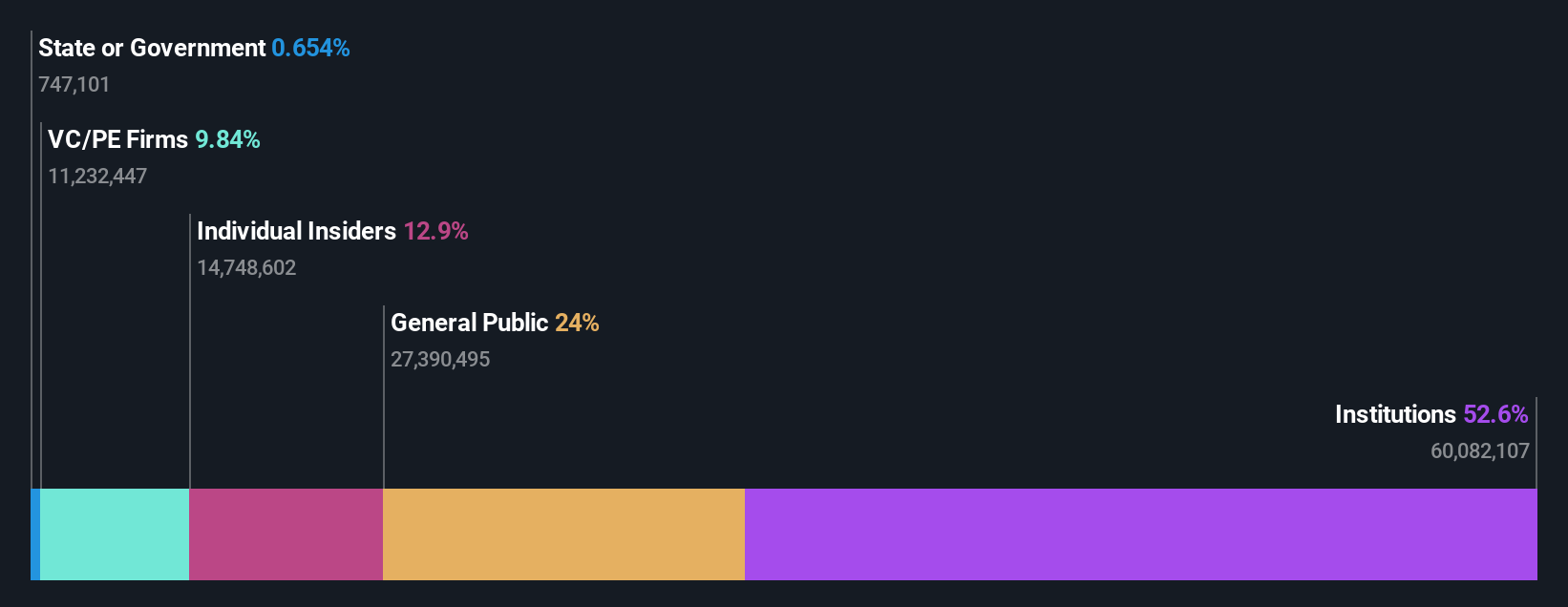

Insider Ownership: 12.9%

Earnings Growth Forecast: 34.8% p.a.

BBB Foods demonstrates significant growth potential with forecasted annual earnings growth of 34.8%, surpassing the US market's average. Its revenue is expected to grow at 19.8% annually, although recent quarterly sales showed a decline to MXN 26.29 million from MXN 27.36 million year-over-year, while revenue increased substantially to MXN 17,131.79 million from MXN 12,684.25 million previously. Trading below fair value and analyst price targets suggests potential upside despite low forecasted return on equity at 17.9%.

- Click here to discover the nuances of BBB Foods with our detailed analytical future growth report.

- The analysis detailed in our BBB Foods valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Embark on your investment journey to our 187 Fast Growing US Companies With High Insider Ownership selection here.

- Seeking Other Investments? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives