- United States

- /

- Hospitality

- /

- NYSE:LUCK

Undervalued Small Caps With Insider Activity In United States October 2024

Reviewed by Simply Wall St

The United States market has remained flat over the last week but has experienced a robust 34% increase over the past year, with earnings projected to grow by 15% annually. In such an environment, identifying stocks that are potentially undervalued and exhibit insider activity can be crucial for investors seeking opportunities in the small-cap sector.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 22.2x | 1.0x | 40.21% | ★★★★★☆ |

| Scholastic | 32.9x | 0.5x | 49.83% | ★★★★☆☆ |

| Citizens & Northern | 12.2x | 2.7x | 46.46% | ★★★★☆☆ |

| Franklin Financial Services | 9.7x | 1.9x | 39.31% | ★★★★☆☆ |

| German American Bancorp | 13.5x | 4.5x | 48.47% | ★★★☆☆☆ |

| MYR Group | 34.9x | 0.5x | 41.39% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -64.17% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -215.14% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -234.62% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

HighPeak Energy (NasdaqGM:HPK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: HighPeak Energy is engaged in the development, exploration, and production of oil and natural gas with a market capitalization of approximately $1.76 billion.

Operations: The primary revenue stream for the company comes from oil and natural gas development, exploration, and production, generating $1.21 billion in the latest period. The gross profit margin shows a trend of fluctuation but remains relatively high at 83.10% in the most recent quarter. Operating expenses are significant, with depreciation and amortization being a major component within these costs.

PE: 12.2x

HighPeak Energy, a small company in the U.S. energy sector, recently reported Q2 2024 revenue of US$275.27 million, up from US$240.76 million the prior year, though net income dipped slightly to US$29.72 million from US$31.83 million. They paid out dividends totaling US$5 million and repurchased 978,989 shares for $14.55 million by June 30, 2024, signaling insider confidence despite lower profit margins and interest coverage challenges. Production guidance was raised to an average of 45-49k Boe/d for 2024, indicating potential growth amid financial hurdles.

- Delve into the full analysis valuation report here for a deeper understanding of HighPeak Energy.

Assess HighPeak Energy's past performance with our detailed historical performance reports.

MYR Group (NasdaqGS:MYRG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MYR Group is a company that specializes in providing electrical construction services, focusing on commercial and industrial projects as well as transmission and distribution operations, with a market capitalization of $2.95 billion.

Operations: C&I and T&D contribute significantly to revenue, with recent figures showing $1.50 billion and $2.09 billion respectively. The gross profit margin has shown fluctuations, most recently at 10.04% as of June 2024. Operating expenses are primarily driven by general and administrative costs, which reached $242 million in the latest period analyzed.

PE: 34.9x

MYR Group, a smaller player in the U.S. market, has been navigating challenges with its reliance on external borrowing for funding. Despite a drop in profit margins from 2.6% to 1.4%, there's optimism with earnings projected to grow by 52.68% annually. Recently, they repurchased 117,422 shares for US$16.26 million between May and June 2024, signaling insider confidence in future prospects despite reporting a net loss of US$15.28 million for Q2 2024 compared to last year's net income of US$22.27 million.

- Click here and access our complete valuation analysis report to understand the dynamics of MYR Group.

Understand MYR Group's track record by examining our Past report.

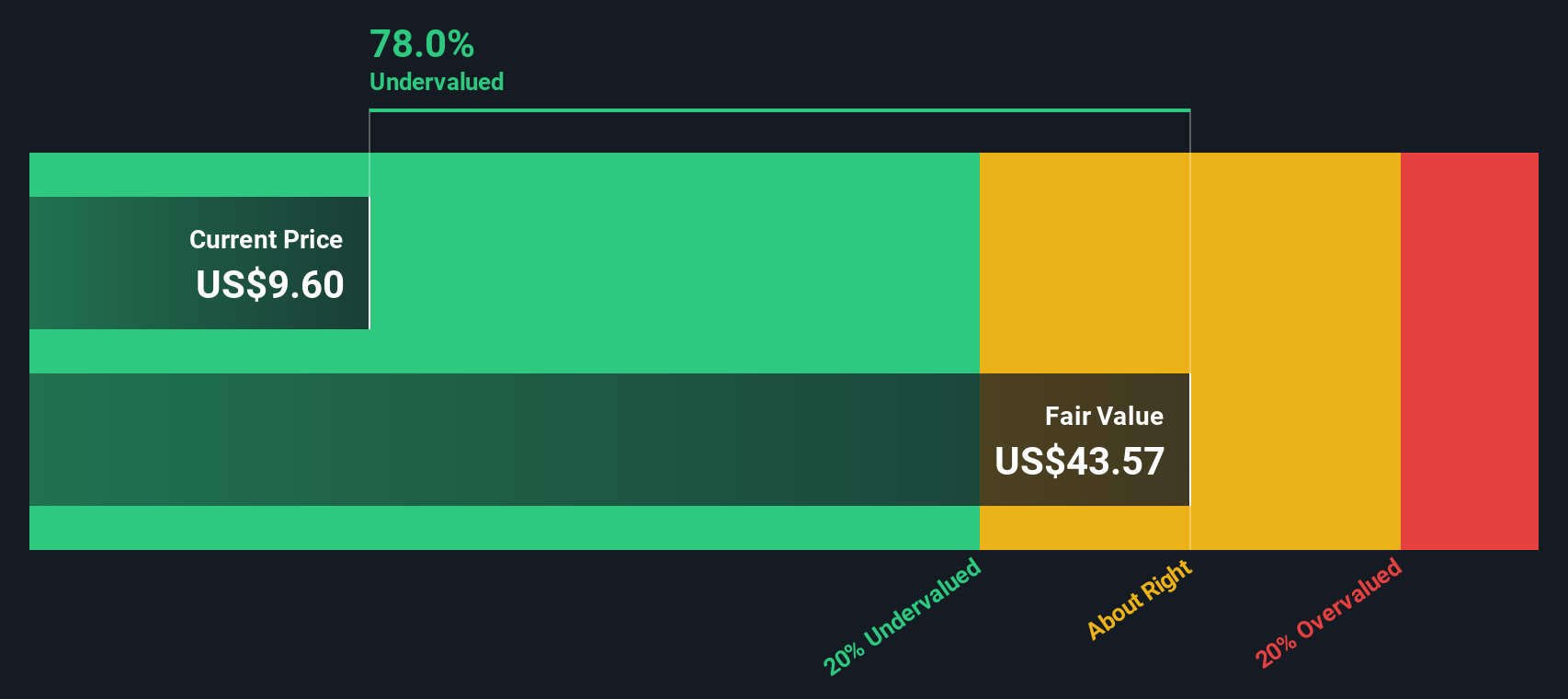

Bowlero (NYSE:BOWL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bowlero operates as a leading bowling entertainment company with a market cap of approximately $2.17 billion.

Operations: The company's primary revenue stream is from its Bowling Entertainment Business, generating $1.15 billion in the most recent period. The cost of goods sold (COGS) for this period was $840.44 million, resulting in a gross profit margin of 27.21%. Operating expenses were recorded at $161.66 million, with general and administrative expenses being a significant component at $155.20 million.

PE: -18.4x

Bowlero, a player in the bowling entertainment sector, presents an intriguing opportunity among smaller U.S. companies. Despite reporting a net loss of US$83.58 million for the fiscal year ending June 2024, sales rose to US$1.15 billion from US$1.06 billion previously. The company repurchased over 3 million shares between April and June 2024 for US$34.9 million, indicating strategic confidence in its future prospects as it anticipates revenue growth up to 10% in fiscal 2025.

- Take a closer look at Bowlero's potential here in our valuation report.

Gain insights into Bowlero's historical performance by reviewing our past performance report.

Seize The Opportunity

- Explore the 55 names from our Undervalued US Small Caps With Insider Buying screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUCK

Lucky Strike Entertainment

Provides location-based entertainment platforms under the AMF, Bowlero, Lucky X Strike, Boomers, and PBA brand names in North America.

Good value with moderate growth potential.

Market Insights

Community Narratives