- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Investors Appear Satisfied With Upstart Holdings, Inc.'s (NASDAQ:UPST) Prospects As Shares Rocket 32%

Despite an already strong run, Upstart Holdings, Inc. (NASDAQ:UPST) shares have been powering on, with a gain of 32% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

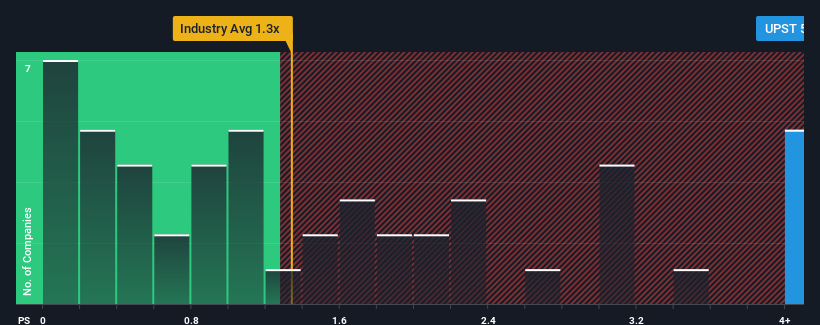

After such a large jump in price, when almost half of the companies in the United States' Consumer Finance industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Upstart Holdings as a stock not worth researching with its 5.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Upstart Holdings

How Upstart Holdings Has Been Performing

Recent times haven't been great for Upstart Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Upstart Holdings.How Is Upstart Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Upstart Holdings would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.5% last year. The solid recent performance means it was also able to grow revenue by 22% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 21% each year over the next three years. With the industry only predicted to deliver 14% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Upstart Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Upstart Holdings' P/S

The strong share price surge has lead to Upstart Holdings' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Upstart Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Consumer Finance industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Upstart Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives