- United States

- /

- Software

- /

- NasdaqCM:PGY

3 US Growth Stocks With High Insider Ownership And 15% Revenue Growth

Reviewed by Simply Wall St

In the current landscape, U.S. stock markets have shown a mixed performance with the S&P 500 and Nasdaq Composite experiencing gains, while the Dow Jones Industrial Average has faced consecutive declines. As investors navigate these fluctuating conditions, growth companies with high insider ownership and robust revenue growth can present compelling opportunities due to their potential alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.3% | 102.3% |

| Coastal Financial (NasdaqGS:CCB) | 18.4% | 40.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's take a closer look at a couple of our picks from the screened companies.

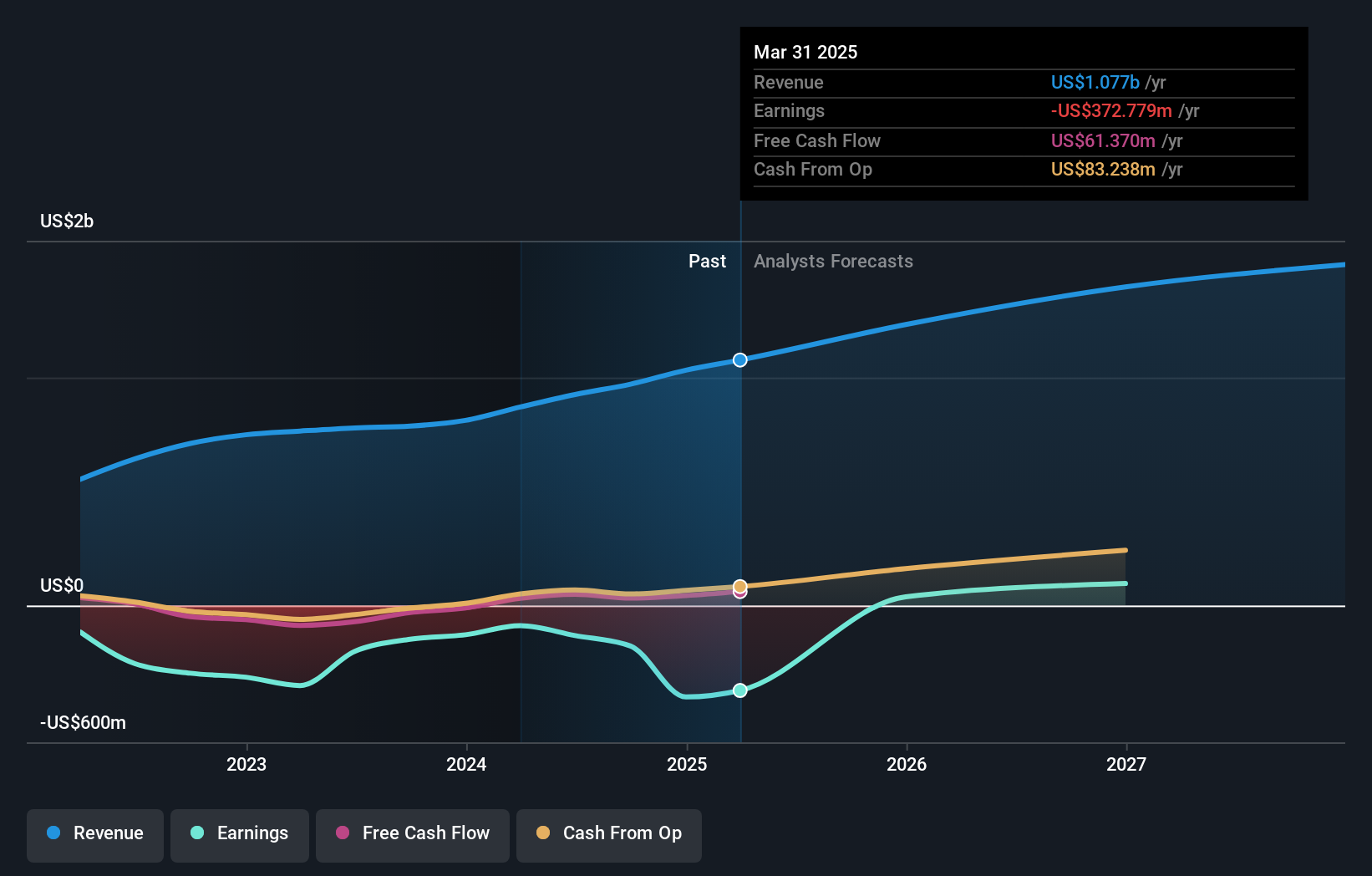

Pagaya Technologies (NasdaqCM:PGY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and AI-powered technology to serve financial institutions and investors globally, with a market cap of approximately $787.10 million.

Operations: Pagaya Technologies generates revenue from its Software & Programming segment, which amounts to approximately $925.42 million.

Insider Ownership: 19.8%

Revenue Growth Forecast: 15.3% p.a.

Pagaya Technologies is navigating a transformative phase with strategic executive appointments, including Josh Fagen as COO of Finance, enhancing investor relations. Despite recent insider selling and shareholder dilution, the company trades significantly below its estimated fair value. Revenue growth is projected at 15.3% annually, outpacing the US market average but remaining volatile. Pagaya's partnership with Castlelake expands funding capacity by up to US$1 billion in consumer loans, bolstering its AI-driven lending technology platform.

- Navigate through the intricacies of Pagaya Technologies with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Pagaya Technologies' share price might be on the cheaper side.

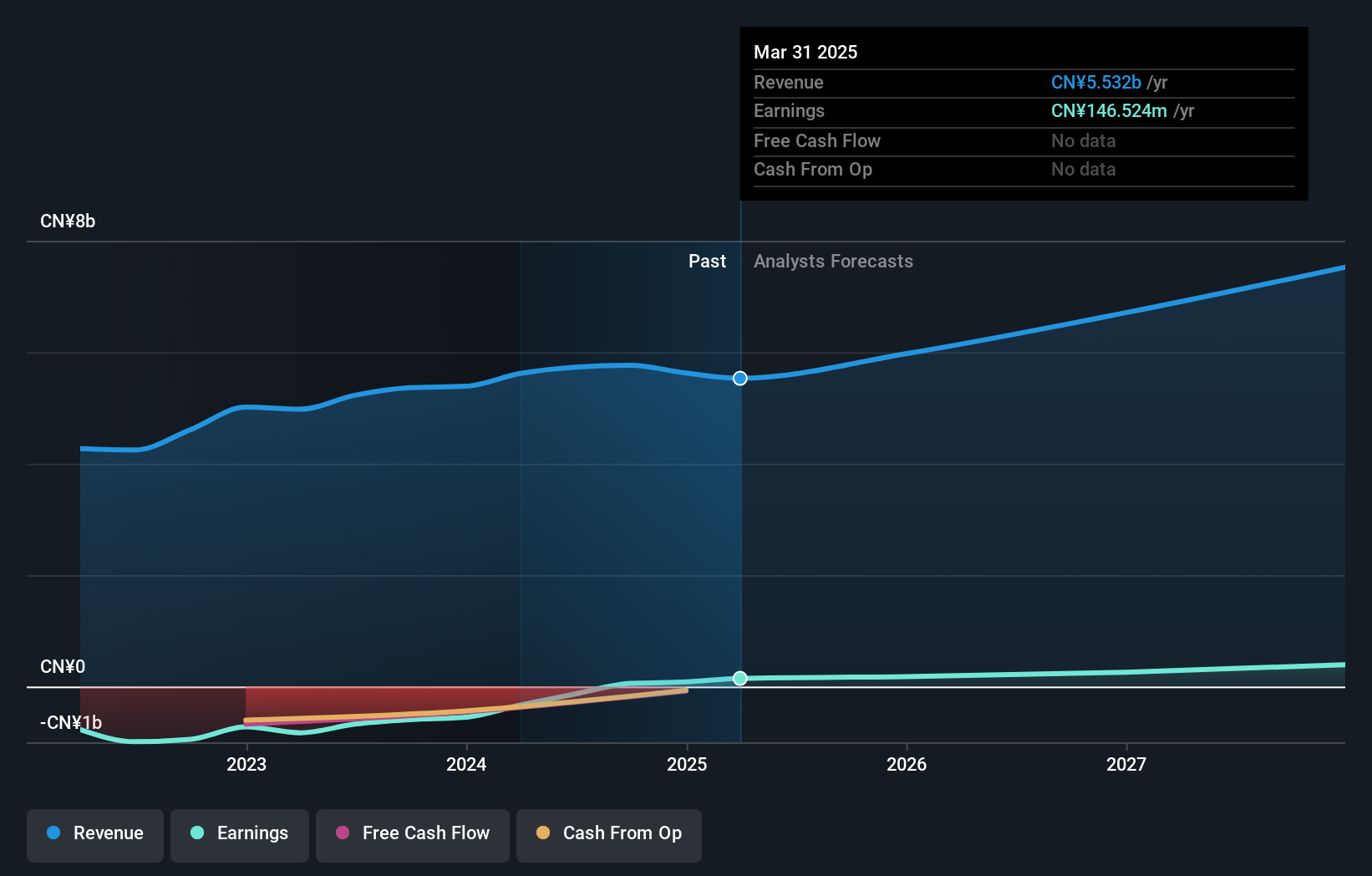

Youdao (NYSE:DAO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Youdao, Inc. is an internet technology company offering online services in content, community, communication, and commerce sectors in China with a market cap of approximately $592.81 million.

Operations: The company's revenue segments comprise CN¥822.21 million from Smart Devices, CN¥3.10 billion from Learning Services, and CN¥1.81 billion from Online Marketing Services.

Insider Ownership: 20.3%

Revenue Growth Forecast: 12.4% p.a.

Youdao is experiencing a significant phase of growth, with revenue projected to increase by 12.4% annually, outpacing the US market average. Despite recent volatility and its removal from the S&P Global BMI Index, Youdao's financials show improvement; net losses have narrowed significantly year-over-year. The company completed a substantial share buyback program totaling $33.8 million, enhancing shareholder value while trading at good relative value compared to peers and industry standards.

- Get an in-depth perspective on Youdao's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Youdao's share price might be too pessimistic.

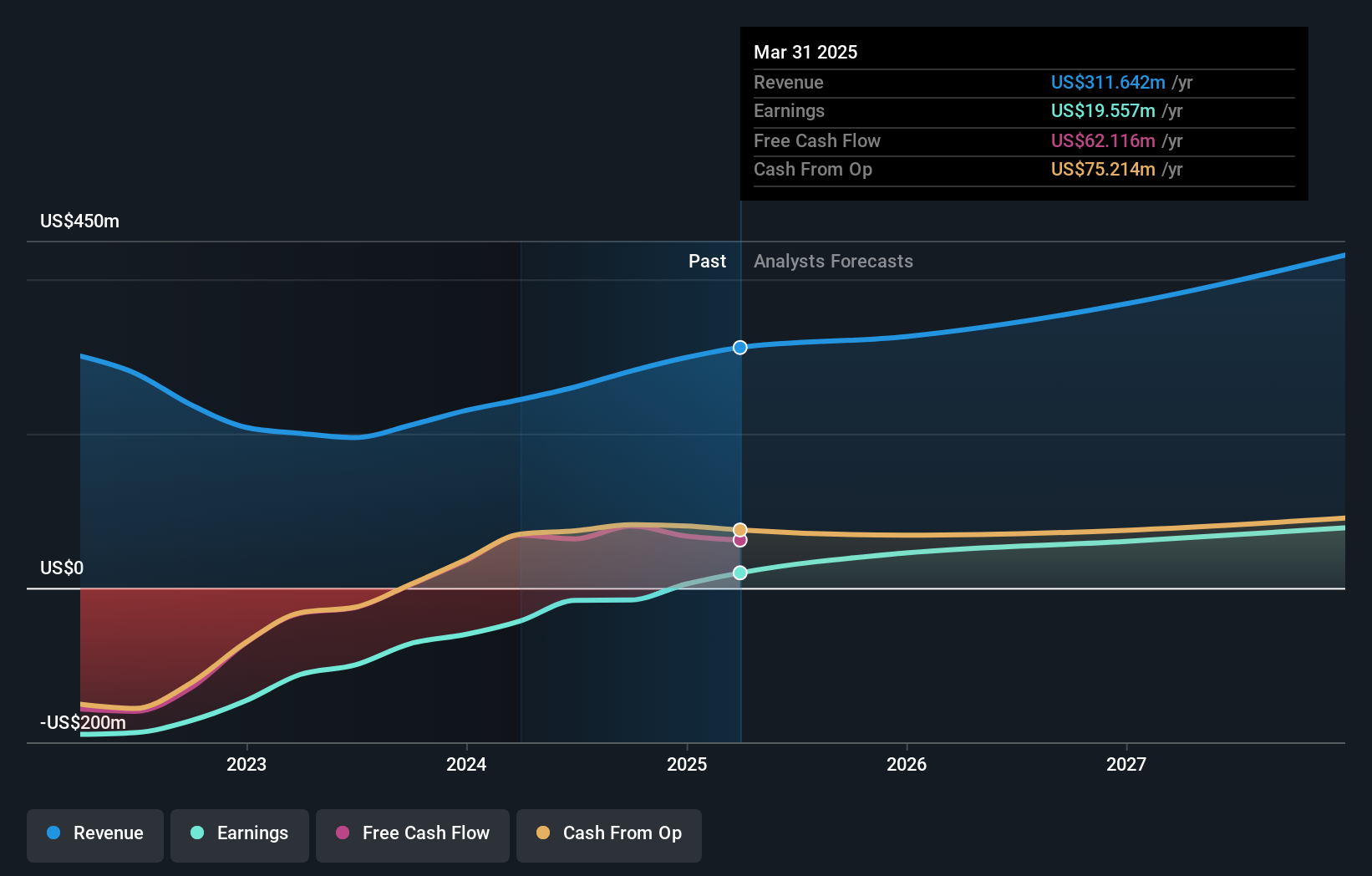

Tuya (NYSE:TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tuya Inc. provides a specialized Internet of Things (IoT) cloud development platform both in China and internationally, with a market cap of approximately $884.58 million.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, which generated $260.44 million.

Insider Ownership: 36%

Revenue Growth Forecast: 15.2% p.a.

Tuya's growth trajectory is marked by a forecasted 15.2% annual revenue increase, surpassing the US market average. Despite its recent removal from the FTSE All-World Index, Tuya has shown financial improvement with Q2 sales rising to US$73.28 million and achieving net income of US$3.13 million compared to a loss previously. The company also announced a special dividend and experienced leadership changes, enhancing its strategic direction under co-founder Alex Yang as CFO.

- Unlock comprehensive insights into our analysis of Tuya stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Tuya shares in the market.

Key Takeaways

- Click through to start exploring the rest of the 181 Fast Growing US Companies With High Insider Ownership now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

Undervalued with high growth potential.

Market Insights

Community Narratives