- United States

- /

- Capital Markets

- /

- NasdaqGS:COWN

Analysts Just Shaved Their Cowen Inc. (NASDAQ:COWN) Forecasts Dramatically

Today is shaping up negative for Cowen Inc. (NASDAQ:COWN) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

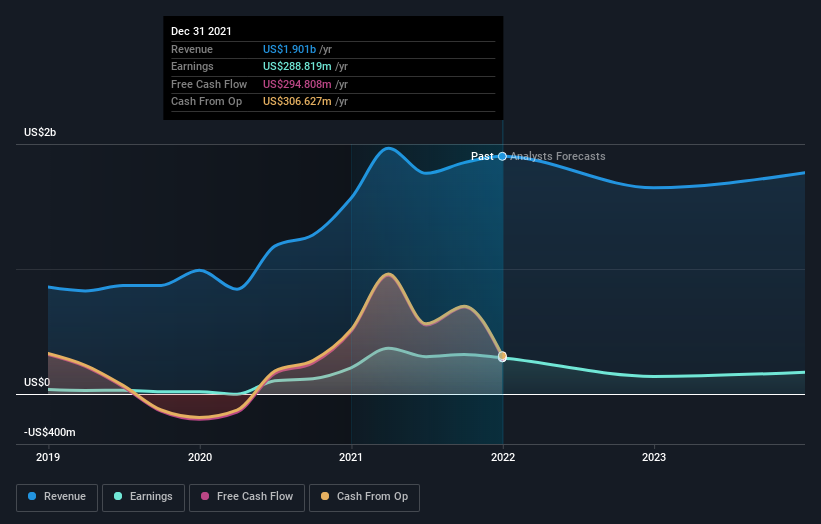

After the downgrade, the consensus from Cowen's five analysts is for revenues of US$1.5b in 2022, which would reflect a disturbing 23% decline in sales compared to the last year of performance. Statutory earnings per share are supposed to crater 57% to US$4.52 in the same period. Prior to this update, the analysts had been forecasting revenues of US$1.7b and earnings per share (EPS) of US$5.30 in 2022. Indeed, we can see that the analysts are a lot more bearish about Cowen's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for Cowen

The consensus price target fell 14% to US$43.17, with the weaker earnings outlook clearly leading analyst valuation estimates. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Cowen, with the most bullish analyst valuing it at US$71.00 and the most bearish at US$29.00 per share. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 23% annualised revenue decline to the end of 2022. That is a notable change from historical growth of 30% over the last five years. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 0.06% per year. The forecasts do look bearish for Cowen, since they're expecting it to shrink faster than the industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately they also cut their revenue estimates for this year, and they expect sales to lag the wider market. That said, earnings per share are more important for creating value for shareholders. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Cowen.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Cowen's financials, such as dilutive stock issuance over the past year. For more information, you can click here to discover this and the 3 other risks we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you're looking to trade Cowen, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COWN

Cowen

Cowen Inc., together with its subsidiaries, provides investment banking, research, sales and trading, prime brokerage, global clearing, securities financing, commission management, and investment management services in the United States and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives