- United States

- /

- Consumer Finance

- /

- NasdaqGS:NAVI

Does Navient's (NAVI) Earnings Miss Cast Doubt on Its Growth Story?

Reviewed by Sasha Jovanovic

- Navient recently reported a weaker quarter with revenues falling year over year and missed analyst expectations, which resulted in a decline in its stock price.

- Despite continued recognition as a top employer for caregivers, the company's quarterly financial underperformance has drawn the most attention from investors, highlighting the importance of earnings momentum for sentiment.

- To assess the impact of Navient’s recent earnings shortfall, we’ll explore how this result may challenge its previously discussed earnings growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Navient Investment Narrative Recap

To be comfortable as a Navient shareholder, one has to believe in the company's ability to rebound from weak quarters and drive sustained growth, particularly in private student lending. The recent earnings miss and revenue decline have put short-term pressure on sentiment, and they could challenge the most important near-term catalyst: achieving a meaningful turnaround in earnings momentum. The biggest risk remains the persistence of elevated delinquency and provision expenses, and this latest result appears to reinforce that concern for now.

Amid the financial headlines, Navient’s continued recognition as a top employer for caregivers is an interesting development. While not directly linked to the company’s earnings outlook, these accolades speak to broader goals around employee engagement and retention, potentially serving as a modest positive for long-term operational stability even as short-term challenges dominate investor attention.

On the flip side, investors should be aware of the potential for further credit losses if late-stage delinquencies remain higher than expected…

Read the full narrative on Navient (it's free!)

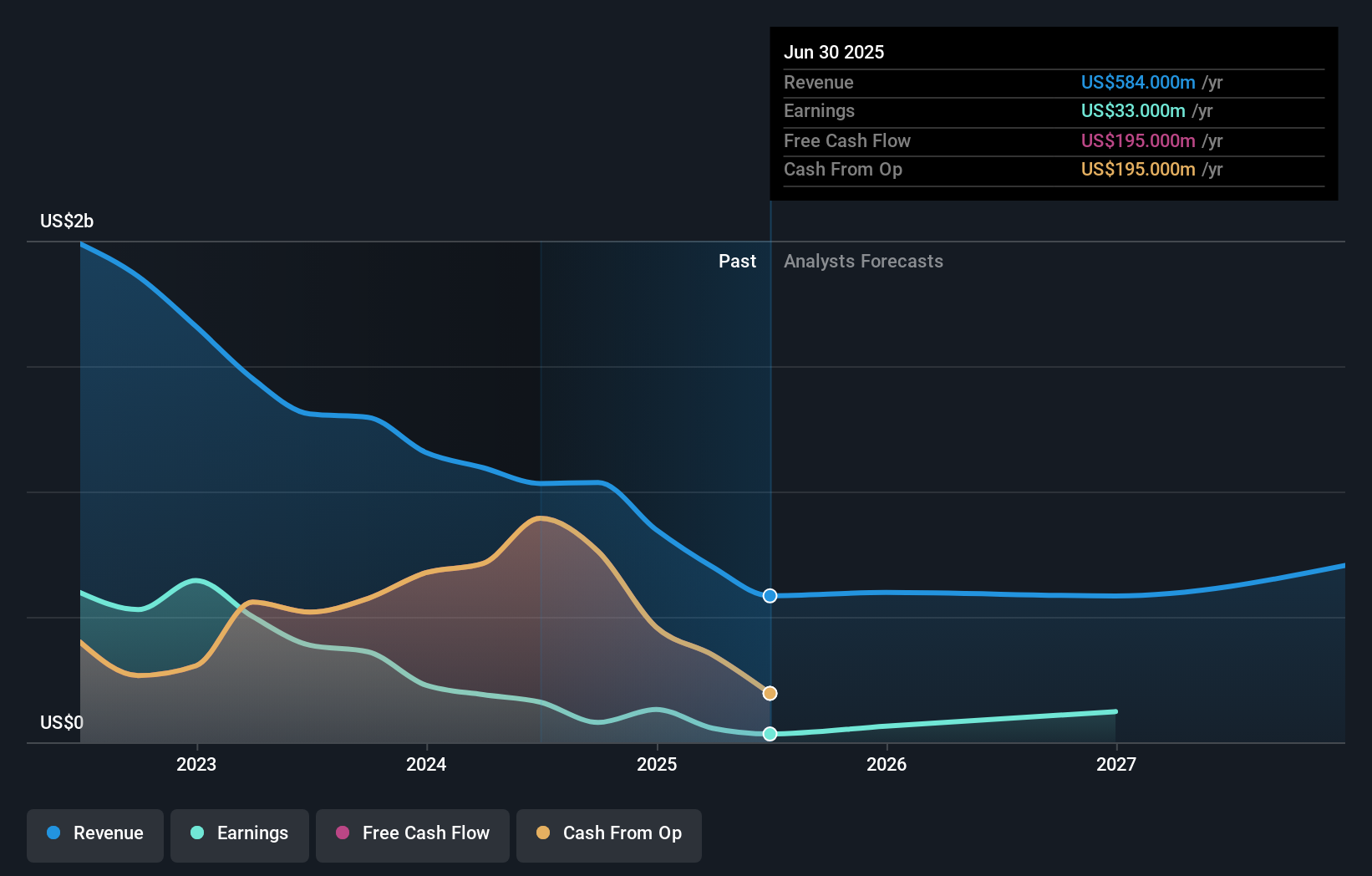

Navient is forecast to generate $668.0 million in revenue and $321.8 million in earnings by 2028. This outlook assumes annual revenue growth of 4.6% and a substantial earnings increase of $288.8 million from current earnings of $33.0 million.

Uncover how Navient's forecasts yield a $14.10 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community offered one fair value estimate for Navient at US$14.10. With ongoing concerns about persistent credit quality issues, it is important to compare a range of viewpoints before making any decisions.

Explore another fair value estimate on Navient - why the stock might be worth just $14.10!

Build Your Own Navient Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Navient research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Navient research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Navient's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navient might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NAVI

Navient

Provides technology-enabled education finance and business processing solutions for education, health care, and government clients in the United States.

Established dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives