- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Upstart Holdings (NasdaqGS:UPST) Sees 5% Dip As Follow-On Equity Offering Raises US$500M

Reviewed by Simply Wall St

Upstart Holdings (NasdaqGS:UPST) recently took significant actions, including expanding its Board of Directors and launching a partnership with Holyoke Credit Union to broaden its consumer loan offerings. Despite these developments, the company's shares fell 4.7% over the last month. The stock price movement coincided with overall market trends, as the S&P 500 experienced a 2.5% decline amid heightened investor concerns about newly imposed U.S. tariffs and their economic impact. Upstart's performance should also be seen in light of its follow-on equity offering of $500 million and mixed earnings guidance, projecting a Q1 revenue of approximately $200 million with an expected net loss. Such factors, coupled with broader financial market pressures, contributed to mitigating the positive impact of internal growth and client partnerships on the share price, reflecting the complex interdependence between company-specific actions and macroeconomic influences.

Click here to discover the nuances of Upstart Holdings with our detailed analytical report.

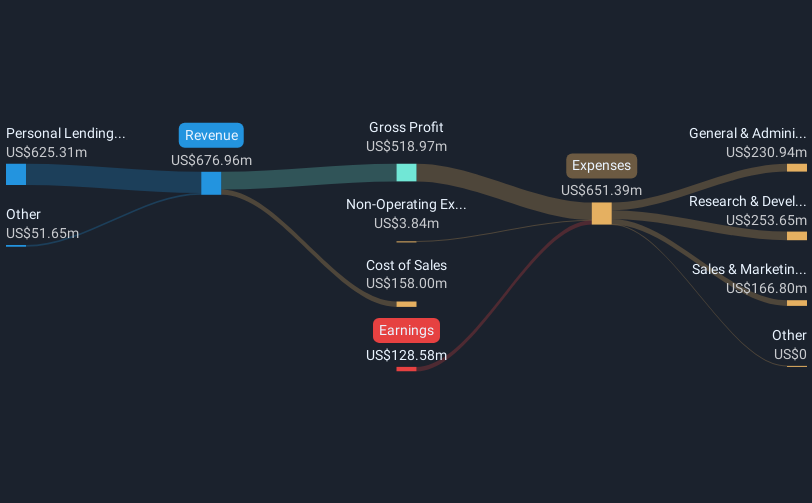

Over the course of last year, Upstart Holdings' total shareholder return was 142.59%, significantly outpacing both the US Market's 13.1% and the US Consumer Finance industry's 35.5% returns. A key driver was the company's effectiveness in expanding its revenue base, with total revenue growing from $513.56 million to $636.53 million. Although Upstart remained unprofitable, its net loss decreased notably, signaling progress toward improved financial health. The absence of substantial insider trading and the ongoing partnerships with institutions like Pelican State Credit Union also reinforced investor confidence.

Further contributing to the impressive returns was the company's strong revenue growth forecast of 21.8% per year, surpassing both the industry average and broader market expectations. However, the follow-on equity offering of $500 million highlighted the company's need for additional capital, an important factor for investors to monitor. Overall, these developments paint a picture of a company experiencing rapid growth yet facing challenges related to profitability and market perceptions of valuation.

- Unlock the insights behind Upstart Holdings' valuation and discover its true investment potential

- Uncover the uncertainties that could impact Upstart Holdings' future growth—read our risk evaluation here.

- Already own Upstart Holdings? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives