- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Upstart Holdings, Inc.'s (NASDAQ:UPST) Shareholders Might Be Looking For Exit

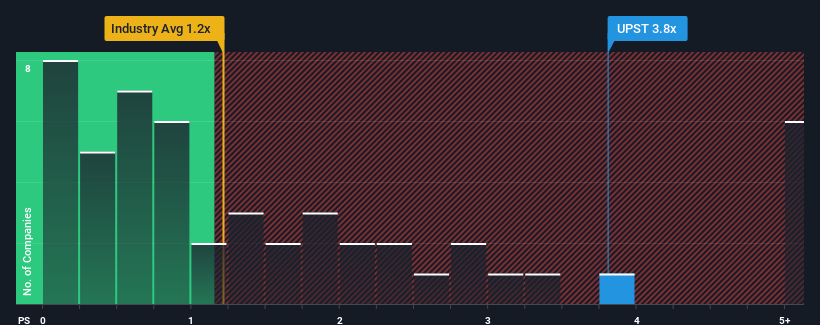

When you see that almost half of the companies in the Consumer Finance industry in the United States have price-to-sales ratios (or "P/S") below 1.2x, Upstart Holdings, Inc. (NASDAQ:UPST) looks to be giving off strong sell signals with its 3.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Upstart Holdings

What Does Upstart Holdings' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Upstart Holdings' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Upstart Holdings.How Is Upstart Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Upstart Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 95% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 0.02% over the next year. With the industry predicted to deliver 32% growth, that's a disappointing outcome.

In light of this, it's alarming that Upstart Holdings' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On Upstart Holdings' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

For a company with revenues that are set to decline in the context of a growing industry, Upstart Holdings' P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

Before you take the next step, you should know about the 3 warning signs for Upstart Holdings that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives