- United States

- /

- Hospitality

- /

- NasdaqGS:MAR

Marriott International (NasdaqGS:MAR) Expands Global Reach With Series Debut In India And Costa Rica

Reviewed by Simply Wall St

Marriott International (NasdaqGS:MAR) experienced significant developments that may have influenced its recent stock rise of 21% over the past month. The launch of its Series by Marriott™ underscores the company's expansion into midscale and upscale segments, especially through its partnership with Concept Hospitality Private Limited in India. Adding to this, the introduction of the St. Regis Hotels & Resorts in Costa Rica aligns with Marriott's luxury market growth strategy. Despite broader market downturns, such as a 1% decline in major indexes, these announcements may have bolstered investor confidence, supporting Marriott's upward trend amidst favorable market sentiment.

The recent developments highlighted in the introduction, such as the expansion into midscale and upscale segments through Series by Marriott™ and the launch of St. Regis Hotels & Resorts in Costa Rica, align well with Marriott's goals for revenue growth and expanded market presence. These initiatives are likely to bolster future earnings by enhancing brand diversity and tapping into emerging markets, thereby potentially increasing Marriott's revenue and occupancy rates.

Marriott International's shares have surged by 173.89% over the past five years, showcasing robust growth in value. In contrast, the Performance Evaluation section indicates Marriott matched the broader U.S. market's 11.1% return over the past year, while underperforming the U.S. Hospitality industry's 11.8%. This demonstrates a relatively stable performance compared to market averages despite short-term fluctuations.

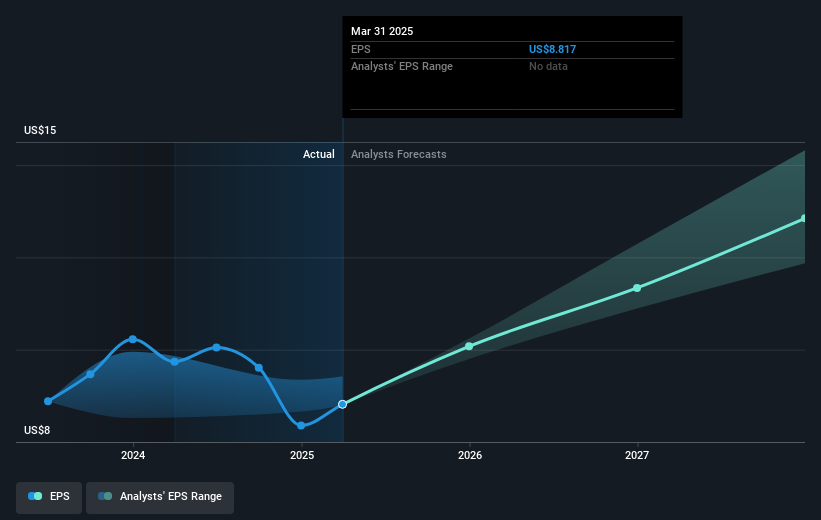

The announcements regarding Marriott's partnership with Concept Hospitality and potential integration of citizenM hotels forecast a positive impact on both revenue and earnings. With analysts projecting 23.5% annual revenue growth, these new ventures might play a key role in achieving these forecasts. However, macroeconomic uncertainties in the U.S. and China could pose risks, potentially impacting room revenues and development costs.

Current Marriott share prices at US$251.96 reflect a modest 7.3% discrepancy from the consensus analyst price target of US$271.87, suggesting the market perceives the stock as fairly priced. Investors may consider this price movement, alongside Marriott's strategic growth plans, to gauge its potential for future value creation and alignment with earnings expectations.

Evaluate Marriott International's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAR

Marriott International

Engages in operation, franchising, and licensing of hotel, residential, timeshare, and other lodging properties worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives