- United States

- /

- Consumer Finance

- /

- NasdaqGS:CACC

Credit Acceptance (CACC) Is Up 6.1% After Earnings Jump and Major Buyback Completion – What's Changed

Reviewed by Simply Wall St

- Credit Acceptance Corporation reported strong second-quarter earnings, with revenue increasing to US$583.8 million and net income rising to US$87.4 million, and announced it had completed the repurchase of 13.25% of its shares under its multi-year buyback plan.

- In addition, during the past month, Credit Acceptance extended the maturity and lowered the interest rate on a US$300.0 million revolving warehouse facility, supporting greater financial flexibility and lowering financing costs for the business.

- With the company posting a significant earnings turnaround and completing major share repurchases, we'll explore how these actions influence its investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Credit Acceptance Investment Narrative Recap

To invest in Credit Acceptance, you need to believe in the company’s ability to grow earnings by serving non-prime borrowers while managing elevated credit risk from recent loan vintages. The recent extension and interest rate reduction on major credit facilities improve near-term financial flexibility but, by themselves, do not materially alter the most important short-term catalyst, stabilizing loan performance, or address the primary risk of persistent credit losses.

Among the recent announcements, the Q2 earnings release stands out: a clear rebound was shown with net income improving to US$87.4 million from last year’s loss, and revenue rising to US$583.8 million. This result supports the recent shift in earnings, though sustained recovery still depends on future loan vintage performance and market share stabilization.

However, beneath the rebound in reported earnings, investors should be aware of persistent risks in loan portfolio quality, especially as...

Read the full narrative on Credit Acceptance (it's free!)

Credit Acceptance's narrative projects $4.5 billion revenue and $504.0 million earnings by 2028. This requires 56.2% yearly revenue growth and a $79.6 million earnings increase from $424.4 million.

Uncover how Credit Acceptance's forecasts yield a $467.50 fair value, in line with its current price.

Exploring Other Perspectives

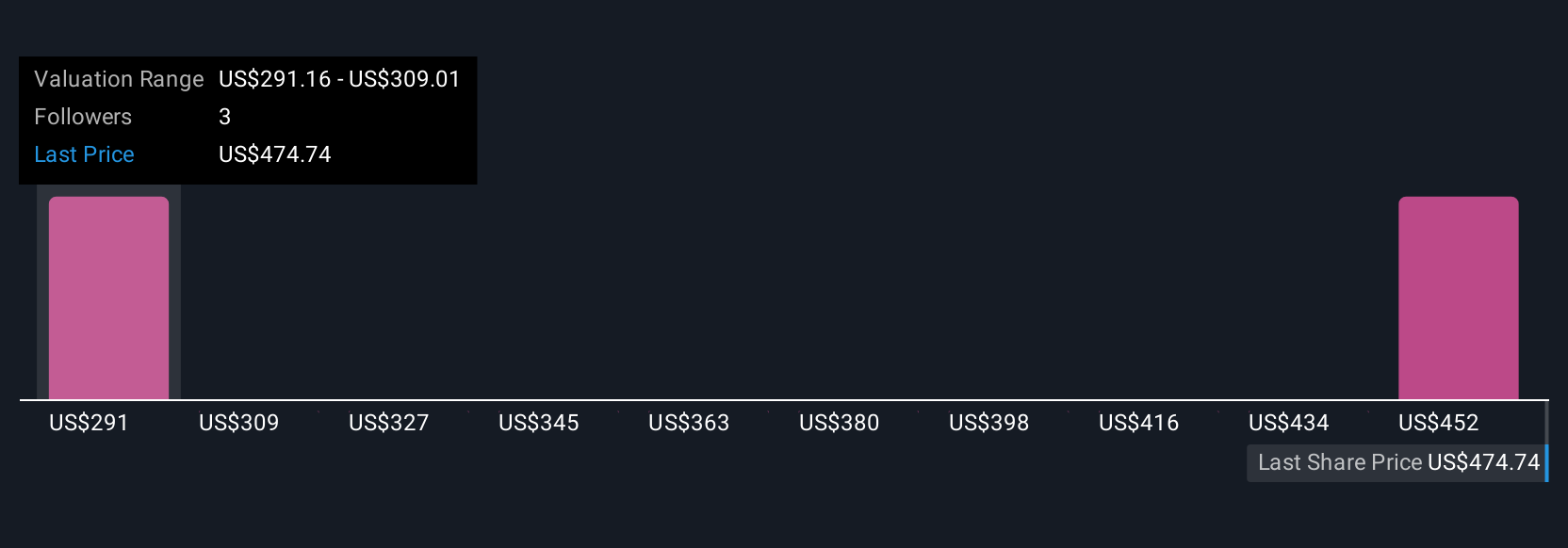

Three Simply Wall St Community fair value estimates for Credit Acceptance span from US$289.92 to US$469.67, reflecting wide-ranging opinions. With loan performance and credit risk remaining a core challenge, consider these diverse viewpoints to better understand the company's future potential.

Explore 3 other fair value estimates on Credit Acceptance - why the stock might be worth 39% less than the current price!

Build Your Own Credit Acceptance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Credit Acceptance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Credit Acceptance's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CACC

Credit Acceptance

Engages in the provision of financing programs, and related products and services in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives