- United States

- /

- Banks

- /

- NYSE:CBAN

Undiscovered Gems in the US Stock Market for December 2024

Reviewed by Simply Wall St

The United States stock market has been relatively flat over the last week but has experienced a significant 32% increase over the past year, with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying undiscovered gems involves seeking companies that demonstrate strong growth potential and are well-positioned to capitalize on future opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Target Hospitality (NasdaqCM:TH)

Simply Wall St Value Rating: ★★★★★★

Overview: Target Hospitality Corp. is a North American company that specializes in providing rental and hospitality services, with a market capitalization of approximately $800.43 million.

Operations: Target Hospitality generates revenue primarily from its Government segment, contributing $268.45 million, and the Hospitality & Facilities Services - South segment, which adds $149.42 million.

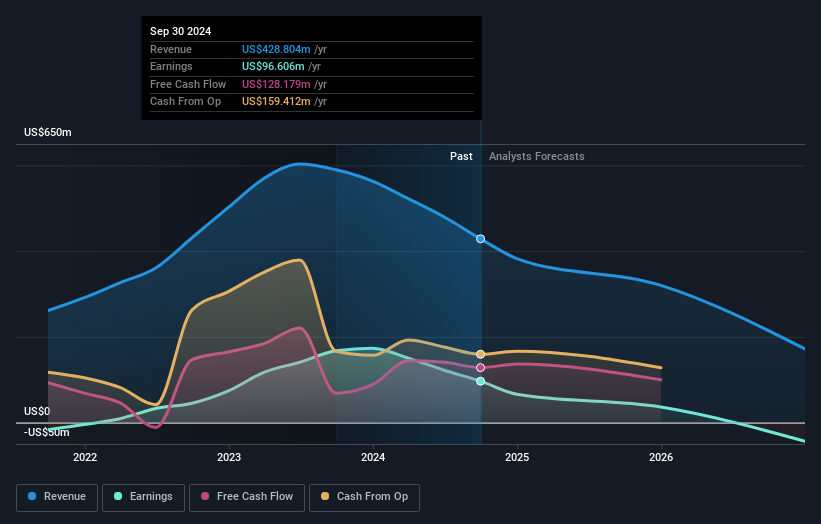

Target Hospitality, a dynamic player in the specialty rental and hospitality services sector, presents a mixed picture with its recent performance and strategic moves. The company's debt to equity ratio has impressively decreased from 279.4% to 43% over five years, reflecting prudent financial management. Despite trading at 63% below estimated fair value, Target faces challenges such as negative earnings growth of -42%, contrasting sharply with the industry average of 14%. Recent contract extensions like the Pecos Children's Center boost revenue visibility with US$168 million annually but political uncertainties remain a concern for sustained growth prospects.

Colony Bankcorp (NYSE:CBAN)

Simply Wall St Value Rating: ★★★★★★

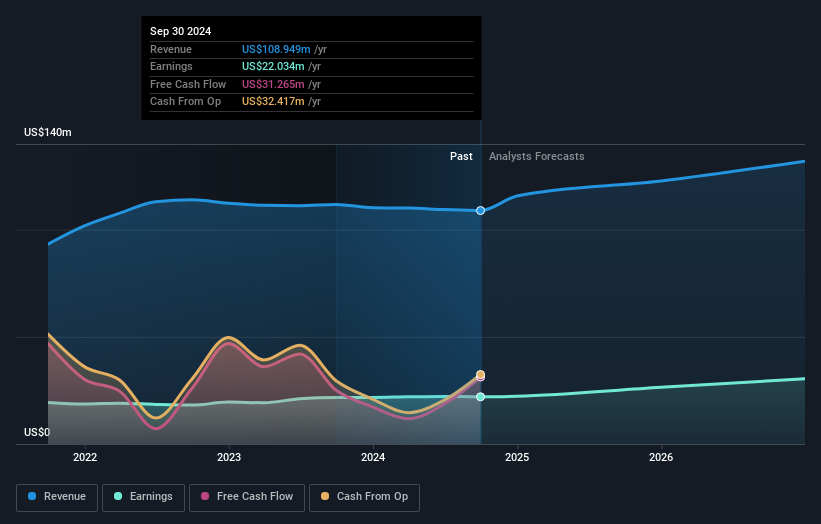

Overview: Colony Bankcorp, Inc. is the bank holding company for Colony Bank, offering a range of banking products and services to both commercial and consumer customers, with a market capitalization of approximately $310.75 million.

Operations: Colony Bankcorp generates revenue primarily from its Banking Division, contributing $89.93 million, followed by the Small Business Specialty Lending Division at $13.20 million and the Mortgage Banking Division at $5.82 million.

Colony Bankcorp, with assets totaling $3.1 billion and equity of $276.1 million, is navigating its path in the banking sector by emphasizing digital transformation and operational efficiency. The bank's deposits stand at $2.5 billion, while loans amount to $1.9 billion, supported by a robust allowance for bad loans at 0.6% of total loans and primarily low-risk funding sources comprising 91% customer deposits. Recently, Colony made strategic moves such as repurchasing 35,000 shares for $0.53 million and appointing Cissy Giglio to enhance process optimization efforts—steps likely aimed at bolstering profitability amidst rising interest expenses and credit risks.

Oil-Dri Corporation of America (NYSE:ODC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Oil-Dri Corporation of America, along with its subsidiaries, specializes in the development, manufacturing, and marketing of sorbent products both domestically and internationally, with a market capitalization of $510.29 million.

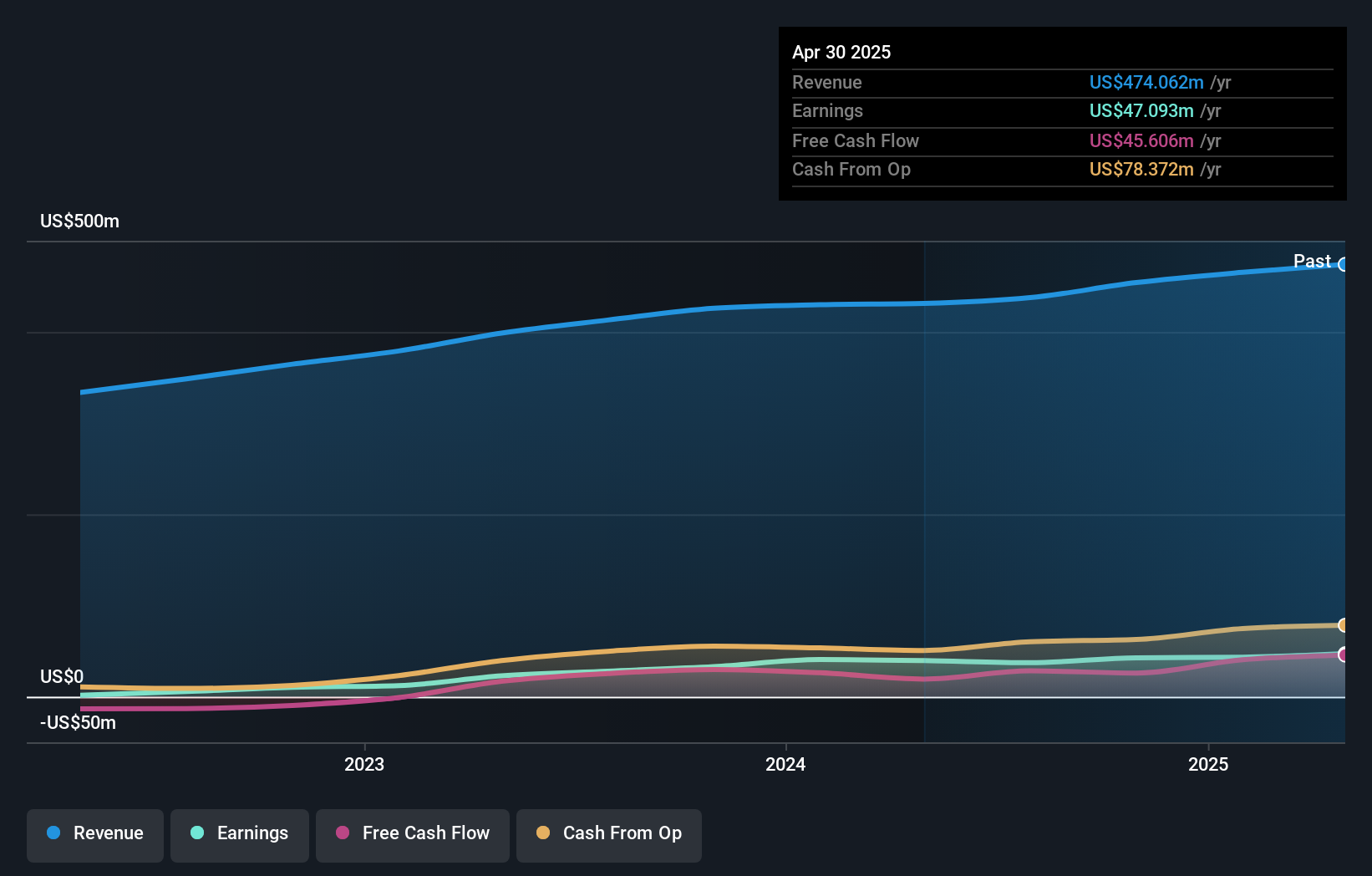

Operations: Oil-Dri generates revenue through its Business to Business Products segment, contributing $150.47 million, and its Retail and Wholesale Products segment, which brings in $287.12 million. The company's net profit margin is a key financial metric to consider when analyzing its overall profitability.

Oil-Dri Corporation of America, a notable player in the household products sector, showcases robust earnings with a 32.9% growth over the past year, outpacing industry averages. The company’s net debt to equity ratio stands at a satisfactory 13%, and its interest payments are comfortably covered by EBIT at 55.5 times. Despite significant insider selling recently, Oil-Dri has been trading at about 70% below estimated fair value. Recent financials reveal full-year sales of US$437.59 million and net income of US$39.43 million, alongside plans for a two-for-one stock split and increased credit facilities up to US$75 million.

- Click here and access our complete health analysis report to understand the dynamics of Oil-Dri Corporation of America.

Learn about Oil-Dri Corporation of America's historical performance.

Make It Happen

- Investigate our full lineup of 229 US Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBAN

Colony Bankcorp

Operates as the bank holding company for Colony Bank that provides various banking products and services to commercial and consumer customers.

Flawless balance sheet and good value.