- United States

- /

- IT

- /

- NYSE:SHOP

Exploring Three High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

The market remained flat over the last week, but over the past 12 months, it has risen by 26%, with earnings forecasted to grow by 15% annually. In this environment, identifying high growth tech stocks that can capitalize on these trends is crucial for investors seeking to align with robust growth opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

CyberArk Software (NasdaqGS:CYBR)

Simply Wall St Growth Rating: ★★★★☆☆

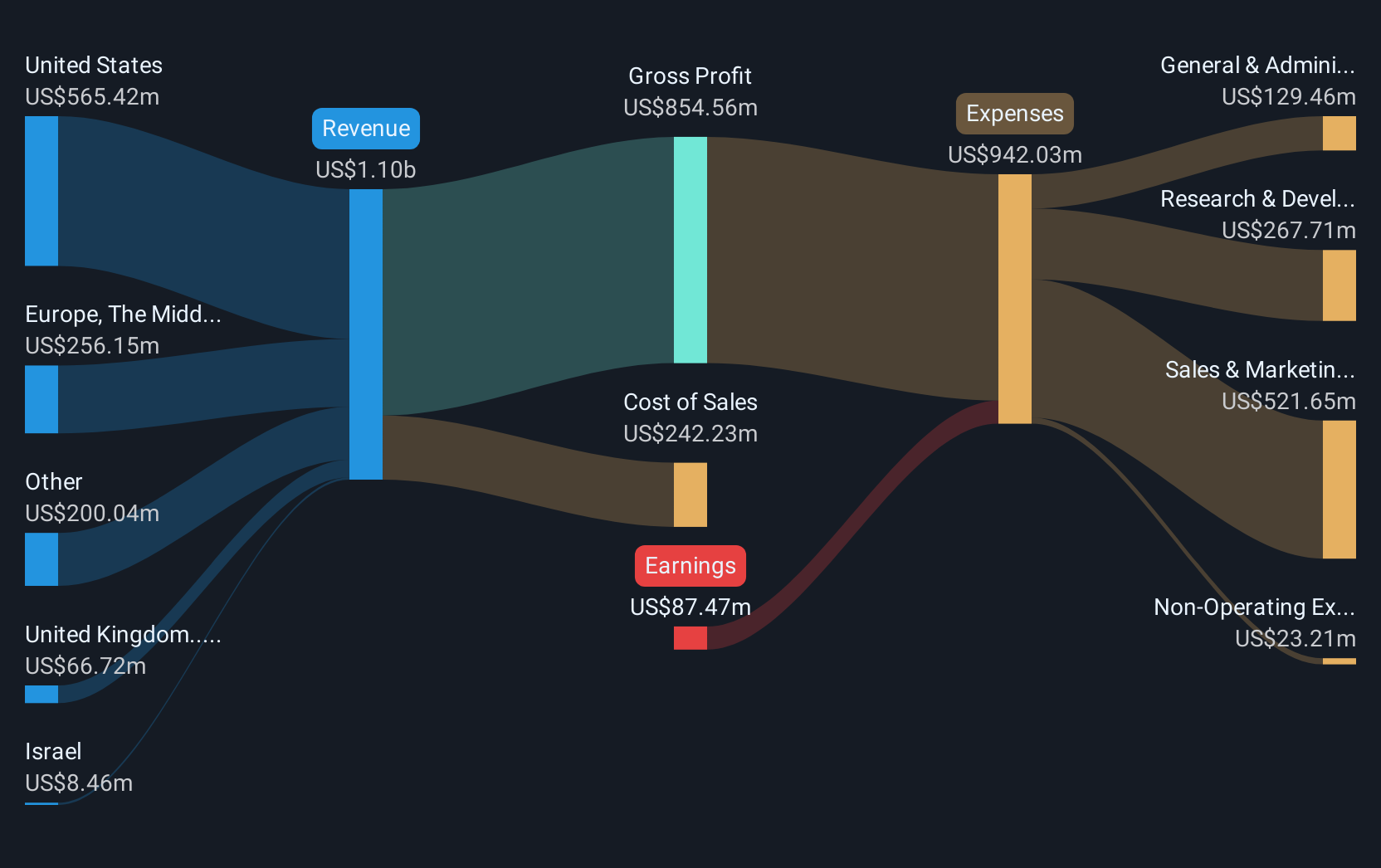

Overview: CyberArk Software Ltd. is a company that develops, markets, and sells software-based identity security solutions and services globally, with a market cap of approximately $14.79 billion.

Operations: CyberArk generates revenue primarily through its security software and services segment, which accounted for $909.46 million. The company's business model focuses on providing identity security solutions to a global market, including regions such as the United States, Europe, the Middle East, and Africa.

CyberArk Software, a leader in identity security solutions, has demonstrated robust financial and strategic growth through innovative offerings and key partnerships. Recently, the company launched FuzzyAI, an open-source framework designed to enhance AI model security, which was well-received at Black Hat Europe 2024. This innovation aligns with CyberArk's commitment to addressing emerging cyber threats in AI-driven environments. Financially, CyberArk has shown impressive performance with a third-quarter revenue of $240.1 million, up from $191.24 million year-over-year and a swing to net income of $11.11 million from a net loss previously. Additionally, the company's strategic partnership with Wiz underscores its proactive approach in cloud security, enhancing multi-cloud environments' safety without compromising development pace. These initiatives not only reflect CyberArk's agile response to market needs but also position it strongly for sustained growth in the cybersecurity domain.

Atlassian (NasdaqGS:TEAM)

Simply Wall St Growth Rating: ★★★★★☆

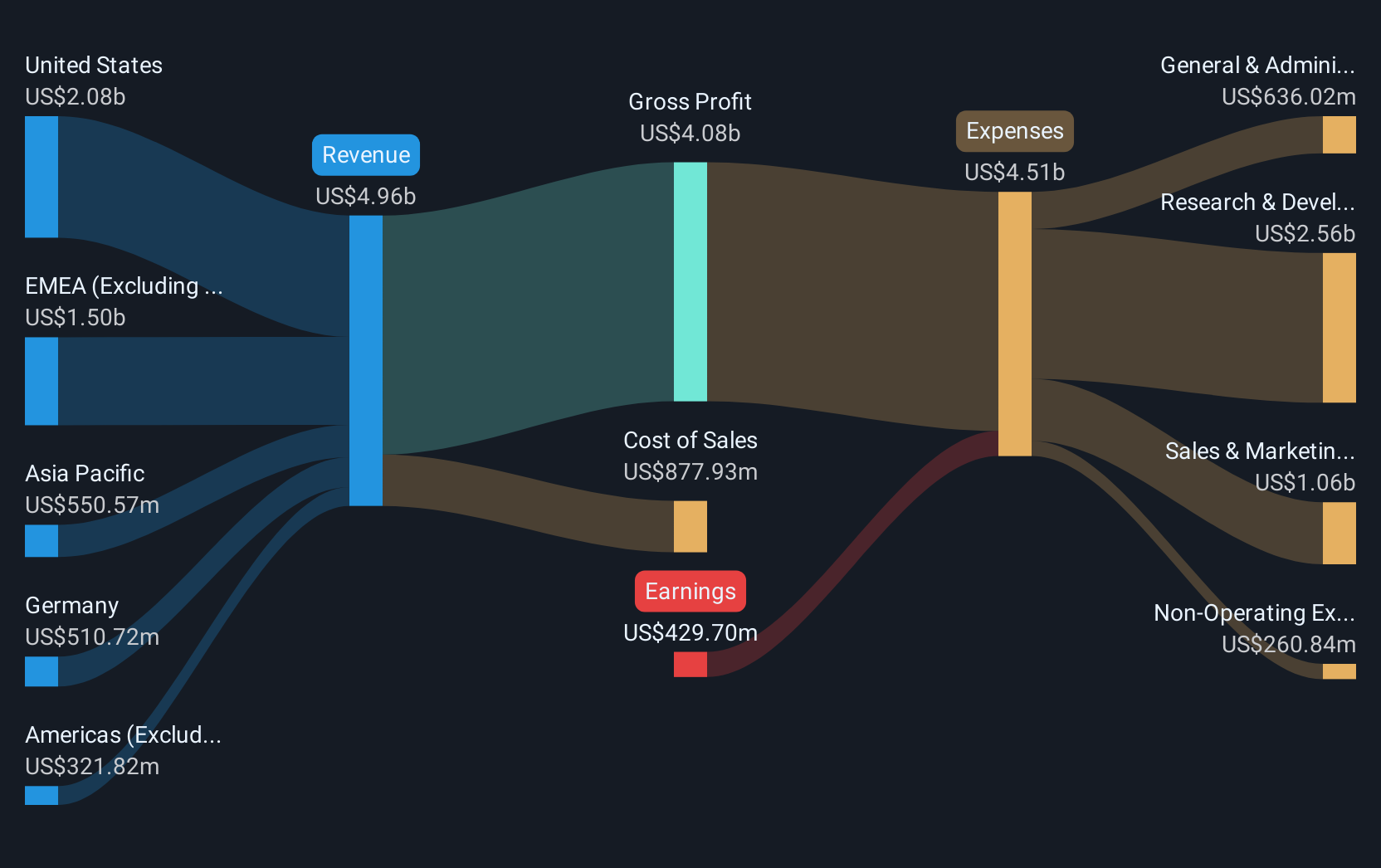

Overview: Atlassian Corporation, with a market cap of $65.18 billion, designs, develops, licenses, and maintains various software products worldwide through its subsidiaries.

Operations: The company generates revenue primarily from its software and programming segment, which amounts to $4.57 billion.

Atlassian's strategic maneuvers, including a significant board reshuffle and a multi-year collaboration with AWS, underscore its proactive stance in enhancing cloud capabilities and AI integration. The recent appointment of Christian Smith to the Board, following his pivotal role in transitioning Splunk to a SaaS model, aligns with Atlassian's cloud-first strategy. This move is complemented by an expansive agreement with AWS aimed at accelerating enterprise migration to Atlassian Cloud, which already contributes over $1 billion annually. This partnership not only promises to halve migration times but also equips providers with essential skills for deploying Atlassian’s AI-enhanced cloud services. Moreover, the company has actively repurchased shares worth $732.37 million since early 2023, reflecting confidence in its financial trajectory amidst an expected annual revenue growth of 16.5% to 17%. These developments collectively fortify Atlassian’s position within the high-growth tech landscape while promising substantial advancements in cloud and AI domains for its diverse global clientele.

- Click here and access our complete health analysis report to understand the dynamics of Atlassian.

Understand Atlassian's track record by examining our Past report.

Shopify (NYSE:SHOP)

Simply Wall St Growth Rating: ★★★★☆☆

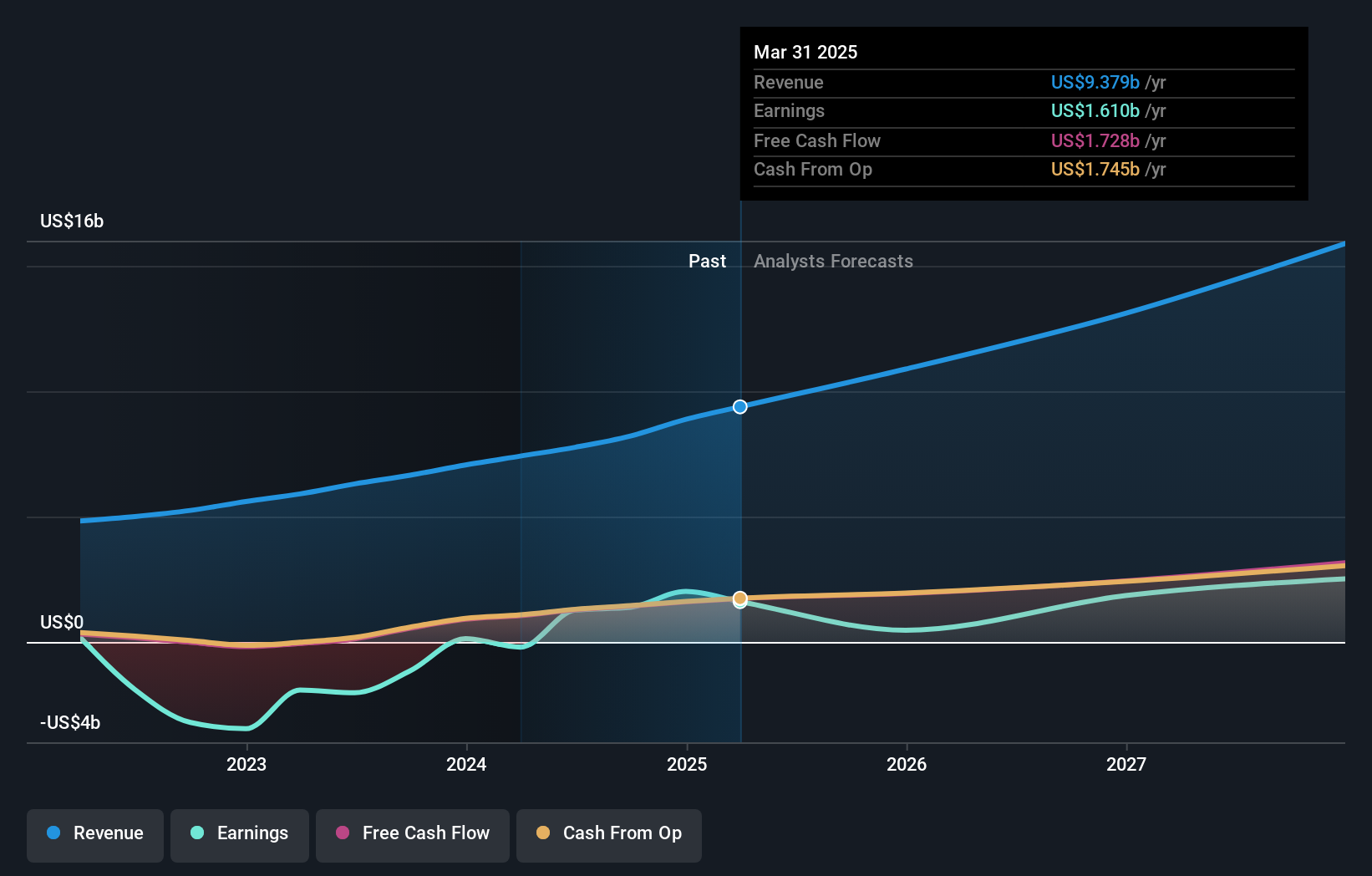

Overview: Shopify Inc. is a commerce company that offers a comprehensive platform and services across various regions including Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, Australia, China, and Latin America with a market capitalization of $141.16 billion.

Operations: Shopify generates revenue primarily from its Internet Software & Services segment, amounting to $8.21 billion. The company operates across multiple regions, providing a robust commerce platform that supports businesses in various markets globally.

Shopify, a key enabler in the e-commerce sector, has demonstrated robust financial health with third-quarter sales reaching $1.55 billion, up from $1.23 billion year-over-year. This growth is underpinned by strategic client expansions like Daily Harvest's migration to Shopify’s platform, enhancing their operational efficiency and customer reach. Furthermore, the company's commitment to innovation is evident from its R&D expenses which have strategically fueled advancements in its commerce infrastructure, ensuring it remains at the forefront of technology trends while supporting scalable business solutions for clients globally. With an upcoming revenue forecast projecting mid-to-high twenties percentage growth and a solid earnings trajectory marked by an 18% annual increase, Shopify is poised to maintain its momentum amidst evolving digital commerce demands.

- Get an in-depth perspective on Shopify's performance by reading our health report here.

Assess Shopify's past performance with our detailed historical performance reports.

Next Steps

- Discover the full array of 234 US High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHOP

Shopify

A commerce company, provides a commerce platform and services in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, Australia, China, and Latin America.

Excellent balance sheet with reasonable growth potential.