- United States

- /

- Hospitality

- /

- NYSE:FLUT

Does Flutter Entertainment’s FanDuel Stake Talks Signal a New Valuation Opportunity in 2025?

Reviewed by Simply Wall St

Trying to figure out what to do with Flutter Entertainment’s stock? You are not alone. This name has been on plenty of radars as it’s juggled headlines, strategic moves, and a fair bit of price action that can make even the most seasoned investors pause and scrutinize.

Let's look at the recent moves: over the past week, Flutter's stock dipped 4.8%, with a similar drop of 4.2% over the past month. When the lens is widened, things start to look a lot brighter. The stock is up 10.4% so far this year, an impressive 26.9% over the past twelve months, and boasts a three-year return of 135.2%. Even stretching back five years, Flutter has delivered a robust 76.8% rise.

What is driving this mix of modest short-term losses and strong long-term gains? Recent news sheds some light. Talks of Flutter potentially increasing its stake in FanDuel for $2B have fueled speculation about deeper US exposure. At the same time, Flutter’s forward-thinking partnership with CME Group is being noticed by analysts, with some industry watchers suggesting that competitors like DraftKings may even follow its lead. On the regulatory side, proposed tax hikes for online gaming in New Jersey caused some concern, but the company’s diversified strategy appears built to weather such headwinds.

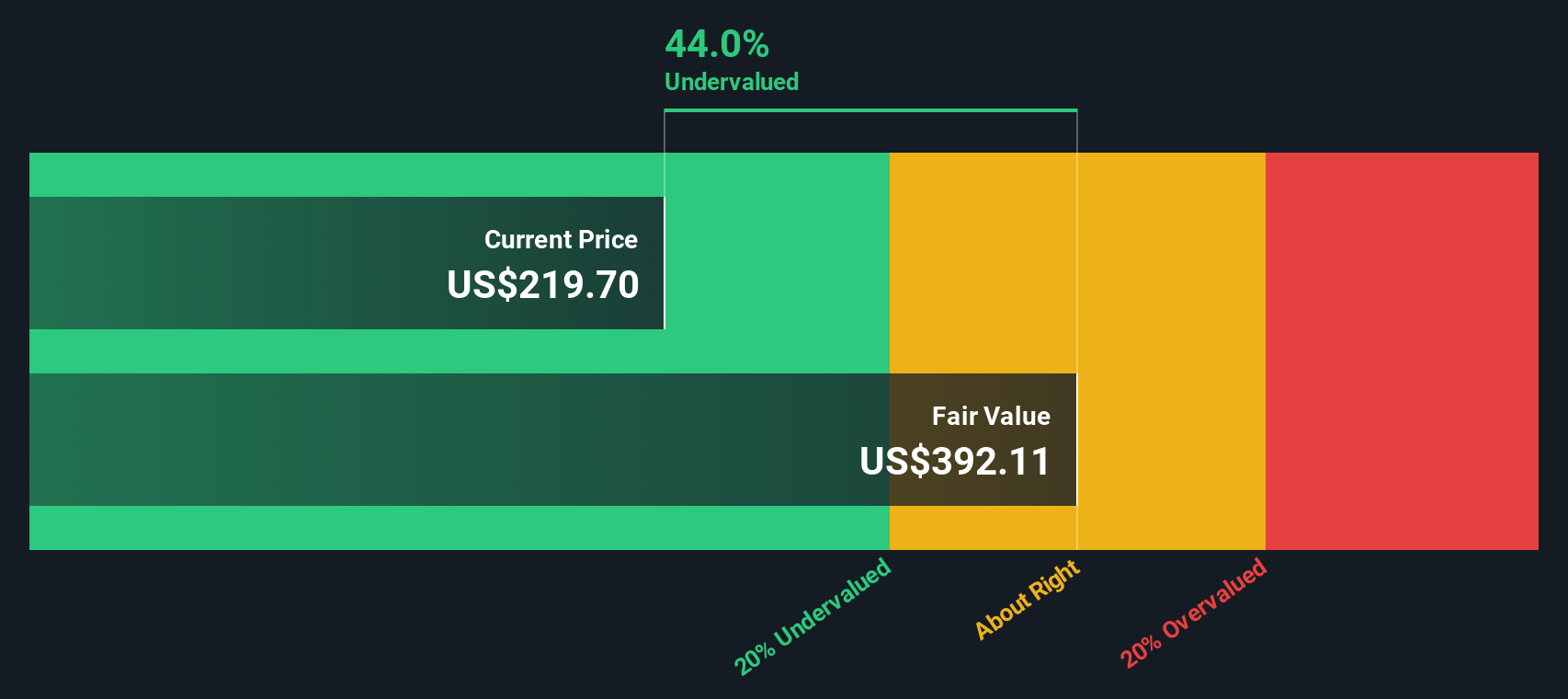

If we look at valuation, Flutter scores a 3 out of 6 on our standard value checklist. This means it’s undervalued in half of the main metrics. However, numbers never tell the whole story. Let’s break down how each approach weighs up Flutter’s valuation, and just as important, consider if there is a more insightful way to judge its true worth.

Flutter Entertainment delivered 26.9% returns over the last year. See how this stacks up to the rest of the Hospitality industry.Approach 1: Flutter Entertainment Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them to today’s value. This approach provides a sense of what the business is intrinsically worth right now based on future expectations.

For Flutter Entertainment, the analysis uses the two-stage Free Cash Flow to Equity method. The company’s current Free Cash Flow stands at $792.7 million, and projections show notable growth ahead. By 2028, analyst forecasts see annual Free Cash Flow increasing to around $3.85 billion, with further increases extrapolated out to 2035. Most of these longer-range numbers are estimates made by Simply Wall St, extending beyond the standard five-year analyst coverage.

Based on these cash flows, the DCF model calculates an intrinsic value of $475.05 per share. This result indicates the stock is roughly 40.8% undervalued compared to its current trading price. In summary, the market may not be fully factoring in Flutter’s growth prospects or the expected strength of its cash generation.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Flutter Entertainment.

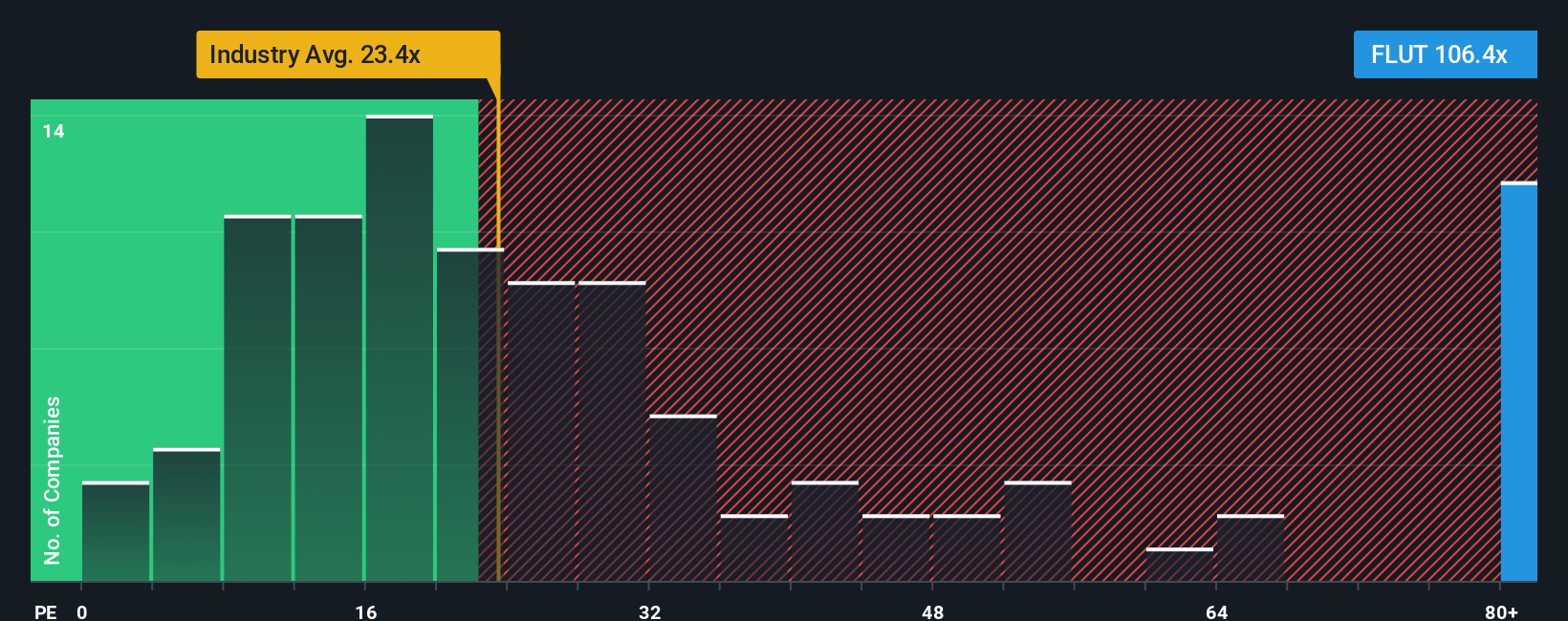

Approach 2: Flutter Entertainment Price vs Earnings

For companies like Flutter Entertainment that are consistently profitable, the Price-to-Earnings (PE) ratio is a well-established way to gauge value. This multiple tells us how much investors are willing to pay for a dollar of earnings, making it especially relevant for established businesses with positive profits.

That said, not all PE ratios are created equal. What counts as a “normal” or “fair” PE depends on how fast a company is expected to grow and what risks it faces. High-growth companies can justify higher PE ratios because their earnings are anticipated to rise. Conversely, added risks typically drag fair valuations lower.

Currently, Flutter trades at a PE of 134.96x. This is substantially higher than both the hospitality industry average of 24.05x and the peer average of 36.65x. While this might raise some eyebrows, context is key. The proprietary Simply Wall St “Fair Ratio,” a forward-looking measure that takes into account Flutter’s specific earnings growth outlook, its industry, margin profile, market cap, and unique risk factors, comes in at 50.41x. Unlike simple peer or industry averages, this Fair Ratio is tailored to the company and offers a more nuanced, apples-to-apples comparison.

Stacking up Flutter’s actual PE (134.96x) against its Fair Ratio (50.41x) suggests the stock is currently overvalued by this method. The market is pricing in far more earnings growth or stability than what is implied by these fundamentals.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Flutter Entertainment Narrative

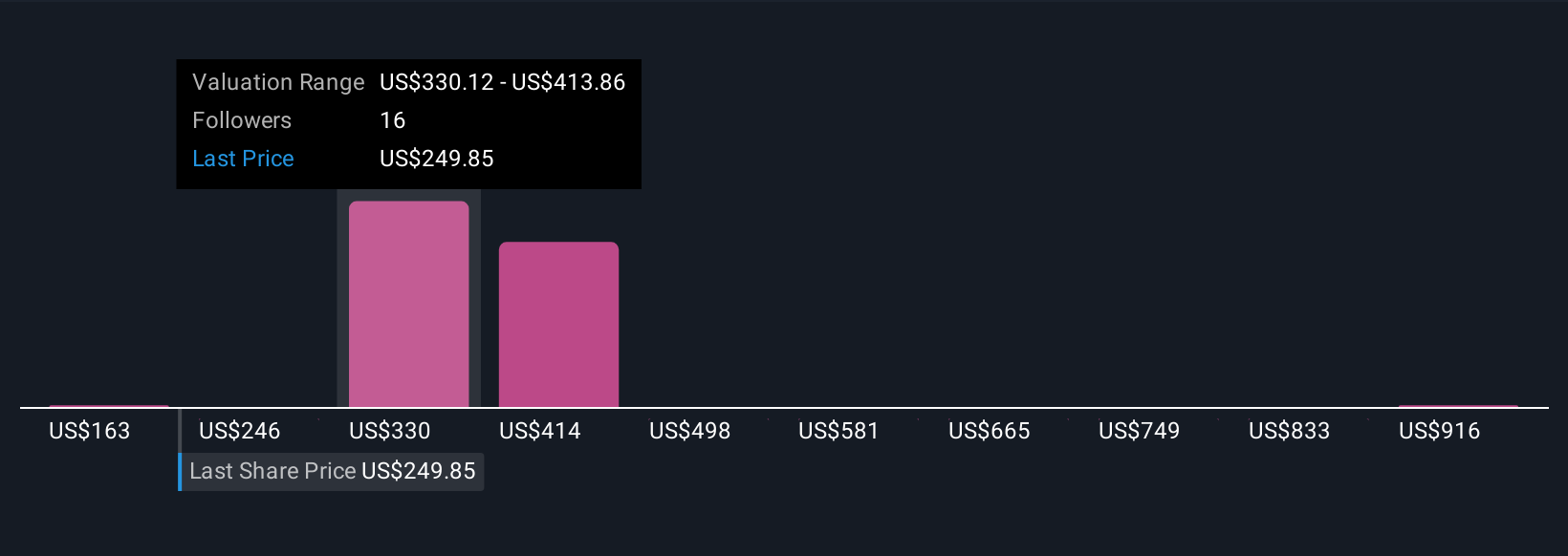

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company that connects your expectations for the business’s future, such as revenue growth, profit margins, and risk factors, to a clear financial forecast and fair value estimate.

By crafting a Narrative, you link your qualitative view of Flutter Entertainment’s opportunities, challenges, and industry developments directly to forecasted numbers. This makes your investment thesis explicit and easy to compare. Narratives are simple to create and update on Simply Wall St, right on the Community page, which is used by millions of investors worldwide.

This approach helps you decide if Flutter is a buy or sell by comparing your fair value to the current share price. Because Narratives update as new earnings or news arrives, your outlook always stays relevant. For example, one investor might tell an optimistic Narrative expecting $3.0 billion in earnings and a price target of $393, while a more cautious Narrative might forecast $1.7 billion in earnings and a price target of just $267.

Do you think there's more to the story for Flutter Entertainment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLUT

Flutter Entertainment

Operates as a sports betting and gaming company in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion