- United States

- /

- Entertainment

- /

- NYSE:IMAX

US Growth Companies With High Insider Ownership January 2025

Reviewed by Simply Wall St

As the U.S. equities market navigates a period of mixed trading, with major indices like the S&P 500 reaching record highs amid optimism over corporate earnings and AI advancements, investors are closely monitoring growth companies that demonstrate strong insider ownership. In this environment, stocks with significant insider stakes can be particularly appealing as they often signal management's confidence in the company's future prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1% |

| Ryan Specialty Holdings (NYSE:RYAN) | 16.6% | 36.4% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 19.1% | 58.7% |

Let's review some notable picks from our screened stocks.

ChromaDex (NasdaqCM:CDXC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ChromaDex Corporation is a bioscience company that develops healthy aging products, with a market cap of approximately $453.18 million.

Operations: The company's revenue is divided into three segments: Ingredients ($16.95 million), Consumer Products ($71.72 million), and Analytical Reference Standards and Services ($3.00 million).

Insider Ownership: 30.4%

Earnings Growth Forecast: 81.8% p.a.

ChromaDex, a company with high insider ownership, has recently shown promising growth potential. It reported a net income of US$1.88 million for Q3 2024, transitioning from a loss the previous year. The company's revenue is forecasted to grow at 18.1% annually, outpacing the market average. Recent product expansions and strategic partnerships bolster its growth outlook. Insider activity indicates more buying than selling in recent months, reflecting confidence in future prospects despite share price volatility.

- Take a closer look at ChromaDex's potential here in our earnings growth report.

- Our expertly prepared valuation report ChromaDex implies its share price may be lower than expected.

Genius Sports (NYSE:GENI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genius Sports Limited develops and sells technology-driven products and services for the sports, sports betting, and sports media industries, with a market cap of approximately $2.02 billion.

Operations: The company generates revenue from its Data Processing segment, which amounts to $462.54 million.

Insider Ownership: 10.1%

Earnings Growth Forecast: 71.8% p.a.

Genius Sports, with significant insider ownership, reported a net income of US$12.51 million for Q3 2024, reversing a previous loss. Revenue grew to US$120.2 million from US$101.73 million year-on-year and is expected to grow at 15% annually, surpassing the US market average. Despite trading below fair value estimates and anticipated profitability in three years, recent equity offerings suggest strategic capital raising efforts amid low forecasted return on equity of 3.9%.

- Click to explore a detailed breakdown of our findings in Genius Sports' earnings growth report.

- In light of our recent valuation report, it seems possible that Genius Sports is trading behind its estimated value.

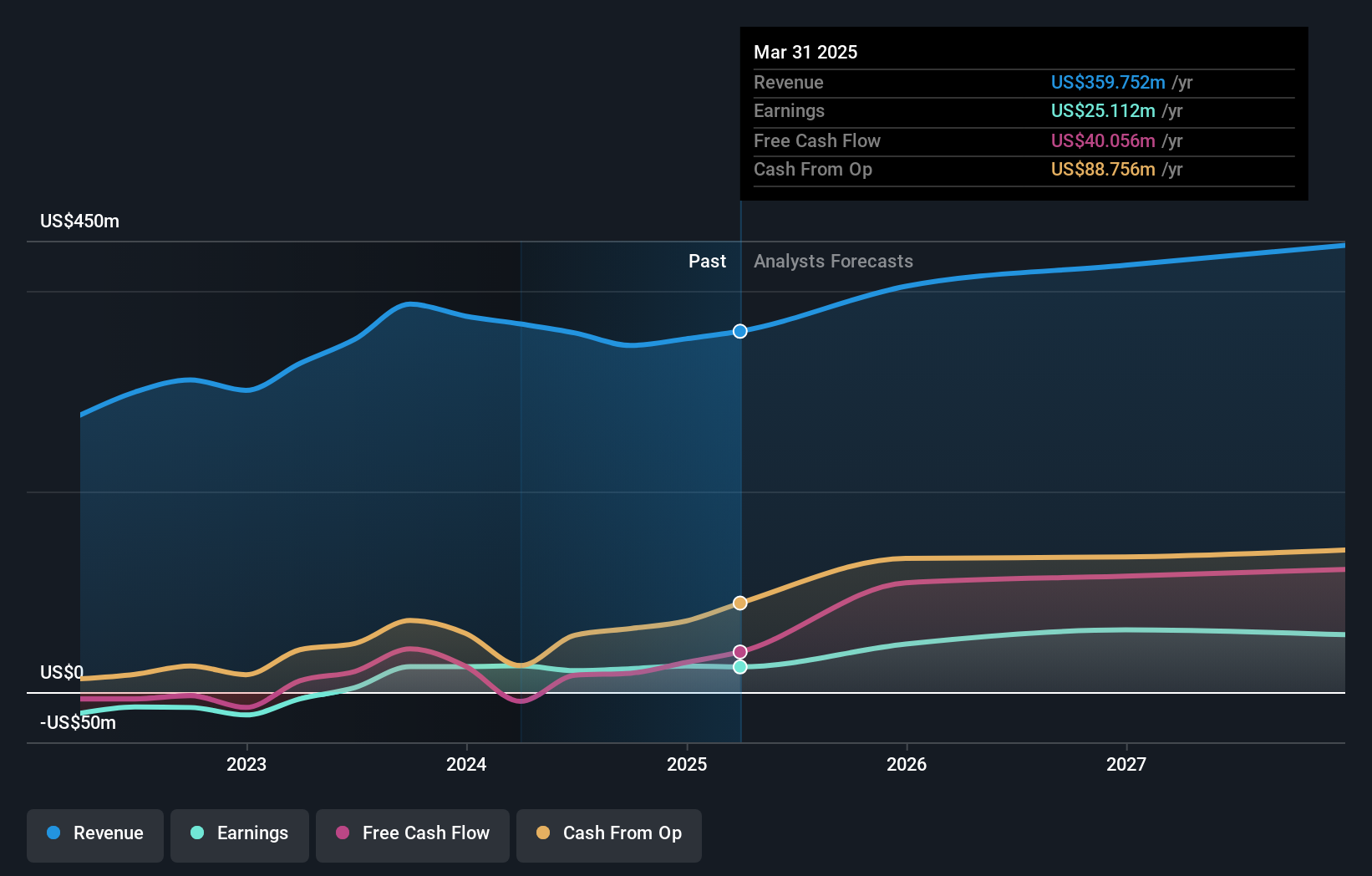

IMAX (NYSE:IMAX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IMAX Corporation, along with its subsidiaries, functions as a technology platform for entertainment and events on a global scale, with a market cap of approximately $1.24 billion.

Operations: The company's revenue is primarily derived from its Technology Products and Services segment, which accounts for $214.51 million, followed by Content Solutions at $118.31 million.

Insider Ownership: 17.8%

Earnings Growth Forecast: 22.3% p.a.

IMAX, with substantial insider ownership, is trading significantly below its estimated fair value. Despite high debt levels and a forecasted low return on equity of 19% in three years, its earnings are expected to grow at 22.3% annually, outpacing the US market average. Recent announcements include a new 3D documentary collaboration with Dolphin Entertainment and consistent earnings growth, indicating potential for future revenue increases despite current financial challenges.

- Unlock comprehensive insights into our analysis of IMAX stock in this growth report.

- Our comprehensive valuation report raises the possibility that IMAX is priced higher than what may be justified by its financials.

Summing It All Up

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 200 more companies for you to explore.Click here to unveil our expertly curated list of 203 Fast Growing US Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events worldwide.

Reasonable growth potential with adequate balance sheet.