- United States

- /

- Software

- /

- NasdaqGS:TEAM

3 US Stocks Including Celsius Holdings That Might Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As major U.S. stock indexes prepare to open higher, buoyed by a surge in chip stocks and renewed optimism in the tech sector, investors are closely watching for opportunities amid fluctuating market conditions. In this environment, identifying undervalued stocks can be crucial for those looking to capitalize on potential growth, as these equities may offer value that is not yet reflected in their current prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.27 | $53.03 | 48.6% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $30.89 | $61.61 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | $39.06 | $77.34 | 49.5% |

| Camden National (NasdaqGS:CAC) | $42.08 | $83.90 | 49.8% |

| Ally Financial (NYSE:ALLY) | $35.85 | $71.62 | 49.9% |

| Kanzhun (NasdaqGS:BZ) | $13.95 | $27.36 | 49% |

| Constellium (NYSE:CSTM) | $10.52 | $20.92 | 49.7% |

| Mr. Cooper Group (NasdaqCM:COOP) | $95.39 | $187.71 | 49.2% |

| Progress Software (NasdaqGS:PRGS) | $65.26 | $128.87 | 49.4% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.59 | $30.75 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

Celsius Holdings (NasdaqCM:CELH)

Overview: Celsius Holdings, Inc. is engaged in the development, processing, marketing, distribution, and sale of functional energy drinks and liquid supplements across various international markets with a market cap of $6.77 billion.

Operations: The company's revenue primarily comes from its non-alcoholic beverages segment, totaling $1.37 billion.

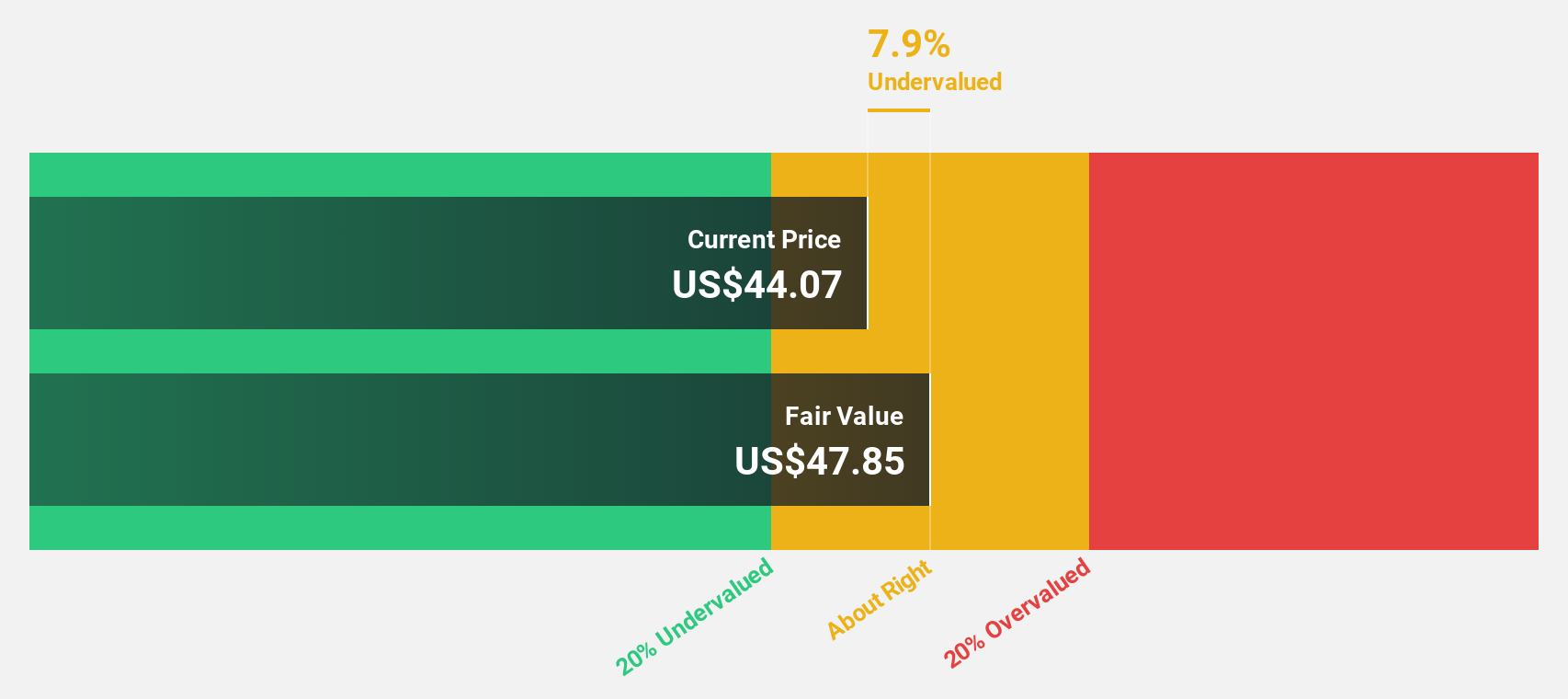

Estimated Discount To Fair Value: 35.2%

Celsius Holdings is trading at US$28.8, significantly below its estimated fair value of US$44.45, suggesting it may be undervalued based on cash flows. Despite a 49% earnings growth last year and projected revenue growth outpacing the U.S. market, recent legal challenges allege misleading sales practices with PepsiCo, potentially impacting future financial performance. The stock's current valuation reflects these concerns amidst ongoing litigation and insider selling activities in recent months.

- Our earnings growth report unveils the potential for significant increases in Celsius Holdings' future results.

- Click here to discover the nuances of Celsius Holdings with our detailed financial health report.

Atlassian (NasdaqGS:TEAM)

Overview: Atlassian Corporation, with a market cap of approximately $65.18 billion, designs, develops, licenses, and maintains various software products worldwide through its subsidiaries.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating $4.57 billion.

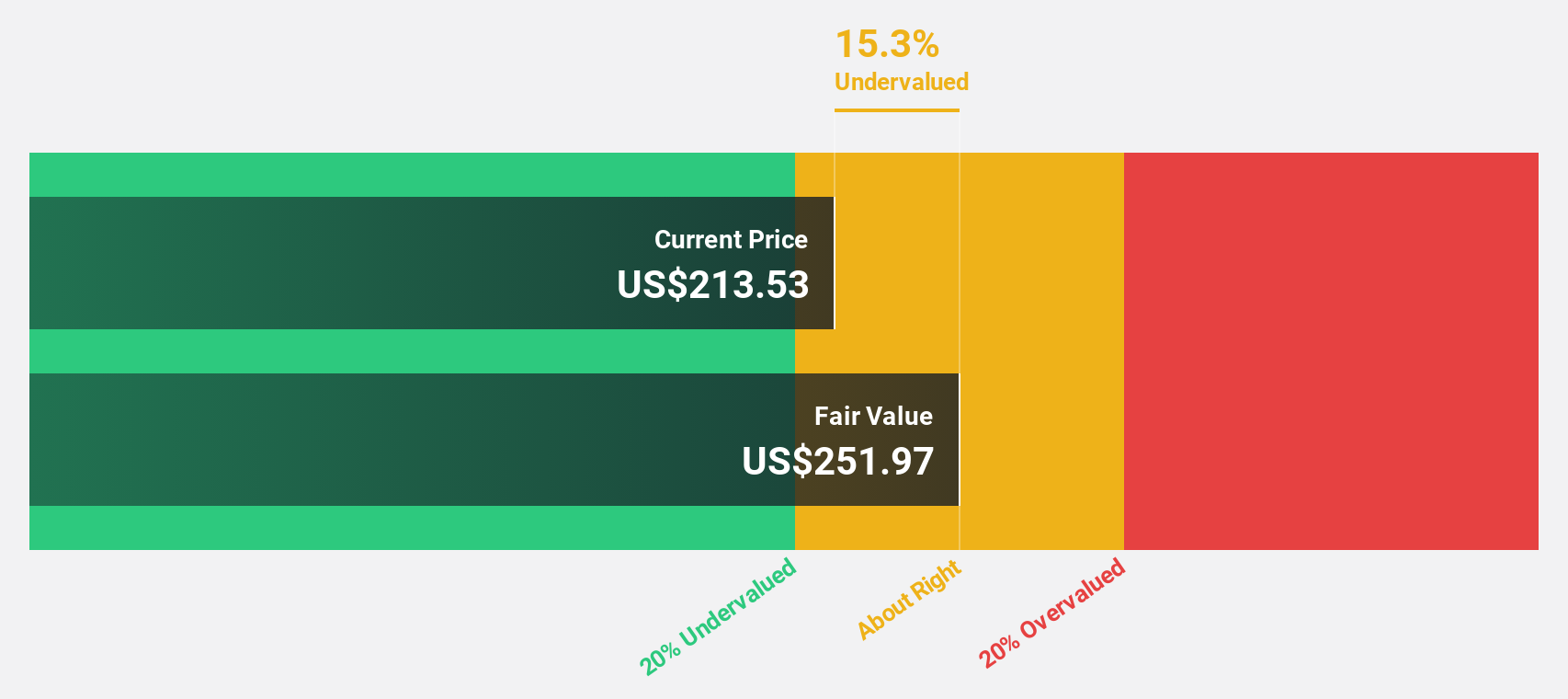

Estimated Discount To Fair Value: 33.6%

Atlassian, trading at US$250.27, is priced below its estimated fair value of US$376.99, highlighting potential undervaluation based on cash flows. Despite a recent net loss increase and significant insider selling, Atlassian's strategic partnership with AWS aims to enhance cloud capabilities and revenue growth above the U.S. market rate of 9%. The appointment of Christian Smith as a board member may bolster sales strategies amid these transformative efforts.

- Insights from our recent growth report point to a promising forecast for Atlassian's business outlook.

- Take a closer look at Atlassian's balance sheet health here in our report.

Cloudflare (NYSE:NET)

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of approximately $39.37 billion.

Operations: Cloudflare generates revenue primarily from its Internet Telephone segment, which amounts to $1.57 billion.

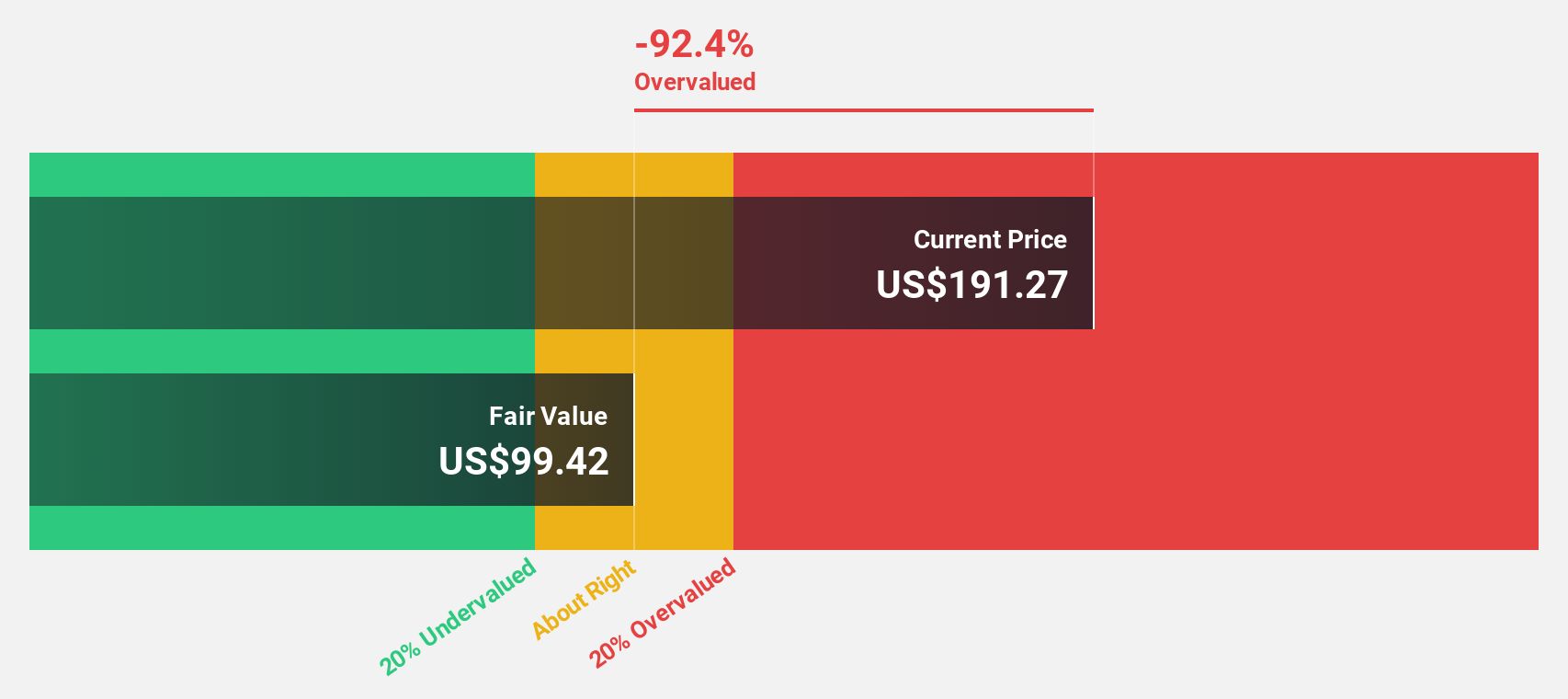

Estimated Discount To Fair Value: 26.2%

Cloudflare, priced at US$114.73, is trading 26.2% below its estimated fair value of US$155.37, suggesting potential undervaluation based on cash flows. Recent earnings showed improved net losses and strong revenue growth to US$430.08 million for Q3 2024. The company's strategic expansion in Lisbon and the appointment of Chirantan CJ Desai as President aim to drive further growth, despite past shareholder dilution and insider selling activities over the last quarter.

- The analysis detailed in our Cloudflare growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Cloudflare stock in this financial health report.

Next Steps

- Click this link to deep-dive into the 177 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Atlassian, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives