- United States

- /

- Hospitality

- /

- NYSE:HGV

Hilton Grand Vacations (HGV): Unlocking Value After Major Equity Raise and $400M Timeshare Loan Securitization

Reviewed by Simply Wall St

Most Popular Narrative: Narrative: 12.7% Undervalued

According to community narrative, Hilton Grand Vacations is currently seen as undervalued by 12.7% compared to its consensus fair value. The valuation assumes robust growth in both revenue and earnings over the next several years, supported by aggressive efficiency and acquisition strategies.

Operational efficiency initiatives and technology enhancements, such as advanced prescreening, digital marketing, and execution-focused sales strategies, are increasing volume per guest (VPG), reducing cost per tour, and expanding real estate margins. These factors are expected to support continued net margin expansion.

What if the future of Hilton Grand Vacations is built on more than just sunny resorts? The narrative suggests a game-changing formula driving growth that could transform how this company’s future value is seen. Want to see which trends and numbers analysts believe will power this next chapter? Dig deeper into the narrative and discover the financial projections behind the current price target.

Result: Fair Value of $53.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising customer loan defaults or sluggish new member growth could threaten Hilton Grand Vacations’ earnings outlook and challenge the optimistic narrative.

Find out about the key risks to this Hilton Grand Vacations narrative.Another View

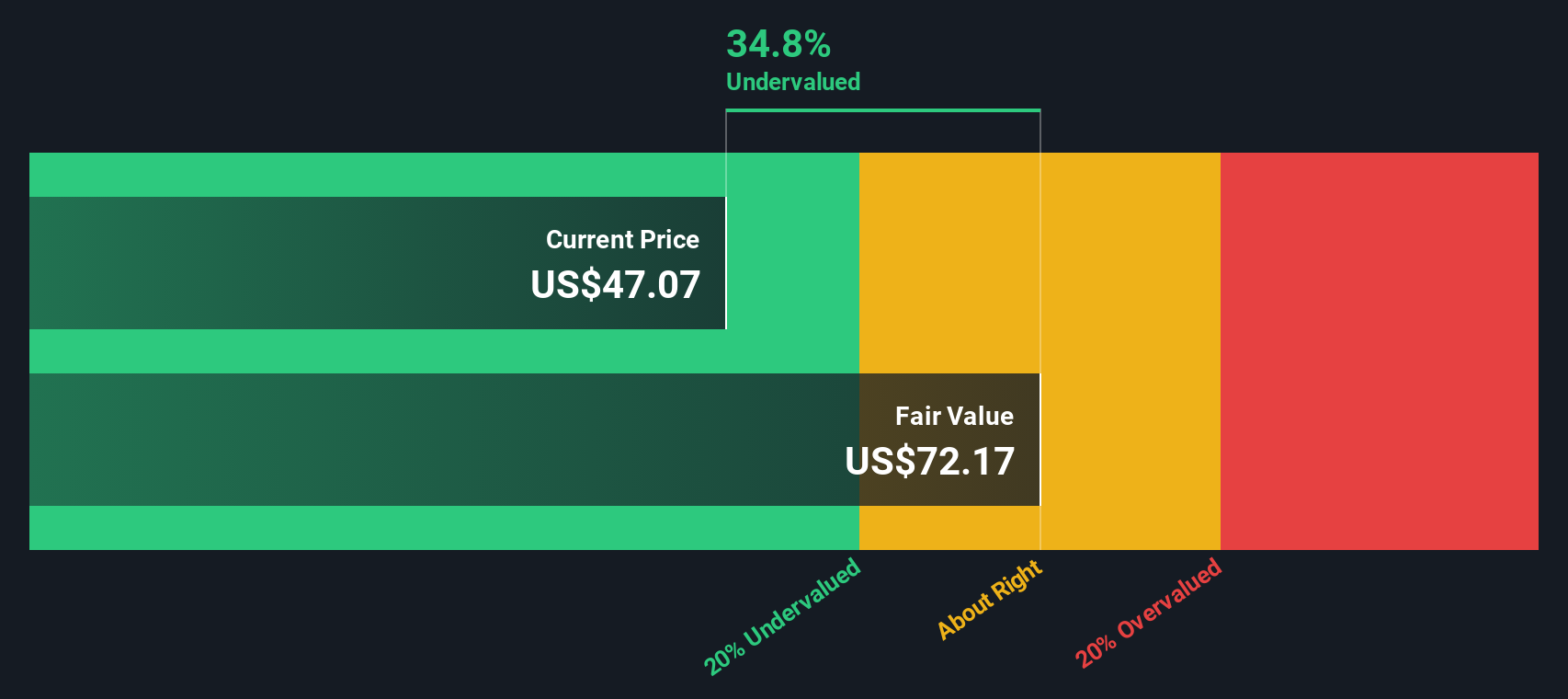

Looking from another angle, our DCF model also suggests Hilton Grand Vacations is undervalued. Although this method uses a different approach, it supports the community narrative. The key question remains: will the future deliver on these projections?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hilton Grand Vacations Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own view in just a few minutes. do it your way.

A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors do not just stop at one company. Uncover a world of powerful investing angles with these hand-picked ideas from Simply Wall Street. Don’t let great opportunities pass you by. Take charge of your next move with these standout choices:

- Start building lasting wealth with companies offering strong and consistent yields when you check out dividend stocks with yields > 3%.

- Tap into the artificial intelligence boom by scouting cutting-edge innovations through AI penny stocks.

- Target value hidden beneath the surface by seeking out stocks trading below fair value with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Grand Vacations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGV

Hilton Grand Vacations

Develops, markets, sells, manages, and operates the resorts, timeshare plans, and ancillary reservation services under the Hilton Grand Vacations brand in the United States and Europe.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives