- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (NasdaqGS:SOFI) Secures US$5B Deal with Blue Owl Capital Amid 11% Stock Surge Over Last Week

Reviewed by Simply Wall St

SoFi Technologies (NasdaqGS:SOFI) has recently secured a significant $5 billion agreement with Blue Owl Capital to bolster its Loan Platform Business, focusing on personal loans. This development aligns with SoFi's efforts to diversify its revenue streams and likely supported the 11% increase in the company's share price over the past week. Meanwhile, as the broader market climbed 2% over the same period, driven by gains in major indices like the S&P 500 and Nasdaq, SoFi's performance indicates a strong positive reaction from investors. This agreement underscores the company's growing influence in the personal lending sector, reflecting increased demand and strategic expansion.

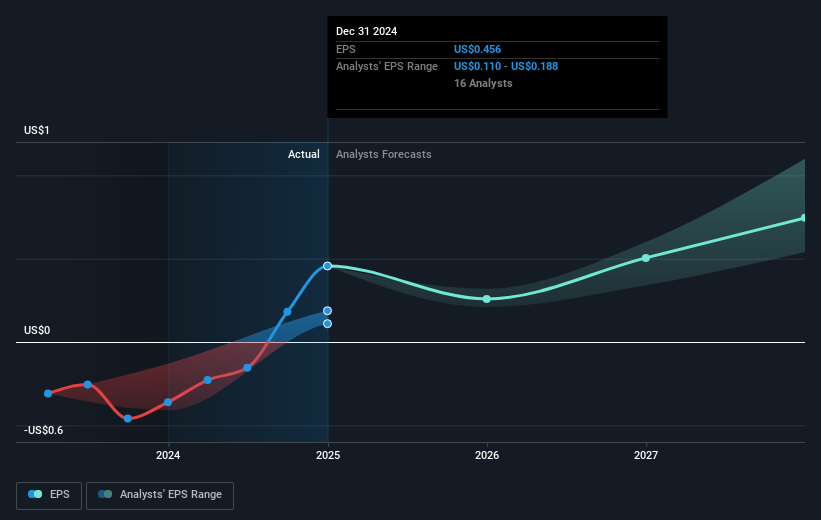

Over the past year, SoFi Technologies achieved a total shareholder return of 84.16%, significantly outperforming both the US Consumer Finance industry, which saw a return of 24.1%, and the broader US market's 10.2% return. This impressive performance can be attributed to several key developments. In January 2025, SoFi reported a net income of $498.67 million for the 2024 fiscal year, a remarkable turnaround from a loss of $300.74 million in 2023. Additionally, the company's inclusion in various Russell indexes in July 2024 likely contributed to increased investor interest, further supported by the launch of a new robo-advisor platform in partnership with BlackRock Inc. in November 2024.

SoFi's strategic partnerships and innovative product offerings have been central to its strong financial results and shareholder returns. The company finalized an important $5 billion agreement with Blue Owl Capital in March 2025, underscoring its expansion in the personal loans market. Furthermore, the previously announced strategic alliance with PrimaryBid Technologies, introduced in October 2024, enhanced the company's offerings in equity program management, potentially attracting more investors and supporting share price growth. SoFi's growth trajectory and its aggressive reinvestment into business initiatives have positioned it as a leader in its sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives