- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

High Insider Ownership Growth Stocks To Consider In May 2025

Reviewed by Simply Wall St

The United States market has remained flat over the last week but has shown a solid 11% increase over the past year, with earnings projected to grow by 14% annually. In this context, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best, potentially aligning well with the positive earnings outlook.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 22.7% | 24% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.2% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 67.1% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.4% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 102.6% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

Here we highlight a subset of our preferred stocks from the screener.

Intuitive Machines (NasdaqGM:LUNR)

Simply Wall St Growth Rating: ★★★★★☆

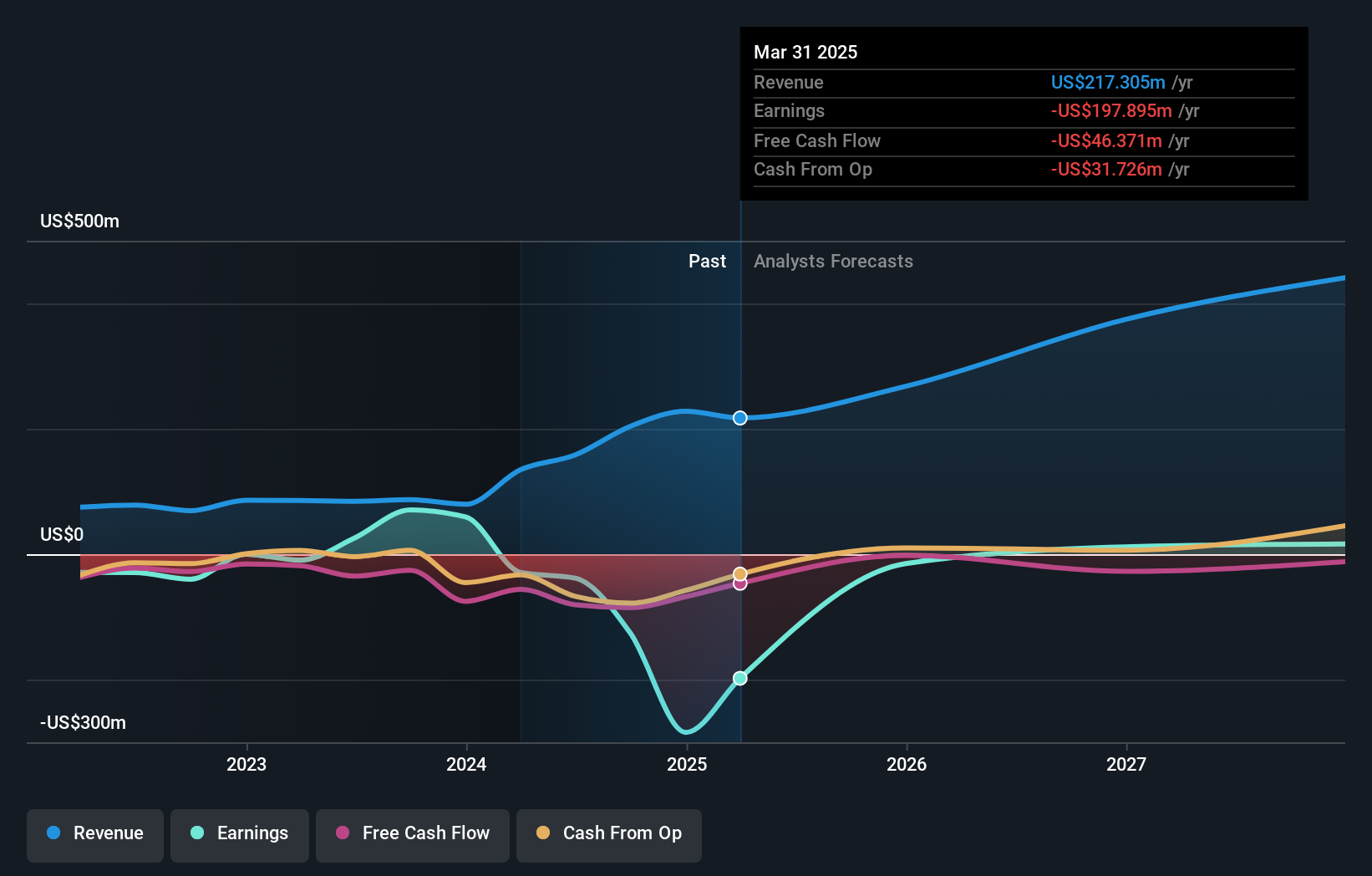

Overview: Intuitive Machines, Inc. designs, manufactures, and operates space products and services in the United States with a market cap of $2.03 billion.

Operations: The company generates revenue from its Aerospace & Defense segment, which amounts to $217.31 million.

Insider Ownership: 11.6%

Intuitive Machines, a growth-focused company with significant insider ownership, recently reported Q1 2025 sales of US$62.52 million and a net income of US$0.513 million, marking an improvement from the previous year's net loss. The company's revenue is expected to grow at 21.7% annually, surpassing the US market average. Despite its volatile share price and past shareholder dilution, Intuitive Machines secured a grant up to $10 million for space exploration projects and maintains access to a $40 million credit facility for growth initiatives.

- Click here and access our complete growth analysis report to understand the dynamics of Intuitive Machines.

- The valuation report we've compiled suggests that Intuitive Machines' current price could be inflated.

Roku (NasdaqGS:ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

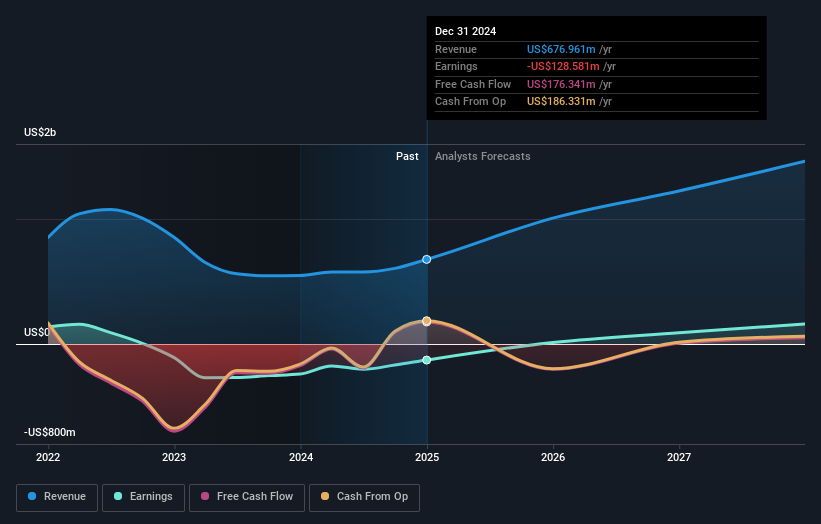

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $10.12 billion.

Operations: Roku generates revenue through two main segments: Devices, which contributed $603.44 million, and Platform, which brought in $3.65 billion.

Insider Ownership: 12.1%

Roku, with substantial insider ownership, is expected to see revenue growth of 9.9% annually, slightly above the US market average. Despite a forecasted low return on equity of 5.7%, Roku is projected to become profitable in three years and trades at 55% below its estimated fair value. Recent product launches and partnerships like the Monster Jam Channel enhance its streaming offerings globally, while executive changes may impact strategic direction in the short term.

- Take a closer look at Roku's potential here in our earnings growth report.

- Our valuation report here indicates Roku may be undervalued.

Upstart Holdings (NasdaqGS:UPST)

Simply Wall St Growth Rating: ★★★★★★

Overview: Upstart Holdings, Inc. operates a cloud-based AI lending platform in the United States and has a market cap of approximately $4.31 billion.

Operations: Upstart Holdings generates revenue through its cloud-based AI lending platform in the United States.

Insider Ownership: 12.6%

Upstart Holdings, characterized by high insider ownership, is forecast to achieve rapid revenue growth of 20.7% annually, significantly outpacing the US market. Despite recent volatility in its share price and substantial insider selling over the past quarter, Upstart's strategic partnerships with credit unions like Lake Trust and First Commonwealth are expanding its personal loan offerings. With a projected return on equity of 24.7% in three years, Upstart aims for profitability within this timeframe.

- Unlock comprehensive insights into our analysis of Upstart Holdings stock in this growth report.

- The analysis detailed in our Upstart Holdings valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Unlock our comprehensive list of 192 Fast Growing US Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives