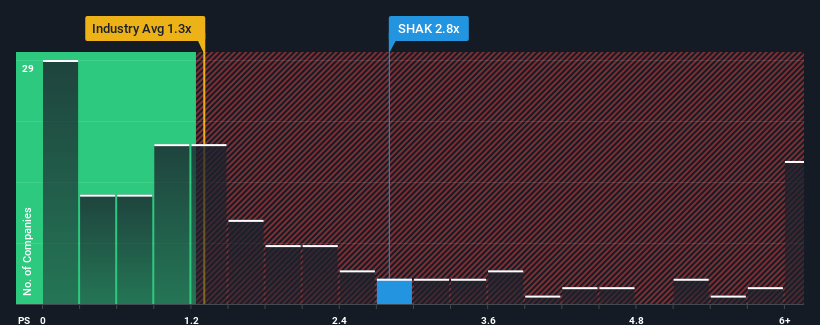

When close to half the companies in the Hospitality industry in the United States have price-to-sales ratios (or "P/S") below 1.3x, you may consider Shake Shack Inc. (NYSE:SHAK) as a stock to potentially avoid with its 2.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Shake Shack

What Does Shake Shack's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Shake Shack has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shake Shack.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Shake Shack's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The strong recent performance means it was also able to grow revenue by 101% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 14% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader industry.

With this in mind, it's not hard to understand why Shake Shack's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shake Shack's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Shake Shack shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Shake Shack with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Shake Shack, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SHAK

Shake Shack

Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives