- United States

- /

- Hospitality

- /

- NYSE:RSI

April 2025's Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

In the midst of heightened market volatility and uncertainty due to recent tariff implementations, U.S. stock indices have experienced significant fluctuations, with technology stocks leading some recovery efforts. As investors navigate these turbulent times, identifying stocks that may be undervalued presents a potential opportunity for those looking to capitalize on discrepancies between current market prices and estimated intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Heritage Financial (NasdaqGS:HFWA) | $21.34 | $42.07 | 49.3% |

| Afya (NasdaqGS:AFYA) | $16.61 | $32.74 | 49.3% |

| Washington Trust Bancorp (NasdaqGS:WASH) | $26.20 | $51.11 | 48.7% |

| Excelerate Energy (NYSE:EE) | $24.70 | $49.01 | 49.6% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.36 | $18.55 | 49.6% |

| Atlanticus Holdings (NasdaqGS:ATLC) | $46.52 | $90.52 | 48.6% |

| Advanced Flower Capital (NasdaqGM:AFCG) | $4.56 | $8.86 | 48.6% |

| National Fuel Gas (NYSE:NFG) | $73.00 | $143.14 | 49% |

| CBIZ (NYSE:CBZ) | $70.03 | $139.64 | 49.8% |

| Coeur Mining (NYSE:CDE) | $4.81 | $9.41 | 48.9% |

Here's a peek at a few of the choices from the screener.

Bank of Marin Bancorp (NasdaqCM:BMRC)

Overview: Bank of Marin Bancorp, with a market cap of $326.81 million, operates as the holding company for Bank of Marin, offering financial services to small and medium-sized businesses, not-for-profit organizations, and commercial real estate investors in the United States.

Operations: The company's revenue primarily comes from its banking segment, which generated $67.98 million.

Estimated Discount To Fair Value: 24.6%

Bank of Marin Bancorp is trading at US$20.21, significantly below its estimated fair value of US$26.82, highlighting its undervaluation based on discounted cash flow analysis. Despite a recent net loss for the year, the company reported improved quarterly earnings with net income rising to US$6 million from US$0.61 million a year ago. However, it has a low allowance for bad loans and its dividend may not be well-covered by earnings currently or in forecasts.

- Our earnings growth report unveils the potential for significant increases in Bank of Marin Bancorp's future results.

- Click here to discover the nuances of Bank of Marin Bancorp with our detailed financial health report.

MasterCraft Boat Holdings (NasdaqGM:MCFT)

Overview: MasterCraft Boat Holdings, Inc., with a market cap of $257.49 million, designs, manufactures, and markets recreational powerboats through its subsidiaries.

Operations: The company generates revenue from its segments with $42.19 million from Pontoon and $224.83 million from Mastercraft (Excl. Aviara).

Estimated Discount To Fair Value: 39.2%

MasterCraft Boat Holdings trades at US$14.71, well below its estimated fair value of US$24.20, suggesting significant undervaluation based on cash flow analysis. Despite a challenging year with reduced sales and net income, the company forecasts revenue growth above the market average and anticipates profitability within three years. Recent executive changes include Scott Kent as CFO from July 2025, ensuring continuity in financial leadership amidst strategic advancements and ongoing share buybacks enhancing shareholder value.

- According our earnings growth report, there's an indication that MasterCraft Boat Holdings might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of MasterCraft Boat Holdings.

Rush Street Interactive (NYSE:RSI)

Overview: Rush Street Interactive, Inc. is an online casino and sports betting company operating in the United States, Canada, and Latin America with a market cap of $2.40 billion.

Operations: The company generates revenue from its Casinos & Resorts segment, totaling $924.08 million.

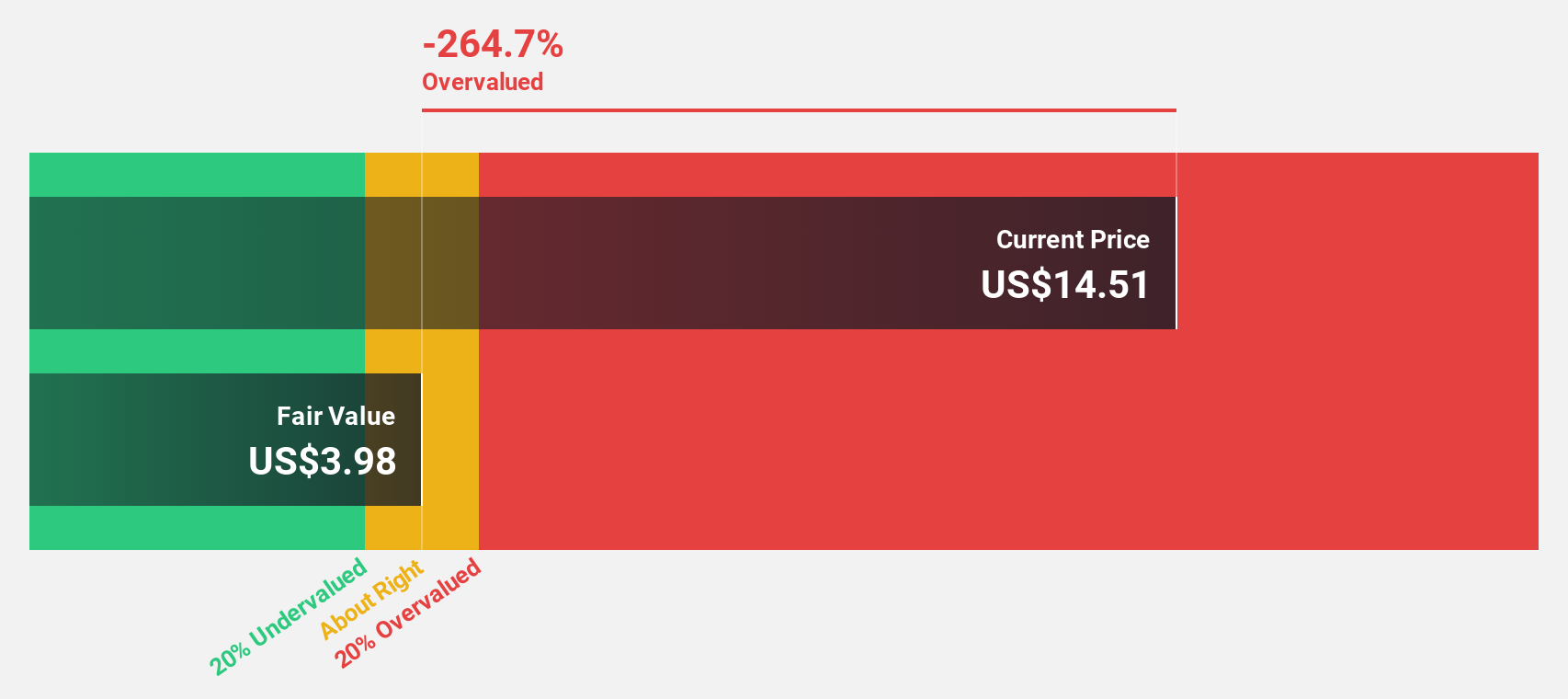

Estimated Discount To Fair Value: 29.2%

Rush Street Interactive, trading at US$10.56, is undervalued with an estimated fair value of US$14.91, reflecting over 20% discount based on cash flow analysis. The company recently turned profitable with net income of US$2.39 million for 2024 and forecasts robust earnings growth of over 90% annually for the next three years. Strategic expansions in iGaming and sports betting partnerships signal potential revenue growth above market averages despite recent board changes enhancing governance expertise.

- The growth report we've compiled suggests that Rush Street Interactive's future prospects could be on the up.

- Navigate through the intricacies of Rush Street Interactive with our comprehensive financial health report here.

Key Takeaways

- Click here to access our complete index of 160 Undervalued US Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives