- United States

- /

- Consumer Finance

- /

- NasdaqGS:CACC

Should You Reassess Credit Acceptance After Its Recent 6% Rally in June 2025?

Reviewed by Bailey Pemberton

If you are sitting on the fence about Credit Acceptance stock, you are not alone. Many investors are debating whether recent upticks hint at something bigger or just a temporary bounce. The stock climbed 6.0% in the past week after a choppy stretch, though it is still down 7.0% over the last month. Longer-term holders have seen a steadier gain, with shares up 9.7% in the last year and an impressive 37.3% over five years. These kinds of returns do not happen in isolation, as investors have been weighing the company's growth potential and shifting risk profile as broader market conditions evolve.

What about value? That is the question that matters to most long-term investors right now. By one basic yardstick that compares six key valuation checks, Credit Acceptance scores just 1 out of 6 for undervaluation, meaning it is only considered undervalued in one area. If you are curious about what those checks are, or whether sometimes the market spots value that traditional models miss, you will want to stick with this analysis. Next, we will explore how different valuation methods stack up for Credit Acceptance, and why the best approach to valuation may not always be the most obvious one.

Credit Acceptance scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

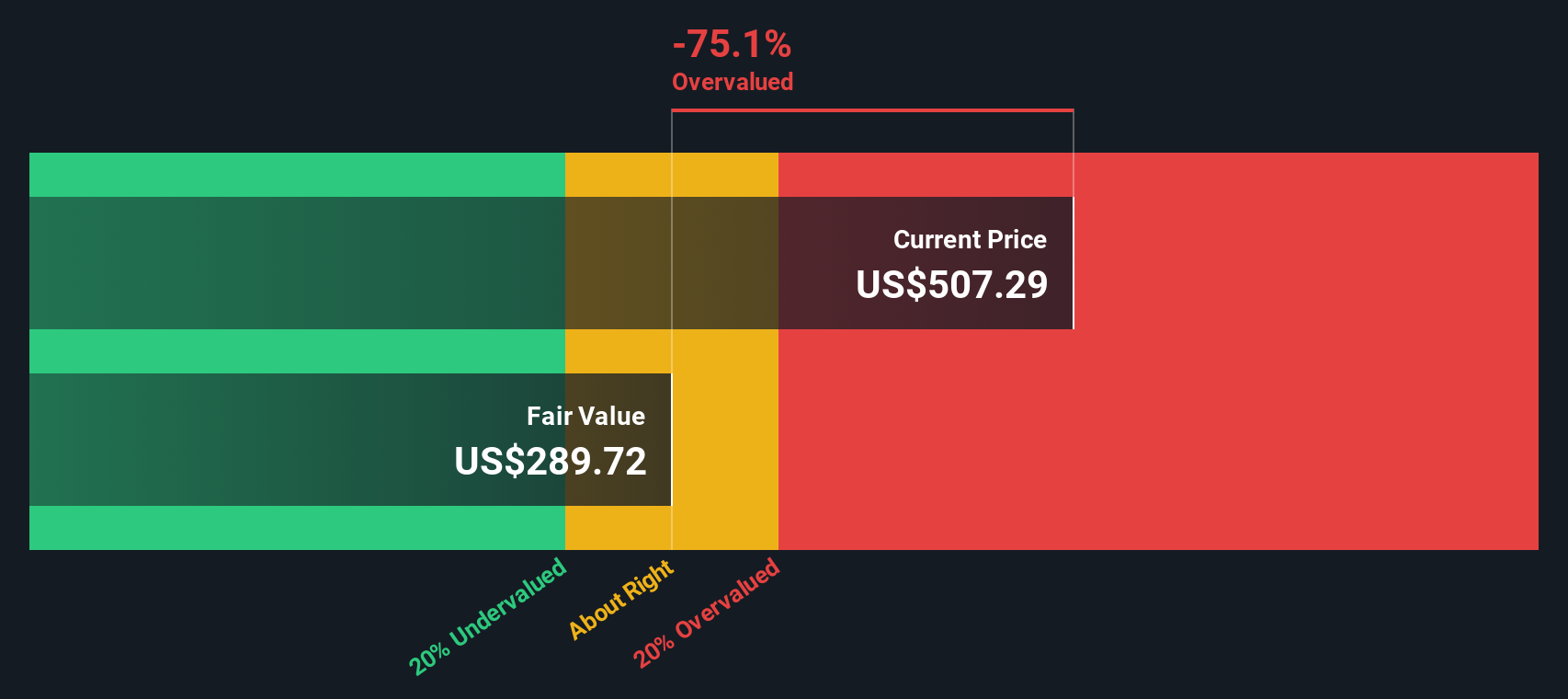

Approach 1: Credit Acceptance Excess Returns Analysis

The Excess Returns model looks at how much profit a company earns above its required cost of capital. Rather than simply using cash flows or earnings, it focuses on the value created by return on equity relative to what investors demand. For Credit Acceptance, this method highlights both the company’s recent performance and its long-term prospects in terms of shareholder value generation.

Here is what the key numbers show:

- Book Value: $138.35 per share

- Stable EPS: $26.20 per share (Source: Median Return on Equity from the past 5 years.)

- Cost of Equity: $14.47 per share

- Excess Return: $11.73 per share

- Average Return on Equity: 19.36%

- Stable Book Value: $135.35 per share (Source: Median Book Value from the past 5 years.)

Based on this analysis, Credit Acceptance’s intrinsic value is significantly lower than its current share price. The model suggests the stock is trading at a 67.8% premium to its estimated value. This indicates that the market may be pricing in more optimistic future growth than the company’s fundamentals support.

Result: OVERVALUED

Our Excess Returns analysis suggests Credit Acceptance may be overvalued by 67.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Credit Acceptance Price vs Earnings

The price-to-earnings (PE) ratio is a go-to valuation yardstick for profitable companies like Credit Acceptance because it directly relates what investors are willing to pay for each dollar of earnings. When a business is generating consistent profits, the PE ratio becomes a quick way to gauge how those profits are being valued by the market.

It is important to remember that a "normal" or "fair" PE ratio should reflect not only current earnings but also market expectations for future growth and the risks tied to the business. Higher growth prospects or lower risks typically justify a higher PE, while slower growth or increased risks warrant a lower one.

Credit Acceptance is currently trading at a PE of 12.87x. For context, this is above the industry average of 10.06x and the peer average of 10.41x within the Consumer Finance sector. This premium suggests the market sees something more in Credit Acceptance than in its typical peer.

However, Simply Wall St’s proprietary “Fair Ratio,” calculated to be 14.92x, offers a more personalized benchmark. Unlike standard industry or peer averages, the Fair Ratio takes into account factors such as the company’s earnings growth outlook, profit margin, unique risks, size, and its place within the industry. The Fair Ratio is therefore tailored specifically to the business in question, rather than relying on broad comparisons that may overlook key company-specific strengths or challenges.

Comparing the current PE of 12.87x to the Fair Ratio of 14.92x suggests that Credit Acceptance is trading slightly below what would be considered fair value based on its fundamentals and risks. This implies there could be a reasonable margin of safety for investors at current levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Credit Acceptance Narrative

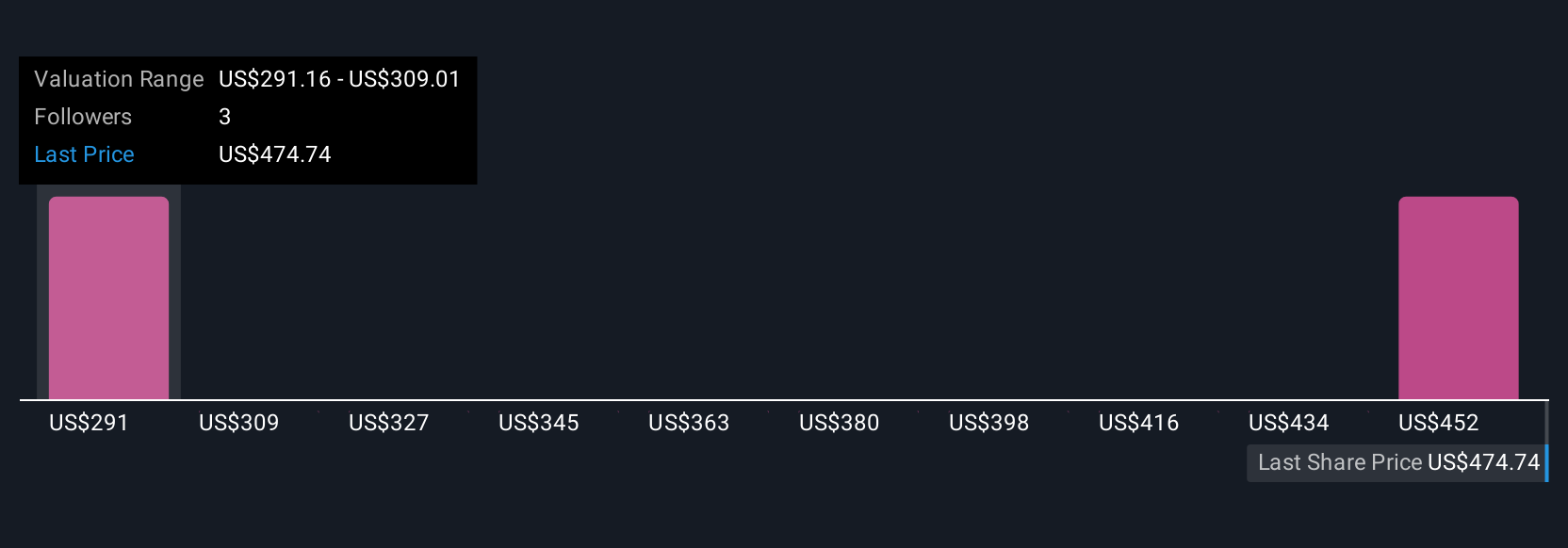

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply the story behind the numbers: your personal perspective on what is driving a company’s future, reflecting your own fair value, and your assumptions for revenue, earnings, and margins. Narratives connect a company’s story and business drivers directly to financial forecasts and ultimately to an estimate of fair value, letting you see how your outlook stacks up against the current price.

On Simply Wall St’s platform, Narratives make this powerful approach easy and accessible to anyone. You can view and create Narratives on the Community page alongside millions of other investors. By linking your Narrative to a fair value and comparing it in real-time to the share price, you can quickly decide when a stock might be worth buying or selling. Plus, Narratives are dynamic, automatically updating when fresh data, news, or earnings are released.

For example, one Credit Acceptance Narrative might expect robust lending expansion and stable earnings, supporting a fair value of $467.50. Another, more cautious view could focus on declining margins and heightened competition, resulting in a lower fair value and a more defensive outlook. Narratives let you test and refine your own investment story to make decisions that match your unique perspective.

Do you think there's more to the story for Credit Acceptance? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CACC

Credit Acceptance

Engages in the provision of financing programs, and related products and services in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives