- United States

- /

- Hospitality

- /

- NasdaqGS:TCOM

A Look at Trip.com Group (NasdaqGS:TCOM) Valuation Following $5 Billion Buyback and Earnings Growth

Reviewed by Simply Wall St

If you have been tracking Trip.com Group (NasdaqGS:TCOM), you likely noticed the buzz after management unveiled a fresh $5 billion share repurchase program alongside its recent earnings announcement. Buyback programs of this scale do not come around every day, and they typically send a strong signal that management has confidence in the company’s outlook and sees the current share price as an attractive investment. Add to that a set of earnings showing steady revenue and profit growth over last year, and it is no surprise that investors are giving the stock a closer look.

These developments arrive as Trip.com Group’s stock is on a clear upswing. Over the past year, the share price has delivered a 55% return, with momentum especially strong in the past month. Solid financials, including a double-digit jump in both revenue and net income compared to a year ago, have kept positive sentiment growing. Earlier buybacks in 2025 and the latest tranche update reinforce a narrative of disciplined capital allocation, helping the rally build steam as markets reassess the stock’s risk profile and growth trajectory.

The big question now is whether Trip.com Group’s latest move marks a true buying opportunity, or if the current valuation already reflects ambitious growth expectations.

Most Popular Narrative: 11.6% Undervalued

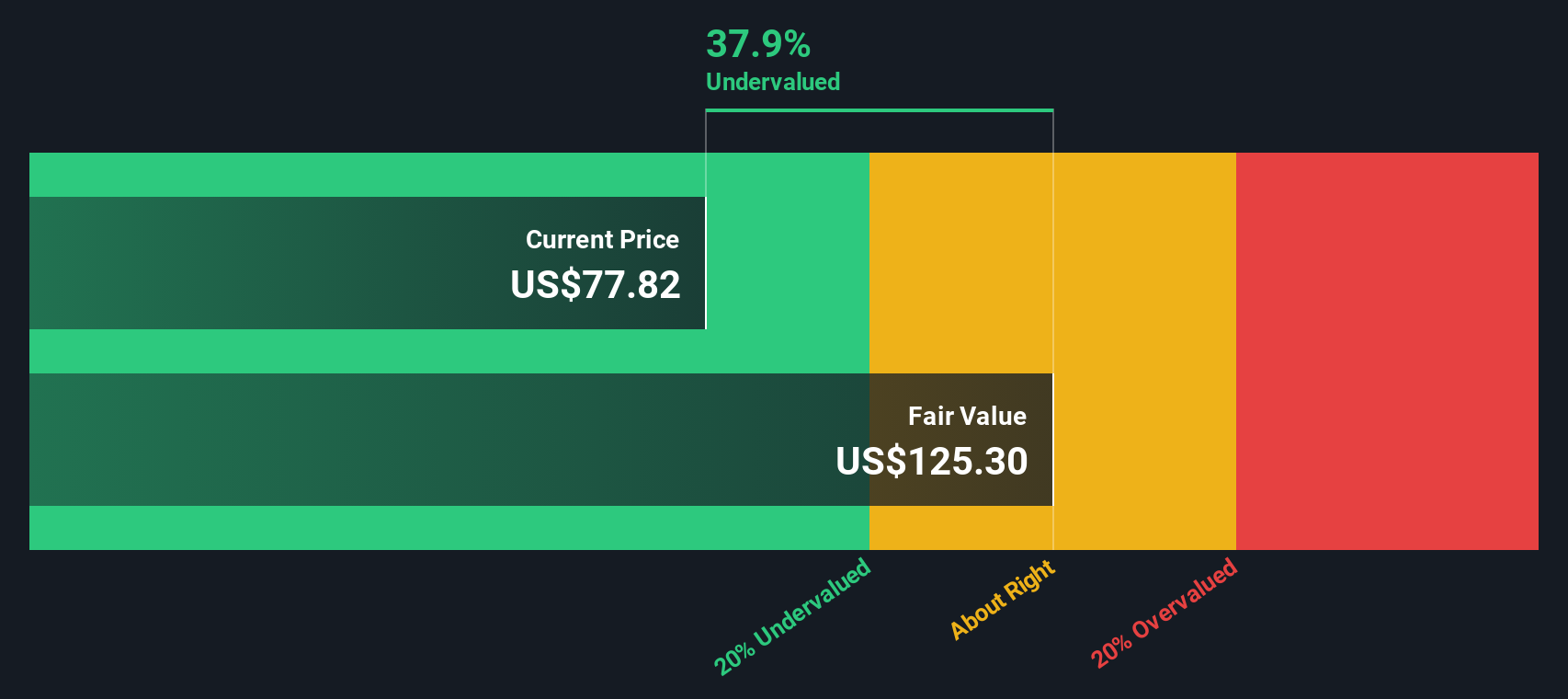

The narrative consensus points to Trip.com Group being undervalued by a meaningful margin, with the company's fair value estimated well above its current share price. This conclusion is based on forward-looking analysis of revenue growth, margin trends, and projected earnings over the next several years.

The rapidly expanding middle class and rising disposable income across Asia-Pacific, which is fueling higher travel demand and international tourism, positions Trip.com Group to capture robust, long-term revenue growth across both inbound and outbound travel markets. Accelerating consumer adoption of digital channels and mobile-first travel planning, with app-originated bookings already comprising 70% of global orders, supports continued high-volume transaction growth and increasing operational efficiencies. This is likely benefiting both revenue and net margins.

Curious how these long-term trends stack up to Wall Street’s boldest forecasts? Analysts are betting big, but which financial assumptions are quietly powering this bullish consensus? The answer may surprise you. Uncover the specific levers and numbers behind this valuation story.

Result: Fair Value of $82.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent pricing pressures and intensifying competition, especially from local and global travel platforms, could challenge Trip.com Group’s growth and profit margins in coming years.

Find out about the key risks to this Trip.com Group narrative.Another View: SWS DCF Model

Looking from a different angle, our DCF model also points to Trip.com Group being undervalued. This approach weighs future cash flows together with current financial strength, but do its assumptions match analyst expectations, or is something missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Trip.com Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Trip.com Group Narrative

If you would rather trust your own research or want to challenge these assumptions, you can easily build your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Trip.com Group.

Looking for More Winning Opportunities?

Smart investors do not stop at one stock. Get ahead by searching for the next standout opportunity using these powerful ideas from the Simply Wall Street Screener.

- Boost your income by targeting steady payers with dividend stocks with yields > 3% offering yields over 3% and the financial strength to keep rewarding shareholders.

- Tap into tomorrow’s innovation by spotting the most promising AI penny stocks, companies unlocking new growth in artificial intelligence before the crowd catches on.

- Seize value now by scouring undervalued stocks based on cash flows that the market has overlooked, uncovering quality businesses trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Trip.com Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:TCOM

Trip.com Group

Through its subsidiaries, operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours, in-destination, corporate travel management, and other travel-related services in China and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)