- United States

- /

- Hospitality

- /

- NYSE:HGV

How Weak Consumer Sentiment Is Shaping Hilton Grand Vacations' (HGV) Resilience in Leisure Travel

Reviewed by Sasha Jovanovic

- Earlier this week, Hilton Grand Vacations was affected by a report indicating U.S. consumer confidence dropped to a five-month low amid concerns over inflation and the job market, coinciding with growing fears about a potential federal government shutdown.

- This sharp decline in consumer sentiment highlights broader anxiety among U.S. households, which could have implications for discretionary sectors like leisure travel and timeshare companies.

- We'll take a closer look at how weaker consumer confidence may shape Hilton Grand Vacations' investment narrative and future earnings potential.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Hilton Grand Vacations Investment Narrative Recap

To invest in Hilton Grand Vacations, you need to believe in the long-term strength of leisure travel and the company's ability to grow its member base, execute on integrations, and enhance customer loyalty programs. While the recent dip in U.S. consumer confidence raises concern about discretionary spending, it does not materially change the short-term catalyst around membership growth and operational efficiency, but it does place a sharper focus on the risk of rising loan delinquencies if household finances deteriorate.

The most relevant development tied to these concerns is Hilton Grand Vacations' August $400 million securitization of timeshare loans at a 96% advance rate, which strengthens liquidity at a time when credit quality and cash flow reliability are especially important. Access to cost-effective funding could help buffer against any temporary decline in tour volume or contract sales stemming from lower consumer sentiment, and provides flexibility to manage through economic uncertainty.

On the other hand, investors should be aware of the potential financial impact if higher delinquencies start to pressure the company's balance sheet in this changing environment...

Read the full narrative on Hilton Grand Vacations (it's free!)

Hilton Grand Vacations is projected to reach $6.4 billion in revenue and $785.5 million in earnings by 2028. This scenario assumes a 12.6% annual revenue growth rate and an increase in earnings of $728.5 million from the current $57.0 million.

Uncover how Hilton Grand Vacations' forecasts yield a $53.44 fair value, a 23% upside to its current price.

Exploring Other Perspectives

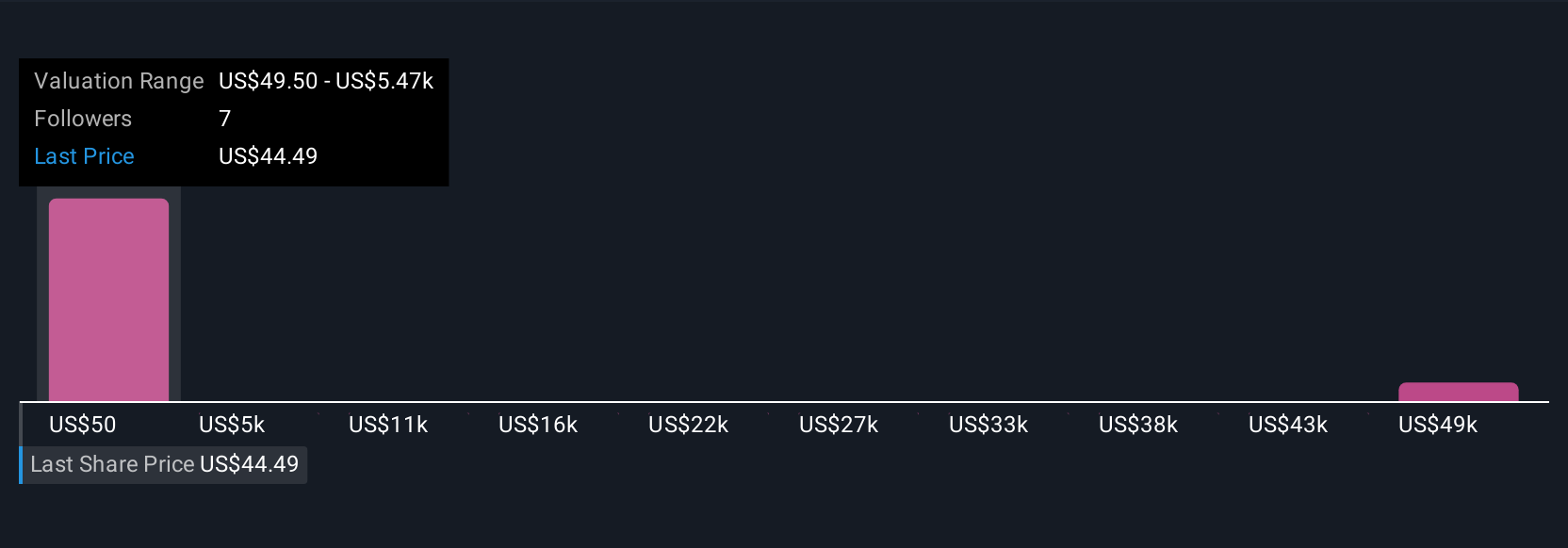

Simply Wall St Community members shared four fair value estimates for Hilton Grand Vacations, ranging sharply from US$53.44 to US$54,269.95 per share. As some point to the company's reliance on consumer loan repayment amid recent confidence swings, it's clear that opinions and risk assessments differ, explore these viewpoints for a fuller understanding of what could drive future performance.

Explore 4 other fair value estimates on Hilton Grand Vacations - why the stock might be a potential multi-bagger!

Build Your Own Hilton Grand Vacations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hilton Grand Vacations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Grand Vacations' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Grand Vacations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGV

Hilton Grand Vacations

Develops, markets, sells, manages, and operates the resorts, timeshare plans, and ancillary reservation services under the Hilton Grand Vacations brand in the United States and Europe.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives