- United States

- /

- Life Sciences

- /

- NasdaqCM:NAGE

3 US Growth Companies With High Insider Ownership Expecting Up To 119% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by cautious optimism following a benign inflation reading, investors are closely monitoring potential volatility amid ongoing economic developments and policy decisions. In this context, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the business and may offer robust earnings potential despite broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 19.7% | 70.7% |

Let's uncover some gems from our specialized screener.

ChromaDex (NasdaqCM:CDXC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ChromaDex Corporation is a bioscience company that develops healthy aging products, with a market cap of $436.34 million.

Operations: The company generates revenue through three main segments: Ingredients ($16.95 million), Consumer Products ($71.72 million), and Analytical Reference Standards and Services ($3.00 million).

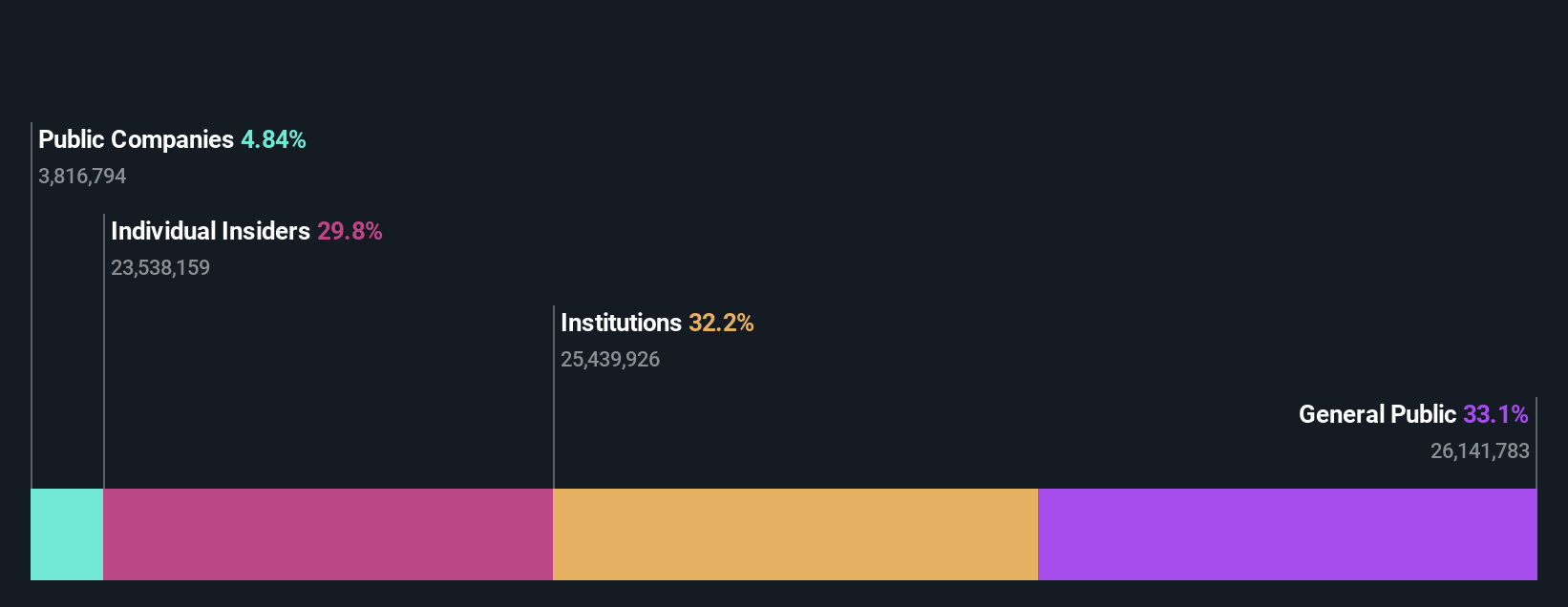

Insider Ownership: 30.5%

Earnings Growth Forecast: 81.8% p.a.

ChromaDex has demonstrated significant growth potential, with revenue forecasted to grow at 18.1% annually, surpassing the US market average. Recent developments include a nationwide rollout of Niagen IV, enhancing its product reach and contributing to its projected 15% revenue increase for 2024. The company has shown improved profitability with US$1.88 million in net income for Q3 2024 compared to a loss last year. Insider activity shows more buying than selling recently, indicating confidence in future performance.

- Get an in-depth perspective on ChromaDex's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that ChromaDex's current price could be quite moderate.

Root (NasdaqGS:ROOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Root, Inc. operates in the United States offering insurance products and services, with a market cap of approximately $1.08 billion.

Operations: The company generates revenue of $1.04 billion from offering insurance products to customers in the United States.

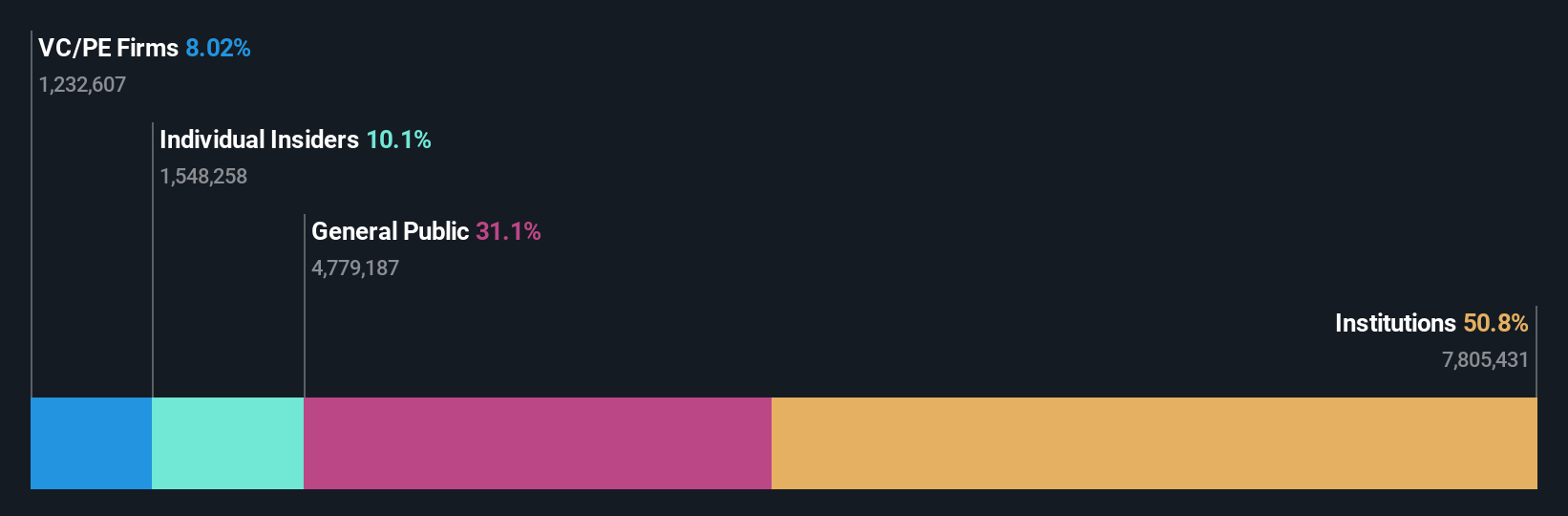

Insider Ownership: 20.4%

Earnings Growth Forecast: 119.5% p.a.

Root has expanded its insurance services to Minnesota, now covering over 77% of the U.S. population. Recent earnings show significant improvement with Q3 revenue at US$305.7 million and net income of US$21.7 million, reversing previous losses. Despite a volatile share price and insider selling, Root's refinancing deal with BlackRock reduces interest expenses by about 50%, enhancing financial flexibility for growth initiatives. However, shareholder dilution occurred in the past year amidst expected profitability within three years.

- Navigate through the intricacies of Root with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Root shares in the market.

Genius Sports (NYSE:GENI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genius Sports Limited develops and sells technology-driven products and services for the sports, sports betting, and sports media industries, with a market cap of $1.81 billion.

Operations: The company's revenue primarily comes from its Data Processing segment, which generated $462.54 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 71.6% p.a.

Genius Sports, with substantial insider ownership, is positioned for growth as it forecasts a 15% annual revenue increase, outpacing the US market. Recent Q3 results show sales of US$120.2 million and a net income turnaround to US$12.51 million from a prior loss. The company launched FANHub, leveraging its extensive sports data network. Leadership changes include appointing Robbie Bach to the board and Mark Kropf as CTO to drive technological advancement in their AI platform GeniusIQ.

- Take a closer look at Genius Sports' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Genius Sports is trading behind its estimated value.

Make It Happen

- Explore the 199 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Niagen Bioscience, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Niagen Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NAGE

Niagen Bioscience

Operates as a bioscience company engages in developing healthy aging products.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives