- United States

- /

- Consumer Finance

- /

- NasdaqGS:CACC

Credit Acceptance (CACC): Valuation Revisited Following Market Rally Driven by Fed Rate Cut Hopes

Reviewed by Simply Wall St

Credit Acceptance (CACC) investors got a fresh jolt of optimism last week, not from any headline about the company itself, but from the broader economic landscape. After Federal Reserve Chair Jerome Powell hinted at a more flexible stance on interest rates during the Jackson Hole symposium, markets rallied, and Credit Acceptance shares were swept up in the momentum. The possibility of rate cuts has eased worries about expensive borrowing and economic slowdowns, putting lenders like Credit Acceptance back on the radar for more risk-tolerant investors.

This uptick comes after a year in which Credit Acceptance has shown moderate growth, with shares climbing about 6% over the past twelve months and recovering from a small dip last month. While annual revenue growth sits near 37% and net income also grew this year, its longer-term performance tells a more nuanced story. The stock is still down nearly 9% over three years but is up over 30% across five years. There is a sense that momentum, at least in the short term, is picking up again as risk perception in the market changes.

With the recent rally driven by macroeconomic optimism instead of company-specific news, investors may be considering whether Credit Acceptance is trading at a discount or if markets are already pricing in a return to stronger growth.

Most Popular Narrative: 8% Overvalued

According to community narrative, Credit Acceptance is currently priced above its fair value, supported by robust market growth drivers but also clouded by risks around profitability and margins. The latest consensus indicates that the market may be too optimistic given the company's future earnings profile.

Ongoing growth in the non-prime borrower segment and persistent income inequality in the U.S. are likely to support stable or increasing demand for Credit Acceptance's auto loan products. This could expand the company's addressable market and sustain long-term revenue growth. Continued U.S. population growth and urbanization may increase the pool of potential subprime borrowers needing access to vehicles, which could provide a structural tailwind for loan originations over time and support top-line revenue expansion.

Ready to dive into the bold predictions behind this valuation? Analysts are banking on transformative demographic shifts and notable profit projections that could reshape the landscape for Credit Acceptance. The main points of interest are their forecasts for revenue momentum and the profitability curve. Can this story deliver the upside investors seek? Read on to unpack the core assumptions fueling this high-stakes consensus.

Result: Fair Value of $467.5 (OVERVAlUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, persistent loan underperformance or intensified competition could easily undermine the bullish outlook that currently supports Credit Acceptance’s elevated valuation. Find out about the key risks to this Credit Acceptance narrative.Another View: Discounted Cash Flow Says Overvalued

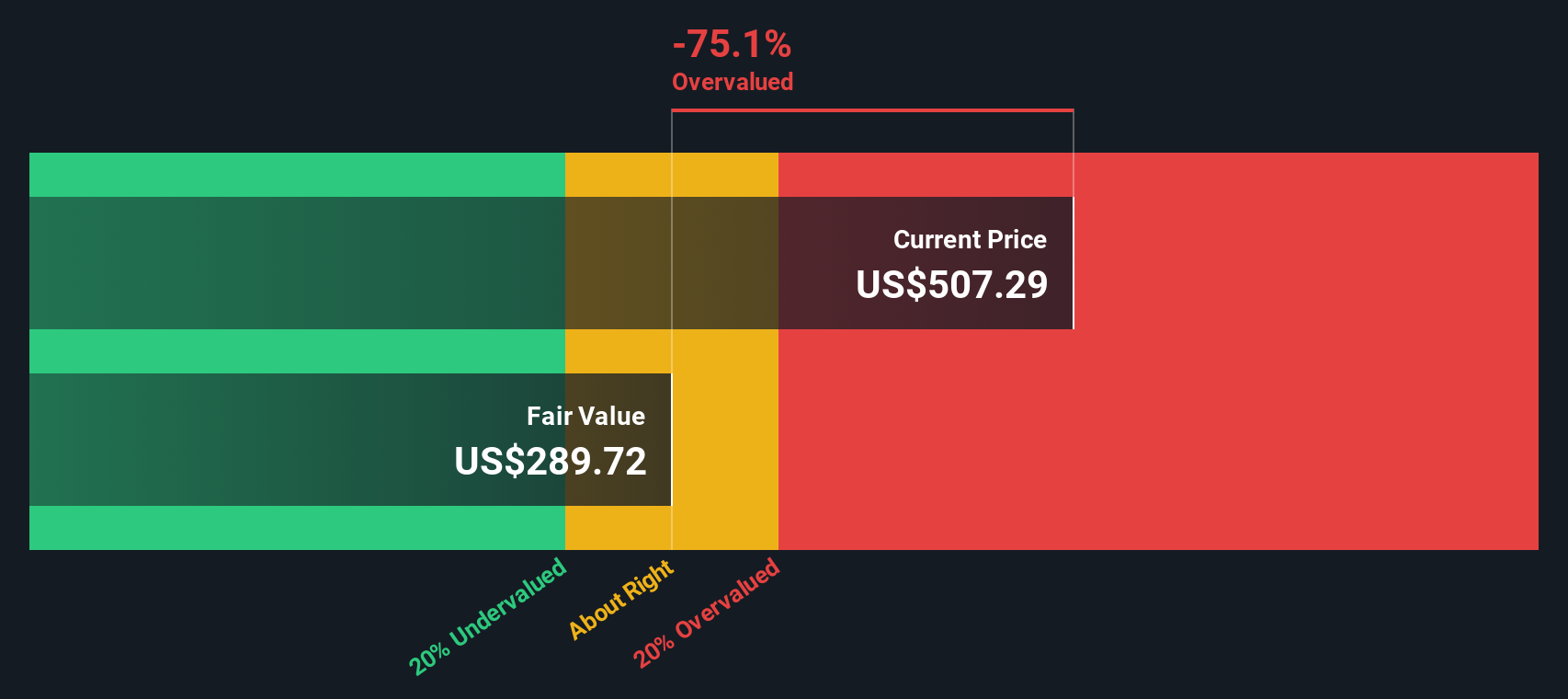

Taking a different perspective, our DCF model paints a less optimistic picture for Credit Acceptance. This approach suggests the current price is above its fair value and challenges the more bullish consensus. Could the real story lie in the details of cash flow assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Credit Acceptance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Credit Acceptance Narrative

If you have a different perspective or want to take your own approach, you can craft your own view using the data in just a few minutes. So why not do it your way?

A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment opportunities?

Sharpen your strategy and aim for smarter decisions by checking out other handpicked investing themes. Simply Wall Street’s unique screeners highlight fresh trends and powerful fundamentals, giving you the edge before market stories make the headlines. Seize your chance to act ahead of the crowd with these compelling ideas:

- Unearth stocks positioned for strong returns by tapping into undervalued stocks based on cash flows. Here, market prices may not yet reflect the true growth outlook.

- Get ahead of the tech curve with AI penny stocks and discover innovative companies shaping the conversation around artificial intelligence breakthroughs.

- Boost your income stream by exploring dividend stocks with yields > 3%. This screener features companies delivering yields above 3% for those seeking more from their portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CACC

Credit Acceptance

Engages in the provision of financing programs, and related products and services in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives