- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (NasdaqGS:SOFI) Launches SmartStart Loan Option Offering Flexible Repayment Terms

Reviewed by Simply Wall St

SoFi Technologies (NasdaqGS:SOFI) introduced its innovative SmartStart refinance option, aiming to provide student loan borrowers with flexible repayment terms. This launch aligns with the company's ongoing commitment to enhance borrower experience and drive growth in its loan offerings. Over the past week, SoFi's share price moved up by 6.92%, aligning with the broader market trends, as the Nasdaq gained 2.3%. The price movement reflects both the favorable sentiment towards SoFi's product offering and the supportive market environment, with robust performance reported in other tech stocks and a general positive sentiment on Wall Street.

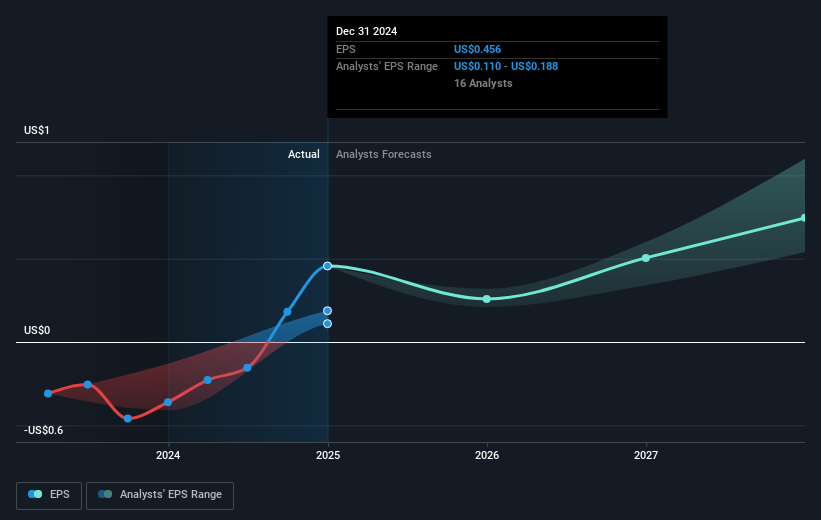

The launch of SoFi Technologies' SmartStart refinance option could significantly influence the company's growth trajectory by potentially expanding its customer base and enhancing loan issuance. With lower repayment terms, there might be an uptick in loan demand, which could positively impact revenue and earnings forecasts. The anticipated growth is notable given analysts' expectations of continued revenue growth and margin improvements. However, it's essential to consider that aggressive reinvestment in strategic partnerships and loan platform expansions may lead to short-term margin pressures amidst a risk of overvaluation if expected gains are delayed.

Over a three-year period, SoFi's total shareholder returns, encompassing share price appreciation and dividends, reached 82.02%. This robust performance indicates significant investor confidence and aligns well with broader market gains. In contrast, while SoFi's one-year return exceeded that of the US Consumer Finance industry, showing positive relative performance, it's worth noting the volatility that accompanied these gains in recent months.

SoFi's current share price of US$15.78 reflects a slight discount to the consensus analyst price target of US$13.29, implying an 18.7% expected decline as perceived by analysts. This suggests that while the company is underpinned by strong revenue and earnings potential, analysts may consider the market's current valuation as somewhat optimistic. Investors are encouraged to critically evaluate these forecasts in relation to their expectations of the company's future growth and profitability.

Our valuation report unveils the possibility SoFi Technologies' shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SoFi Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives