- United States

- /

- Consumer Services

- /

- NYSE:EDU

US Growth Companies With High Insider Ownership January 2025

Reviewed by Simply Wall St

As the United States stock market experiences a notable surge, with major indices like the S&P 500 and Dow Jones posting their best weekly gains in months, investors are keenly observing growth companies that demonstrate resilience and potential in this vibrant environment. In particular, firms with high insider ownership often attract attention due to the confidence insiders have in their company's future prospects, making them intriguing candidates for those looking to navigate the current market landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.6% | 34.7% |

| CarGurus (NasdaqGS:CARG) | 16.9% | 42.4% |

| RH (NYSE:RH) | 17.1% | 53.8% |

Here's a peek at a few of the choices from the screener.

Airbnb (NasdaqGS:ABNB)

Simply Wall St Growth Rating: ★★★★☆☆

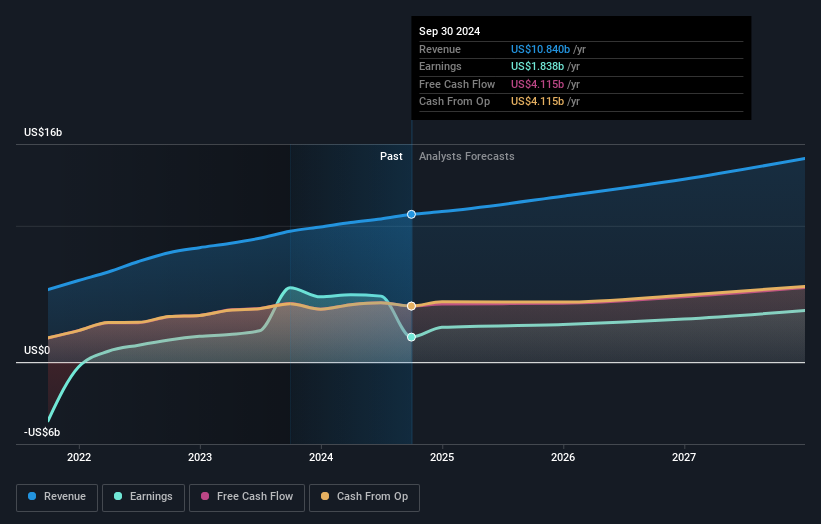

Overview: Airbnb, Inc., along with its subsidiaries, operates a global platform that allows hosts to offer accommodations and experiences to guests, with a market cap of approximately $84.42 billion.

Operations: The company generates revenue of $10.84 billion from its Internet Information Providers segment, which facilitates accommodations and experiences for guests worldwide.

Insider Ownership: 28.4%

Airbnb's recent performance highlights mixed financial results, with Q3 2024 sales rising to US$3.73 billion from US$3.40 billion year-on-year, yet net income declining significantly. Despite this, the company has engaged in substantial share buybacks totaling over US$1.84 billion, indicating confidence in its valuation, which trades at a discount to estimated fair value. Forecasts suggest Airbnb's earnings will grow faster than the broader U.S. market but with moderated revenue growth expectations and no significant insider trading activity recently reported.

- Unlock comprehensive insights into our analysis of Airbnb stock in this growth report.

- Our valuation report unveils the possibility Airbnb's shares may be trading at a premium.

New Oriental Education & Technology Group (NYSE:EDU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: New Oriental Education & Technology Group Inc. operates as a provider of private educational services in China, with a market cap of approximately $9.95 billion.

Operations: New Oriental Education & Technology Group Inc. generates revenue from its private educational services in China.

Insider Ownership: 12.2%

New Oriental Education & Technology Group's earnings grew by 40.8% last year, and future earnings are forecast to grow significantly at 21.3% annually, outpacing the broader U.S. market. The company trades well below its estimated fair value and has recently provided strong revenue guidance for Q3 2025, expecting net revenues between US$1 billion to US$1.03 billion, marking an 18%-21% increase year-on-year. Recent board changes include appointing Dr. Yue Zhuge as an independent director.

- Delve into the full analysis future growth report here for a deeper understanding of New Oriental Education & Technology Group.

- Upon reviewing our latest valuation report, New Oriental Education & Technology Group's share price might be too pessimistic.

TAL Education Group (NYSE:TAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TAL Education Group offers K-12 after-school tutoring services in China and has a market cap of approximately $5.98 billion.

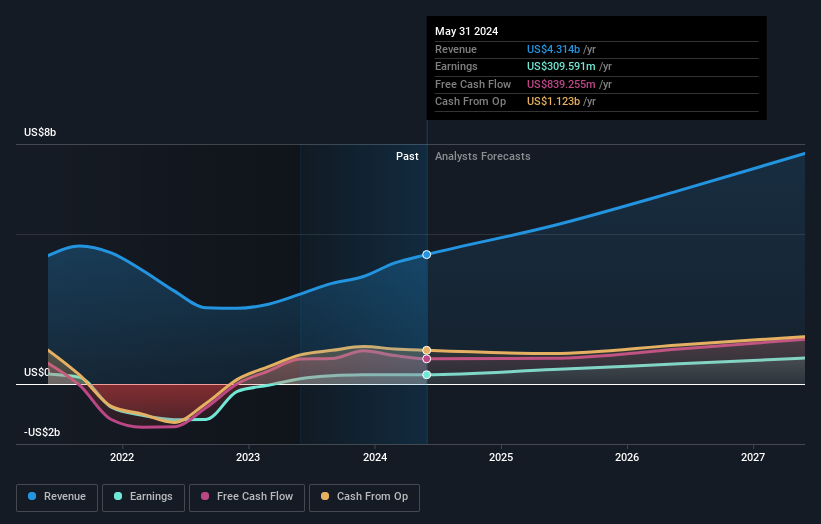

Operations: The company generates revenue from its K-12 after-school tutoring services in China, amounting to $1.84 billion.

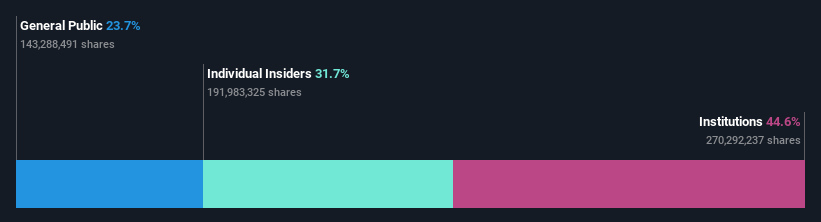

Insider Ownership: 31.7%

TAL Education Group's recent earnings report shows strong growth, with second-quarter sales reaching US$619.36 million, up from US$411.93 million a year ago, and net income rising to US$57.43 million. The company's revenue is projected to grow significantly at 21.4% annually, surpassing market expectations of 9%. Analysts anticipate a 40.4% stock price increase as it trades well below its estimated fair value despite low forecasted return on equity and no substantial insider trading activity recently.

- Click here to discover the nuances of TAL Education Group with our detailed analytical future growth report.

- Our expertly prepared valuation report TAL Education Group implies its share price may be lower than expected.

Taking Advantage

- Investigate our full lineup of 206 Fast Growing US Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if New Oriental Education & Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EDU

New Oriental Education & Technology Group

New Oriental Education & Technology Group Inc.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives