- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (SOFI) Is Up 6.8% After Raising 2025 Guidance and Reporting Strong Q2 Results

Reviewed by Simply Wall St

- SoFi Technologies recently reported second quarter 2025 results, highlighting US$792.41 million in revenue and US$97.26 million in net income, while also raising full-year guidance to approximately US$370 million in net income and enhanced member growth expectations.

- This upward revision signals management's increased confidence in the company's earnings power and member acquisition trajectory for the remainder of 2025.

- We'll explore how SoFi’s improved profit outlook and revised 2025 guidance strengthen its broader investment case and future growth expectations.

Find companies with promising cash flow potential yet trading below their fair value.

SoFi Technologies Investment Narrative Recap

For anyone considering SoFi Technologies, the core belief centers around its ability to scale a comprehensive digital financial ecosystem while maintaining quality earnings growth. The recent Q2 results and upward guidance revision highlight strong momentum in profit growth and member acquisition, which appear to reinforce the short-term catalyst of accelerating revenue and net income; however, the risk of margin pressure from higher deposit costs remains material and unchanged in the current environment.

The newly announced partnership with Paychex is particularly relevant, as it could support SoFi’s expected member growth and aid further cross-selling of SoFi’s services. By gaining access to Paychex’s considerable user base, SoFi could potentially enhance brand visibility and product adoption, supporting one of its central business catalysts tied to expanding financial services reach and increasing fee-based income streams.

However, in contrast, investors should be aware of potential margin pressures if rising deposit costs are not matched by higher lending returns, as ...

Read the full narrative on SoFi Technologies (it's free!)

SoFi Technologies' narrative projects $4.4 billion revenue and $912.2 million earnings by 2028. This requires 16.9% annual revenue growth and a $450 million earnings increase from $462.2 million today.

Uncover how SoFi Technologies' forecasts yield a $17.09 fair value, a 24% downside to its current price.

Exploring Other Perspectives

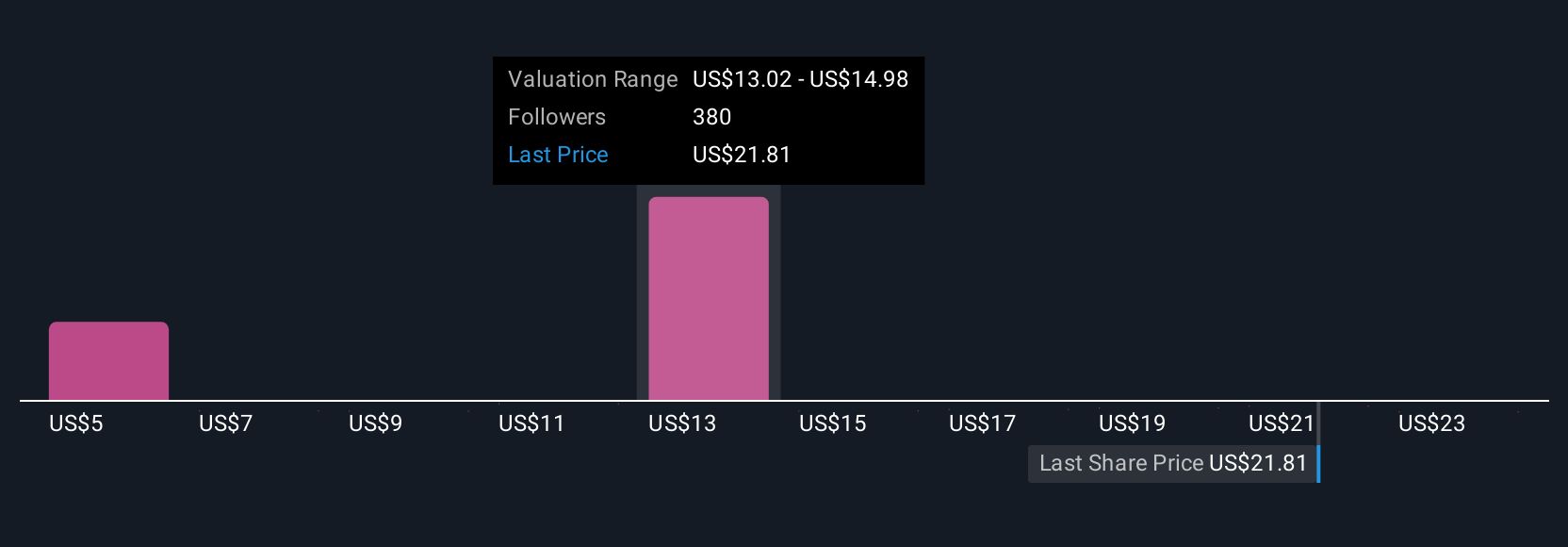

Fifty-one perspectives from the Simply Wall St Community set SoFi’s fair value between US$5.44 and US$25 per share. While outlooks range widely, many market participants are also watching ongoing competition for high-yield deposits and resulting margin risks, offering several alternative viewpoints worth exploring.

Explore 51 other fair value estimates on SoFi Technologies - why the stock might be worth less than half the current price!

Build Your Own SoFi Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SoFi Technologies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free SoFi Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoFi Technologies' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion