- United States

- /

- Hospitality

- /

- NYSE:CAVA

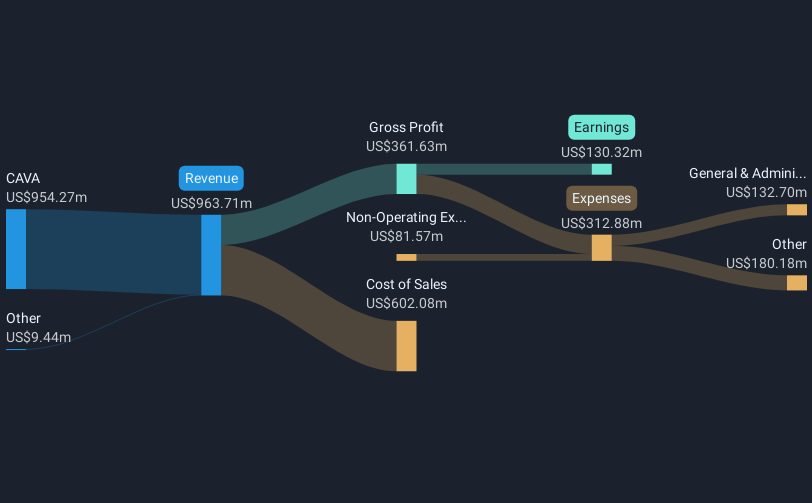

CAVA Group (NYSE:CAVA) Reports Strong Q1 Earnings with Nearly US$26 Million Net Income

Reviewed by Simply Wall St

CAVA Group (NYSE:CAVA) reported a 12% increase in its share price over the last month, as the broader market also witnessed positive momentum. The company's robust first-quarter earnings report, showing a significant rise in sales and net income, likely contributed to its stock ascent, while maintaining strong annual guidance provided additional support. Meanwhile, the introduction of new products, like the Hot Harissa Pita Chips, paired with creative marketing efforts, may have added to investor enthusiasm. Despite positive news for CAVA, broader market gains and easing trade tensions between the U.S. and China contributed to the overall upward market trend.

Find companies with promising cash flow potential yet trading below their fair value.

The recent introduction of new products like the Hot Harissa Pita Chips has likely played a role in influencing investor sentiment, supporting the recent 12% share price increase over the last month. Over a longer period, CAVA Group's total return, including dividends, was 28.12% over the last year. This performance contrasts with the broader market's 11.2% return and the U.S. Hospitality industry's 12% return over the same period, highlighting CAVA's strong market presence and positive investor outlook.

Expansion plans into new geographic markets, such as Detroit and South Florida, are part of the company's growth strategy, which may drive revenue growth. However, these initiatives can add pressure to profit margins due to potential increased costs and brand recognition challenges. In the context of its revenue and earnings forecasts, revenue is expected to grow by 16.7% annually, while earnings are forecasted to increase by 5.9% annually. This steady growth trajectory may support future earnings but could be impacted if expansion costs are not offset by higher sales volumes.

Currently, CAVA's share price is trading at US$93.32, which is at a 19.3% discount to the analyst consensus price target of US$115.66. This indicates potential for upward movement if the company successfully navigates its expansion plans and technological advancements. The company's ability to maintain stronger-than-industry returns will be crucial in justifying its higher valuation ratios compared to its peers. These factors will be essential in assessing CAVA's ability to achieve the projected price targets.

Learn about CAVA Group's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CAVA Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives