- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Upstart Holdings, Inc. (NASDAQ:UPST) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

Unfortunately for some shareholders, the Upstart Holdings, Inc. (NASDAQ:UPST) share price has dived 25% in the last thirty days, prolonging recent pain. Still, a bad month hasn't completely ruined the past year with the stock gaining 73%, which is great even in a bull market.

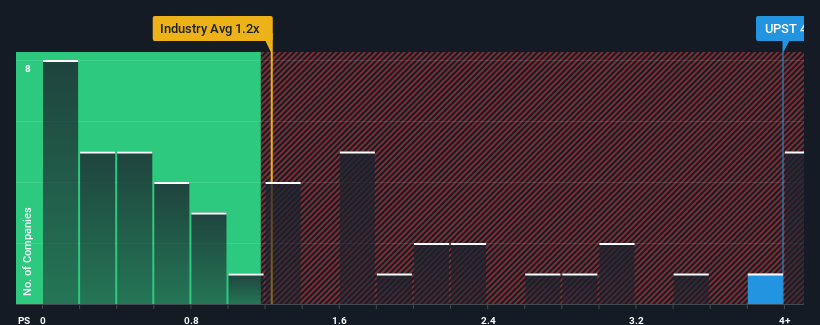

Although its price has dipped substantially, given around half the companies in the United States' Consumer Finance industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Upstart Holdings as a stock to avoid entirely with its 4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Upstart Holdings

How Has Upstart Holdings Performed Recently?

Upstart Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Upstart Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Upstart Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Upstart Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. Even so, admirably revenue has lifted 127% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 17% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 15% per annum, which is noticeably less attractive.

In light of this, it's understandable that Upstart Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Upstart Holdings' shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Upstart Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Upstart Holdings has 3 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Upstart Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives